Improving Financial Risk Management With Innovation Funding

3 December 2024

At the core of building a successful business is the ability to weigh financial risk – but is it possible to reduce the risks with funding aimed at supporting cutting edge work? We explored the relationship between financial risk management and innovation funding to present vital strategies, benefits and how businesses can further reduce financial risk with R&D tax credits.

No matter the industry, running a business means frequently facing financial risk. With successful financial risk management however, many of these risks can be managed, allowing the business to continue building a balanced profit.

For businesses investing in research and development, financial risks may seem elevated, but through the strategic use of innovation funding, there is a way to mitigate the overall risk of investment. Today, we’re going to show you how it works.

Definition of Financial Risk Management

Financial risk management is an ongoing practice that seeks to reduce the impact of financial risks that a business may encounter during its operations.

With the aim of ensuring the business is achieving its financial goals and obligations, it ties in closely with cash flow management. The most important aspect of financial risk management is to avoid substantial risks that may jeopardise target profits.

Essential practices within financial risk management include:

- Risk assessment

- Vulnerability assessment

- Risk treatment

- Frequent risk monitoring

Book a quick call back

Strategies for Financial Risk Management

Given the importance of financial risk management, there are a range of approaches to achieving financial safety. Some of the key strategies used in financial risk management are:

- Establishing emergency lines of funding or credit

- Building contingency plans for operations

- Diversifying business assets

- Building effective internal and external indicators of risk

Benefits of Financial Risk Management

By embracing financial risk management strategies, businesses are able to safeguard against potential financial losses. Ultimately this promotes financial stability and continued success.

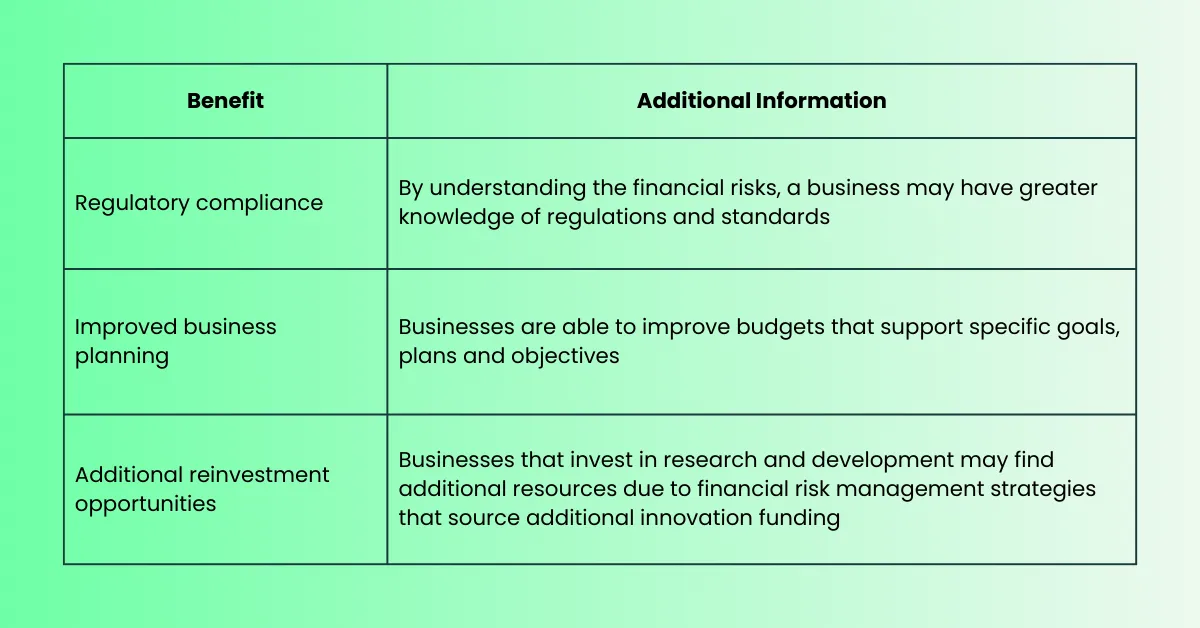

While this alone could drive businesses to undertake financial risk management, some additional benefits are highlighted in the following table:

What is Innovation Funding

In the world of business, innovation funding is financial support that’s designated to the development of new products, services, software and in some cases, processes.

Additionally, some innovation funding provides support for collaborative work, allowing for an exchange of ideas and knowledge that lead to new innovations.

This form of funding has several purposes, including:

- Development of cutting edge technologies

- Facilitating climate neutrality innovations

- Advancing the British economy via innovation

Ultimately, innovation funding feeds into the British government’s plans to position the UK as an innovation hub.

How Innovation Funding Reduces Financial Risk

It’s well known that investment in innovation can improve business reputation, market competitiveness, and product lines, but it’s also known to present itself as a financial risk.

With innovation funding however, businesses are able to offset the cost of research and development. This enables them to mitigate the financial risk of research and development processes, while enhancing adaptability to market trends.

Overall, integrating innovation funding into financial risk management strategies can reduce annual expenditure, and upon the successful completion of an innovative project, can actually increase revenue, strengthening business plans.

Types of Innovation Funding

In the UK, innovation funding covers a wide variety of sectors, meaning some funding opportunities may be subject to industry. There are however, a wide range of funding opportunities that transcend industry, providing additional support to innovative businesses.

Some of the most prominent innovation funding opportunities are:

- Horizon Europe Programme

- Knowledge Transfer Partnership (KTP) funding

- Catapult Network funding

- UKRI Future Economy fund

- R&D Tax Credit funding

How R&D Tax Credits Work to Reduce Financial Risk

Funded by the British government, the R&D tax credit relief operates by allowing businesses to reclaim up to 33% of eligible expenditure. This form of innovation funding is available for research and development projects in a wide variety of industries, as long as the innovation is not in:

- The arts

- Humanities

- Social sciences (including economics)

With the option to carry forward R&D tax credits, businesses can choose to use the relief against future tax liabilities. This helps to improve financial risk management strategies, by building a safety net against potential financial losses.

Strategic Advantages of R&D Tax Credit Relief

As we’ve already discussed, innovation funding has a range of benefits for businesses investing in advancement, but what makes R&D tax credit relief so special?

By aligning business and industry goals, R&D tax credits provide the benefits in this image:

Qualifying for R&D Tax Credits

R&D tax relief only works to reduce financial risk if the business and project is eligible, and for that we must turn to HMRC’s eligibility criteria.

To qualify for R&D tax credits, businesses must be liable to corporation tax in the UK, and must be involved in a research and development project that seeks to overcome a scientific or technological uncertainty which could not otherwise be solved by an expert in the field.

Additionally a qualifying project must seek to produce a new or improved product, service, software or process as a result of qualifying activities.

Qualifying activities are tasks within an eligible research and development project that meets the following criteria:

- Activity aims to advance knowledge or capability

- Activity seeks to resolve industry uncertainties

- Activity is conducted using a systematic approach

- Activity is not easily replicated

After establishing eligible projects and qualifying criteria, businesses can then identify the eligible expenditure that includes:

- Staff costs (including PAYE, NIC and pension contributions)

- Externally provided worker (EPW) costs

- Subcontracted R&D costs

- Consumable items

- Software used in research and development

In order to ensure that R&D tax credit claims are compliant with HMRC’s policy and guidelines, it is advised that businesses work with an R&D tax credit advisor who has a greater knowledge of the relief requirements.

How Alexander Clifford Supports R&D Tax Credit Claims

As one of the UK’s leading R&D tax credit advisories, the team at Alexander Clifford has a profound knowledge of HMRC’s eligibility requirements and policy.

Combining this knowledge with their passion for innovation, our specialists work closely with clients to identify key qualifying activities and costs that are often overlooked. This is how they’ve submitted over 2,400 successful R&D tax credit claims on behalf of clients, resulting in over £83 million in claimed relief.

This is what makes Alexander Clifford your trusted choice for R&D tax credits.

Has your business been involved in innovative research and development? Reduce your financial risk with R&D tax credits, by filling in the contact form below, or book an appointment with one of our advisors.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.