A deep dive into R&D tax credits for small and medium-sized enterprises (SMEs)

31 August 2023

R&D tax credits for small and medium-sized enterprises (SMEs) are an unmissable opportunity for businesses in the UK to receive vital financial support for their innovation. Research and Development activities create a greener, more efficient and exciting future for our society, overcoming industrial challenges with outside-the-box thinking. The UK’s government not only encourages their R&D endeavours but rewards them through R&D tax relief. This article showcases the business benefits of the R&D tax credit scheme and provides all the information you need to understand the criteria and claiming process of said scheme.

What is the SME R&D tax credit scheme?

The UK government offers R&D tax credits as tax relief to encourage small and medium-sized enterprises to invest in research and development activities. The government encourages research and development activities, whether or not you’re making a profit, because they contribute to economic growth, technological advancement, and the progression of society with opportunities for efficiency and sustainability across all industries. So it is safe to say that R&D tax credits allow you to take actions based on your innovative thinking without being held back by cost, ultimately enabling you to expand your business operations by hiring top-notch talent, investing in marketing, offsetting expenses, or acquiring the necessary machinery.

What is an SME under R&D tax relief?

To qualify for SME status and be eligible to claim R&D tax credits, you need to meet the following criteria:

- Less than 500 staff

- A turnover of under €100 million

- Or a balance sheet total of under €86 million

💡 Wondering why the values are in Euros? Well, the definition of SMEs was originally established by the European Commission. However, it’s worth mentioning that R&D tax credits have no affiliation with the European Union or its funding in any manner, irrespective of the origin of the SME definition.

What to consider if you are an SME who doesn’t qualify to claim under the SME scheme?

There are certain circumstances that if you’re an SME who doesn’t qualify for the above R&D SME criteria, you can claim under Research and Development Expenditure Credit (RDEC). The RDEC is a similar incentive but generally designed for larger companies. The exceptions where SMEs can qualify for RDEC are:

Subcontracting SMEs

If you were hired by a bigger company to conduct research and development (R&D) on their behalf, you would need to seek reimbursement through the RDEC Scheme. This is necessary because the expenses incurred for the subcontracted R&D work will be considered part of the contracting company’s overall R&D expenditure. HMRC has implemented this requirement to prevent excessive subsidisation of duplicate R&D efforts.

When SMEs are owned by larger companies

It might be a case where an SME is merged with a larger company which can be classified into two further groups.

Partner enterprises

If a larger company has ownership over your SME, you might be required to make your claims using the RDEC Scheme. It’s considered a “partner enterprise” in cases where your SME is owned between 25% to 50% by a larger company. HMRC considers certain aspects like assets, balance sheet, and employee count to be influenced proportionately by the larger company’s ownership.

Linked enterprises

You transition from a “partner enterprise” to a “linked enterprise” when your SME is majority-owned by a larger company, so when you hit the 50% or above mark. Your profit for scheme selection will incorporate the entire sum of the larger company’s assets, balance sheet, and employee count.

Grant recipient

If the grant you receive is classified as ‘notified state aid,’ you might be required to claim it partially or entirely through the RDEC Scheme. Most government-backed grants fall under this category, though there are exceptions.

The proportion of qualifying expenses that should be claimed through the RDEC scheme depends on the number of projects, the financial support received for those projects, and the manner in which the grant is received.

How does the R&D SME scheme work?

The R&D tax credits for SMEs provide you with a cash injection from the government, either in the form of claiming cash refunds from HMRC or opting for a reduction on corporation tax, if your business is involved in:

- The development of new or improved products, processes, services or even the advancement of existing ones in your industry

- Overcoming technical challenges or uncertainties to achieve scientific advancements

- Systematic investigation or experimentation throughout the process. In other words, trying something that isn’t guaranteed to work with investigation or experimentation throughout the process

Qualifying activities for R&D differ greatly depending on your industry so it’s advisable to check your eligibility with R&D tax credit specialists to be sure you don’t miss out!

Let’s break down the SME R&D tax credit rates

There was a change in R&D rates that came into play in April 2023. The changes to SME R&D rates impact companies with a May 2024 year-end. The R&D enhancement is now calculated on 86% of the qualifying expenditure which is then added back onto the qualifying expenditure to give you the enhanced expenditure (186%).

The cap on claiming R&D tax credits for SMEs

There is a limit on the tax credit that SMEs can receive under the R&D tax credit scheme. The cap is now restricted to three times the company’s total PAYE and national insurance liability for the year. This measure aims to qualify expenditures to direct the benefits of the R&D tax credit scheme specifically to SMEs that genuinely prioritise research and development, promoting innovation and encouraging investment in these areas.

The cap exemption applies to a company under the following conditions:

- The company’s employees are involved in activities related to creating, preparing to create, or managing Intellectual Property (IP).

- The company’s qualifying R&D expenditure does not exceed 15% when spent on subcontracting R&D to connected parties or on externally provided workers (EPWs) supplied by connected parties.

There is an R&D SME cap that has the purpose of preventing abuse of the government’s incentive. The maximum payable R&D tax credit for an SME is limited to £20,000 plus 300% of its total Pay as you Earn (PAYE) and National Insurance Contributions (NIC) liability during the relevant period.

What are R&D-intensive SMEs?

R&D-intensive SMEs are businesses that place a significant emphasis on R&D activities as a core part of their operations. These companies allocate a substantial portion of their resources, such as time, finances, and human capital, to conduct innovative research, create new technologies, develop new products, or improve existing ones.

How to test if your business activity qualifies for the R&D SME scheme?

To evaluate whether or not your work could be considered R&D activity, we recommend you analyse the four-part criteria:

- Permitted purpose – Does your work have the aim of enhancing the performance, reliability, quality and functionality of a product or software?

- Technological uncertainty – Are the answers to your work not clear at first? Is there a chance that unpredictable results may arise during the development of a product or software, including the associated processes?

- The process of experimentation – Have you completed or are you undertaking a trial-and-error phase intending to overcome technological uncertainties?

- Technological in nature – Does your work fall within the domains of engineering, physical sciences, biological sciences, or computer science?

Examples of R&D activities

R&D activities vary across diverse industries, and the significance of your project’s scope becomes paramount when defining such undertakings. However, here are a few examples to give you an idea of what activities fall under R&D.

- Creating sustainable alternatives – Researching and adopting eco-friendly processes to meet environmental regulations.

- Exploring automation and robotics – Transforming everyday tasks in your industry with technology to increase productivity and reduce manual labour.

- Reducing food and materials waste – Utilising and creating new products, packing, and processes that extend the shelf life of food products, allow for freezing and prevent wastage.

- Reduced mistake-making with accuracy from AI – Involving AI-powered algorithms, to transform results. In the context of pharma, you can accurately monitor disease progression, and the success rate of drugs, and create opportunities for early diagnosis.

What expenditures qualify under the R&D SME scheme?

Staff PAYE costs/Pension contributions

Your company is eligible to request reimbursement for salaries, wages, class 1 National Insurance Contributions (NIC), and pension fund contributions paid to employees who are directly and actively involved in the R&D project.

Subcontracted costs

These refer to the staff costs paid to an external agency for individuals who are directly and actively involved in the R&D project. These individuals are not direct employees of the company but are engaged through the agency, known as externally provided workers (EPWs). Typically, relief is provided on 65% of the payments made to the staff provider. However, specific rules come into play if the company and the staff provider are connected or choose to be connected.

Consumables & Utilities

Your company is eligible to claim for the expenses incurred on items that are directly used and consumed in qualifying R&D projects. These expenses cover materials and the portion of water, fuel, and power utilised in the R&D process.

Software purchases

You can be reimbursed for expenses related to software that is directly used in your R&D activity. If the software is only partially used in direct R&D, you should make a suitable allocation to determine the eligible cost for the claim.

Travel costs

The travel costs associated with your research and development projects may also be eligible in your claim.

What costs don’t qualify for R&D tax credits?

R&D tax credits are specifically intended to assist companies engaged in trial and error for innovations and advancements. This implies that expenses related to the following are not eligible for R&D tax credits:

- Capital expenditures such as the purchase of land

- Expenses related to patents and trademarks

- Rent or rates

- Distribution and production costs

- Redundancy payments

- Costs associated with the production and distribution of goods and services that are the outcome of R&D activities

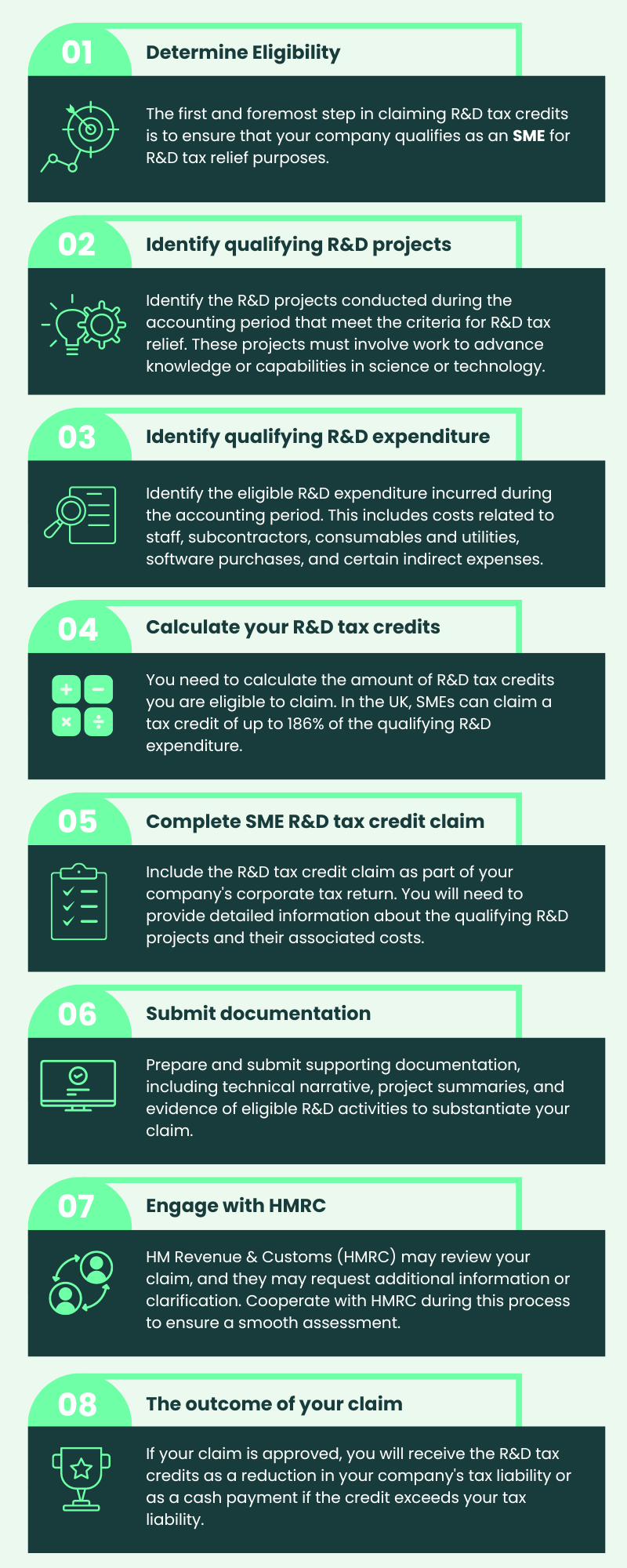

How to claim R&D tax credits for SMEs?

R&D tax credit claim template for SMEs

Our team of R&D tax credit specialists has meticulously developed the R&D tax credit claim template for SMEs. It provides a step-by-step guide to recording your qualifying costs and other necessary details mandatory to make a robust claim to HMRC. By using this template, you can increase the chances of achieving a favourable outcome for your application.

You can download the template for FREE here.

We are here to help you claim R&D tax credits for SMEs

At Alexander Clifford, we understand that innovation is the heartbeat of your business. That’s why we’re excited to unveil our streamlined R&D claim process, tailored to help you unlock the hidden potential of your research and development efforts. Our team is built with years of collective experience in R&D tax credits and we use a personalised approach to truly understand your business, helping us to reclaim every eligible penny and putting substantial funding back into your hands. Contact us to check the eligibility for R&D tax credits for your SME and start a robust claim.