How R&D Tax Credits Drive Innovation and Growth in the Retail Industry

Businesses in retail rely on advancement in order to remain competitive, but there could be added benefits for those investing in research and development. Discover the ins and outs of technological innovation in retail, the importance of advancing research and development, future innovative trends, how UK based retailers can benefit from R&D tax relief, and the qualifying criteria.

In the 21st century, retailers rely on technology to be able to provide a 24 hour service to consumers. In order to adapt technology to their needs, many retailers invest in costly research and development projects – costs that could be significantly reduced with R&D tax credits.

To highlight the power of technology in the retail industry, we’re taking a look at recent innovations, future trends and the tax relief that can help transform the way retail businesses approach research and development. What’s more is that we’ll touch on how to prepare for an upcoming R&D claim, with the relevant documentation.

Technological Innovation in Retail

While advancements in technological innovation have revolutionised a wide range of industries, the retail sector has been quick to adapt. This has greatly transformed the way retailers operate and engage with consumers, with the integration of:

Using these advancements, retailers now have the ability to analyse consumer preferences in real time, tailor promotions, and optimise inventory management efficiently.

Moreover, advancements in payment technologies (such as mobile wallets and contactless payments) have streamlined transactions, making the checkout process quicker and more convenient for consumers.

The Role of Research and Development in Retail

Considering the fact that innovation in retail supports businesses through everyday management and customer satisfaction, while presenting opportunities to thrive in a competitive market, adopting fresh advancement is quickly becoming a necessity for retailers. But great innovative advancements don’t just appear out of thin air.

Necessary advancements are often the product of intense research and development efforts, with retailers often choosing to invest in their own innovations based on their current needs. By investing in their own research and development efforts, retailers are able to anticipate and adapt to:

- Changing consumer preferences

- Technological advancements

- Market trends

While the benefits of investing in research and development are alluring, some retailers may be put off by the financial pressure that innovation often puts upon a business. Thankfully for those in the UK, there exists government backed financial relief that’s known as R&D tax credits.

Book a quick call back

How do Omnichannel Strategies or AI Enhance Retail?

Omnichannel strategies and AI work cohesively to play an essential role in reshaping customer experience and optimising operational efficiency. Their combined efforts allow customers to do the following through various platforms:

- Browse

- Purchase

- Return items

While omnichannel strategies operate to provide a cohesive shopping experience through integrating physical, mobile and online stores, AI may take a more customer specific approach by providing customers with round the clock service via automated chatbots, and by presenting personalised recommendations.

AI also provides retailers with additional capabilities that can help them to form advanced marketing strategies via the use of automated data analysis that presents real time insights.

Overall, implementing omnichannel strategies and AI not only enhances the shopping journey but also boosts operational efficiency by reducing manual tasks and optimising resource allocation.

Future Trends in Retail Innovation

The future of retail innovation holds promising prospects as technological advancements continue to reshape the industry landscape. Becoming more consumer centric, emerging trends include:

- Augmented reality (AR)

- Virtual reality (VR)

These technologies allow customers to visualise products in real world settings before making a purchase, bridging the gap between online and in store shopping.

As consumers become more eco-conscious, another emerging trend prioritises sustainability throughout the supply chain. This allows businesses to put their ethics into practice, helping them align with customers.

Finally, one of the surprising trends of the future is set to be the rise of voice commerce through smart assistants (such as Amazon Alexa, Apple’s Siri and Google Assistant). Voice activated shopping is set to offer customers a convenient and efficient way to make purchases, driving retailers to adapt their strategies to cater to this growing trend.

How Do R&D Tax Credits Support Innovation in Retail?

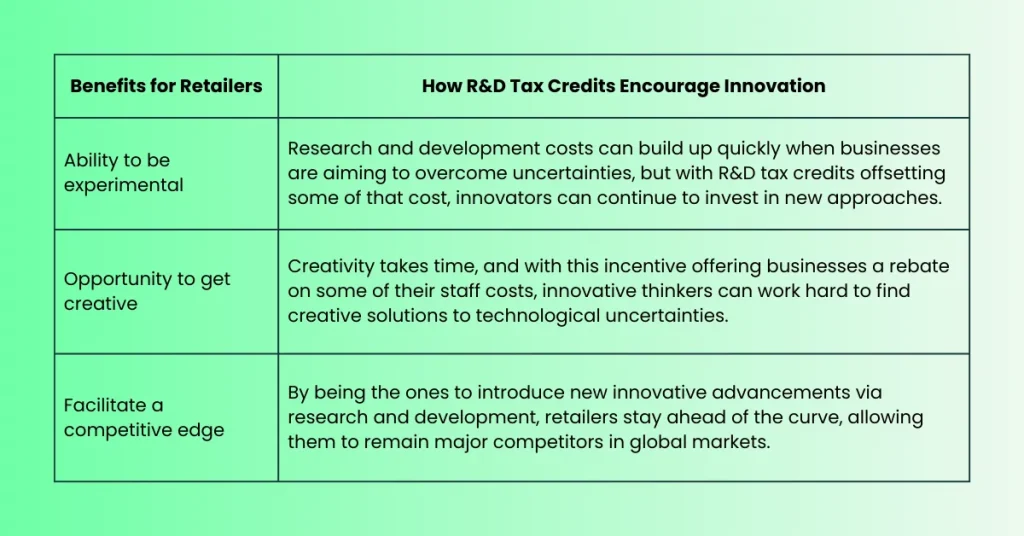

As a government funded incentive, R&D tax credits have the ability to support innovative businesses by offsetting some of the cost invested in research and development. The following table highlights exactly how this could benefit retailers throughout their own technological advancement:

Qualifying for R&D Tax Credits as a Retailer

As R&D tax credits are a government incentive, qualifying for the relief requires following strict HMRC guidelines. First of all, those looking to claim must ensure that their research and development project aligns with HMRC’s definition – that is to say that a research and development project is a project that aims to overcome a technological or scientific uncertainty, that could not be easily solved by an expert in the field.

Following this, claimants must ensure that the project aim is within the realm of their industry. For example, if a retailer is looking to invest in fintech innovation, it must be relevant to their business in order to qualify for R&D tax relief.

In order to present the aims of a research and development project, HMRC guidelines require that claiming businesses organise documentation which includes:

- Project descriptions

- Technical reports

- Qualifying activities

- Qualifying costs

With accurate and in depth documentation that supports qualifying factors, claims are held to a high standard that may stand up against scrutiny. This not only allows businesses to ensure the safety of received tax credits, but it also allows them to maximise their tax credit relief.

Example of Retail Businesses Successfully Claiming R&D Tax Credits

In order to show exactly how R&D tax credits can have an impact on retailers, we wanted to place a specific focus on one of our successful clients.

This client combined technology with psychological research in order to build an AI system that could more accurately analyse customer data and recommend products. This provided the customer with bespoke recommendations which ultimately improved their level of loyalty.

The amount of research and development that went into building an understanding of customer psychology and in developing the technology through machine learning, the specialist team at Alexander Clifford immediately recognised that this client qualified for R&D tax relief.

Through the efforts of our team and our collaborative process, this client received £166,695 in R&D tax credits.

FAQ’s

The R&D tax credits system is rife with policy, meaning there is a lot of information to take in. To help simplify the claims process, we wanted to touch base on some of your most frequently asked questions surrounding R&D tax relief and innovation in retail.

What Costs Qualify for R&D Tax Relief?

R&D tax credits can be incredibly generous for innovative businesses, because they offer a portion of financial relief for a range of costs, such as:

- Staff costs (such as PAYE, pension, NIC contributions)

- Consumable items (such as materials)

- Software used in research and development

For a full list of qualifying expenditure, click here.

Do I Need Specific Documents for R&D Tax Credits?

In order to compile an effective and robust R&D claim, businesses will need to provide a range of specific documentation that may include:

- Project information

- Tax computations

- Financial records

- Additional information

Click here for a full list of required documentation.

What Common Mistakes Should Retailers Avoid When Claiming R&D Tax Credits?

When looking to make an R&D tax credit claim, there are many mistakes that are commonly made – especially for those who are new to the claims process. Some of the most frequent mistakes in relation to R&D relief for retailers we see are:

- Overlooking small projects

Many retailers make the mistake of believing that only large projects can qualify for the tax relief, but this is far from the truth as small projects may involve technological challenges that qualify - Neglecting software development

Retail in the 21st century relies on a range of software, and as businesses look to develop them in a way that simplifies processes, it’s easy to overlook them as research and development projects – but if the research and development requires overcoming technological challenges, it may qualify for relief

For more information about common mistakes made in R&D tax credits and how to avoid them, click here.

Final Thoughts

R&D tax credits are more than just a financial relief mechanism; they are a strategic enabler for growth and innovation in the retail sector. Retailers who leverage these credits can experiment, innovate, and optimise operations, all while mitigating the financial risks associated with development activities.

By continuously investing in research and development, retailers can stay ahead of technological trends, meet evolving customer demands, and drive long term success. However, ensuring eligibility and maintaining comprehensive documentation is critical to maximising the benefits and successfully navigating the claims process.

How Alexander Clifford Can Help Maximise R&D Tax Credit Benefits

When filing your R&D tax credit claim, HMRC recommends that you work with an R&D tax credit specialist. Not only will this help ensure that your claim is compliant with HMRC standards, but it will also help to maximise your relief as a specialist may be able to identify additional qualifying expenditure.

Here at Alexander Clifford, our specialist team collaborates with clients to assemble effective, compliant claims that produce positive results. With over 2,400 successful claims submitted to HMRC, our team has formed a 5-star service that simplifies the claims process, and provides clients with the maximum benefits from their research and development efforts.

This is what makes Alexander Clifford your trusted choice for R&D tax credits.

Have you been working on a research and development project in retail? Get started on your R&D tax credit claim by filling out the contact form below.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.