Precision in practice

Crunch your numbers

with our R&D Tax Credit calculator

We have designed our R&D tax calculator to simplify the complex process of calculating your eligible R&D tax credits. With just a few inputs, our reliable calculator swiftly and accurately evaluates your research and development expenditures and applicable tax incentives, providing you with an estimated entitlement to apply for R&D claims with confidence and maximise your tax benefits.

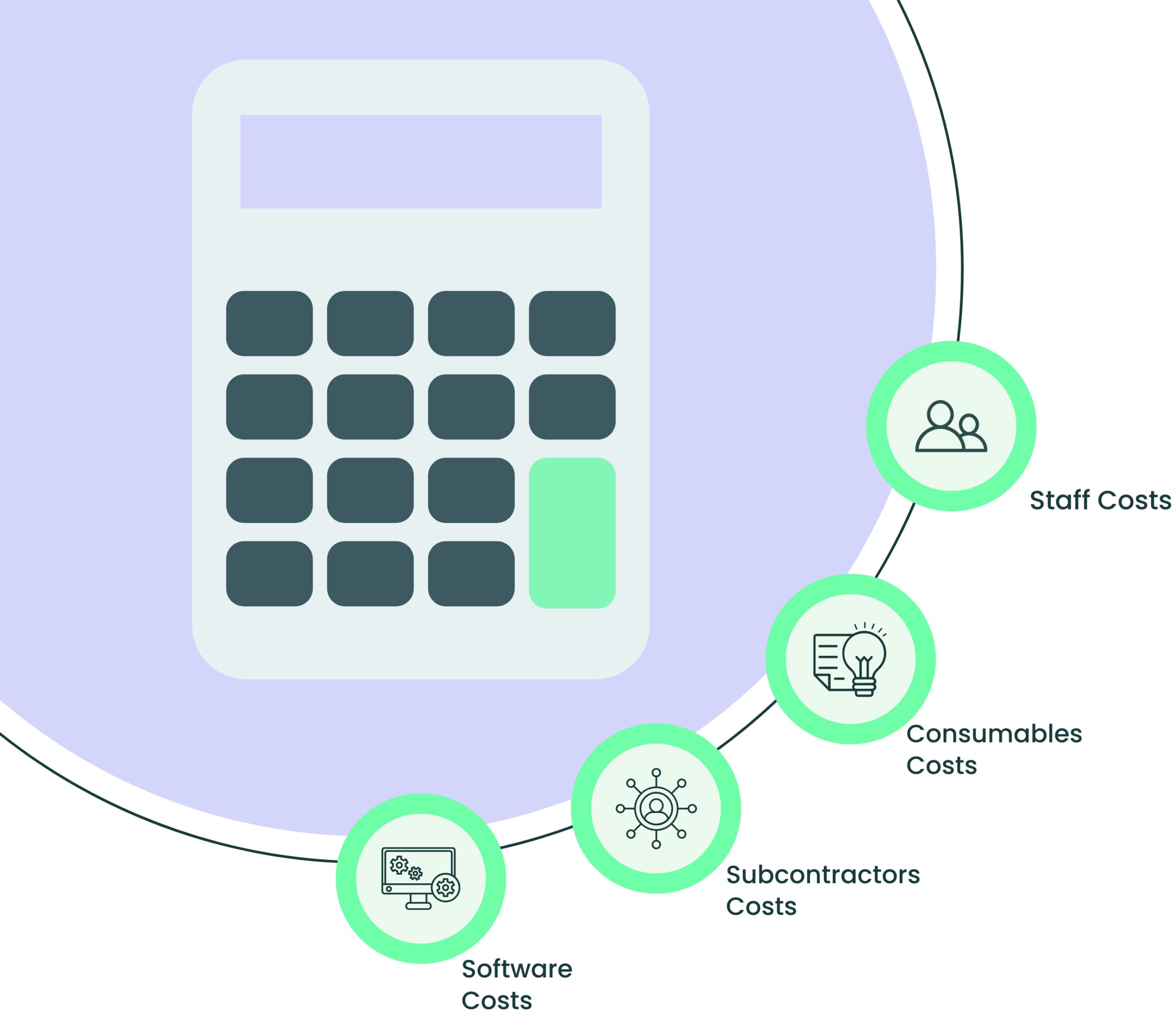

What expenses are included?

- Staff PAYE costs / Pension contributions

- Materials and consumables

- Subcontractors' cost

- Utilities

- Software purchases

- Travel costs

How to calculate R&D tax credits for SMEs?

The financial status of your SME will determine the rates of R&D tax credits, whether it's making a profit or facing a loss. Generally, an SME can get up to 27% benefit from this relief. SMEs trading at a profit or loss can calculate their entitlement based on the calculation of R&D tax credit using the R&D enhancement. The R&D enhancement is calculated at 86% of the qualifying expenditures which is then added back onto the qualifying expenditures to give you the enhanced expenditure (186%).

Loss-making SMEs

For companies trading at a loss and claiming before April 2023, we are able to retrieve your R&D entitlement up to 33.35% in the form of a cash benefit. So for every £100 spent on qualifying R&D expenditure, we can claim back up to £33.35. This is done by applying the enhancement rate of 130% to all qualifying expenditure. We can then surrender the revised loss figure at the surrender rate of 14.5% to give us your payable tax credits. For example: If your company has spent £500,000 on qualifying R&D expenses, we can look to claim back up to £108,750. Note: Any claims made after April 2023, the respective rates will decrease from 33.4% to 18.6%.

Example of a loss-making SME

| Description | Amount |

|---|---|

| Qualifying R&D expenditure | £500,000 |

| R&D enhancement at 130% | £650,000 |

| R&D enhanced expenditure totalling 230% | £1,150,000 |

| Loss for the financial year | -£100,000 |

| Loss after R&D relief | -£750,000 |

| Surrenderable loss | £750,000 |

| Entitlement Payable at 14.5% | £108,750 |

Profit-making SMEs

For companies trading at a profit and claiming before April 2023, the entitlement received received will be up to 24.7% in the form of a corporation tax reduction or refund for tax already paid to HMRC. This is calculated in a similar way to loss-making SMEs apart from the entitlement will be calculated on the revised profit figure for the year at the current corporation tax rate of 19%. For example: If the company has a total qualifying R&D expenditure of £500,000, depending on the company's tax position, we are able to retrieve the entitlement of up to £123,500 in the form of a corporation tax reduction/rebate. Note: Any claims made after April 2023, the respective rates will decrease from 24.7% to 21.5%.

Example of a profit-making SME

| Description | Amount |

|---|---|

| Qualifying R&D expenditure | £500,000 |

| R&D enhancement at 130% | £650,000 |

| R&D enhanced expenditure totalling 230% | £1,150,000 |

| Profit for the financial year | £750,000 |

| Profit after R&D relief | £100,000 |

| Corporation Tax reduction | £123,500 |

For companies claiming for periods starting before April 1st, 2023, the current rate of 130% of qualifying expenses will apply. For companies claiming R&D relief for periods starting on or after April 1st, 2023, their entitlement will be calculated at 86% of the qualifying expenses.

How to calculate RDEC?

The RDEC rate has been established at 20% amid the recent changes to R&D tax relief. Businesses are now able to recover up to 20p for every £1 invested in eligible R&D activities. This rate remains consistent irrespective of the financial circumstances, as opposed to the SME scheme.

Example: Estimated R&D expenditure: £500,000 at the RDEC enhancement rate of 13% = £65,000

= £565,000 as above-the-line credit

Calculate the benefit at a corporation tax rate of 19% = £107,350

What are R&D qualifying costs?

R&D tax credit calculation template

Our team of R&D tax credit specialists has diligently developed the R&D tax credit claim template, providing a systematic walkthrough for documenting your eligible expenses and essential details required for a comprehensive R&D claim. The template performs R&D tax credit calculations by simply adding values to designated fields and providing an estimate of your entitlement. This empowers you to make informed claims, enhancing the likelihood of securing a positive result for your application.

Leveraging the R&D Tax Credit calculator to your advantage

Document Expenses

Collect and keep track of all expenses related to your qualifying research and development activities. Accurate documentation is crucial when claiming tax credits.

Qualifying Costs

Identify costs based on the percentage of time or resources dedicated to qualifying activities. This includes expenses like staff salaries, software purchases, materials, subcontractor fees, utilities, travel costs, & more.

Input Data

Enter the collected financial information into the designated fields in our R&D tax credit calculator. Be sure to provide accurate and complete information to ensure accurate estimated figures.

Make a Claim

After obtaining the estimated entitlement and reviewing it, submit your claim for R&D tax credits. Include all necessary documentation and supporting evidence to maximise your chances of approval.

Frequently Asked Questions

In general, you cannot include VAT costs in an R&D tax credit claim. However, there is an exception to this rule if your VAT costs are not recoverable through a VAT return. Whether you fall under this exception will be determined by your VAT classification.

- HMRC will award you differently depending on your current tax position. If your company ended the year in profit, the maximum percentage you can claim back is commonly 24.7% of your R&D expenditures.

- If your company is a loss-making entity, the maximum percentage you can retrieve is commonly 33.4% of your R&D expenditures.

- In most cases, you will receive a cash repayment deposited into your account.

Dividends received by directors are not considered qualifying expenditure for research and development (R&D) tax credits. As a result, you cannot include director's dividends in your R&D tax credit claim.

Expenditures considered capital in nature, like plant and equipment, cannot be included in an R&D claim. However, if these assets are utilised as part of an R&D project, they can be claimed under R&D capital allowances, allowing for a full write-down of 100% in the year they are incurred.

Yes, HMRC doesn't base the eligibility of R&D tax credits on a company's financial position, as long as the projects involve qualifying activities that entail experimentation, trial and error, etc.

No, it is not possible to claim an expense as R&D expenditure if you have not actually paid for it. Accrued costs can be included, but they must be paid at the time of making the claim.