R&D Tax Credits for Cloud Computing Software

Explore the world of cloud computing software and the innovative advancements that support the needs of various industries. Discern the challenges in CCS, the current focuses, the future trends, and how R&D tax credits can support the forthcoming progress in cloud computing.

Throughout the technological age, society has become more reliant upon data storage systems such as cloud computing software (CCS). Serving both public and private sectors, the infrastructure for cloud software is forever developing in order to improve accessibility and cost effectiveness.

Making advancements in cloud computing software requires a steady investment in research and development – the cost of which can be astronomical. Thankfully for those looking to innovate in the CCS space, there exists significant support with R&D tax credit claim, a government funded initiative that supports technological advancement in the UK.

The Advancement of Cloud Computing Software

When it comes to cloud infrastructure, research and development plays an indispensable role. Given its ability to increase data management, compliance, performance and deployment strategies, cloud computing software has the ability to provide necessary insights into market trends and customer needs.

As with all research and development efforts, there are of course both advantages and challenges to the advancement of CCS, from the shining beacon of light it has become for market analysis to the challenges faced when creating user friendly interfaces.

Advantages of Innovation in Cloud Computing Software

When exploring the advancement of CCS technology, research and development has the ability to provide a wide range of advantages, especially in these areas:

- Scalability

- Cost efficiency

- Speed to market

- Collaboration and accessibility

With data management, compliance requirements and continuous improvements being facilitated by innovative research and development, businesses are finding more efficient ways to operate within the cloud environment. But this is not without its difficulties.

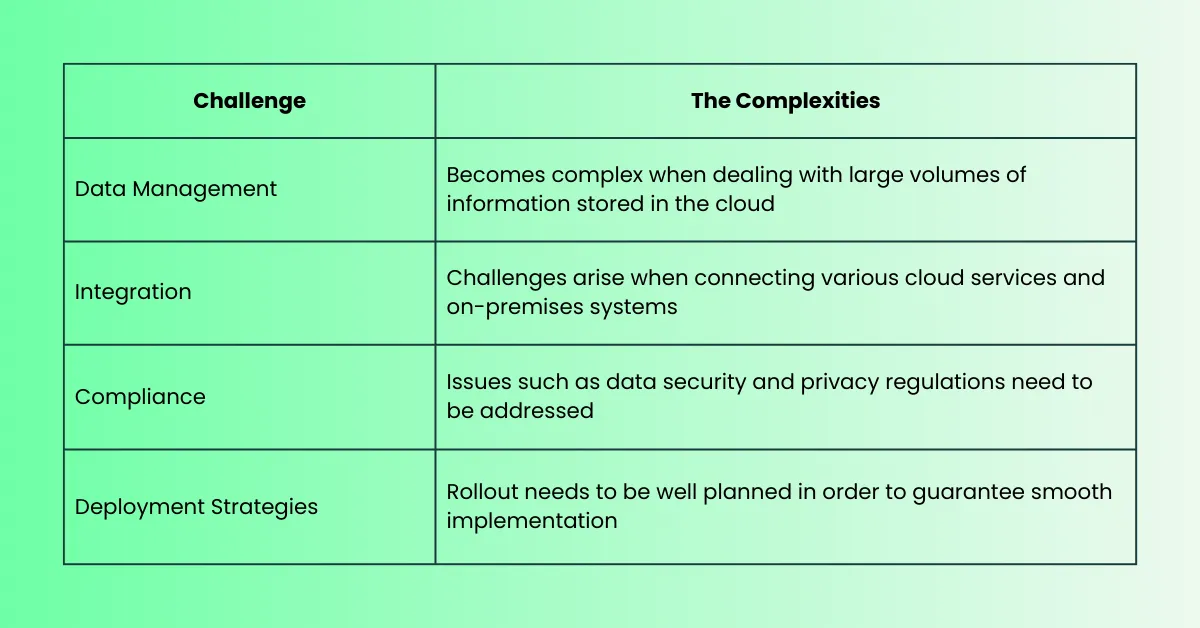

Challenges Faced in Cloud Computing Software Research and Development

Developing cloud software presents numerous challenges that require careful navigation. The following table depicts some of the key difficulties faced by those looking to innovate in the CCS space.

In order to identify and easily resolve issues early in the implementation process, robust testing measures should be in place. This requires a strategic approach and continuous innovation.

Innovations Through Research and Development in the Cloud

The field of cloud computing is ripe for continuous innovation through research and development, with advances in areas like scalability, data analytics, and machine learning, driving significant changes.

Cloud infrastructure is rapidly evolving, with hybrid solutions – combining on premise and cloud resources – becoming more common. New methods are making deployment processes smoother, and serverless architecture is improving resource efficiency.

Edge computing is expanding the boundaries of traditional cloud limits by processing data closer to the user, enabling faster responses. Connecting different cloud services seamlessly is becoming more important.

These innovations are reshaping the cloud landscape, offering better performance, flexibility, and efficiency. Of course, such innovative development can become costly. This is where R&D tax credits can help to alleviate the financial burden of research and development in CCS. Get more information about R&D tax credits by booking a chat with one of our specialist consultants.

Book a quick call back

Strategies for Cloud Solutions

Developing effective cloud strategies requires careful planning to meet an organisation’s specific needs. The following strategies outline the necessary steps to maintaining cloud effectiveness:

- Optimising cloud solutions

- Enhancing scalability solutions

- Building effective data management

- Improving performance focuses (speed, reliability and efficiency)

- Enhancing customer/user experience

- Optimising deployment strategies

Plans for moving to the cloud should be carefully crafted to minimise disruptions and maximise benefits. By implementing these strategies, organisations can fully leverage the benefits of cloud computing.

Impact of Research and Development on Cloud Security

Research and development greatly enhance cloud security measures. By continuously innovating, cloud security evolves to tackle new threats and comply with legal requirements. Efforts focus on:

- Improving data encryption

- Detecting threats

- Assessing vulnerability

- Refining response procedures

Security frameworks are updated regularly to manage risks effectively. Research also strengthens:

- User authentication and access controls

- Protecting sensitive information

Investing in cloud security research and development helps organisations proactively identify and address vulnerabilities, boosting overall security. This commitment not only protects against cyber threats but also reassures users that their data is safe.

Future Trends in Cloud Research and Development

As cloud computing continues to evolve, several future trends are set to revolutionise the industry. Some of these trends include:

- Focus on scalability

- Protecting data privacy

- AI (artificial intelligence) integration

- Cost saving strategies (resource sharing, enhanced workload management)

- Hybrid models (combining public and private clouds)

- Improving UX (user experience)

Meeting global legal standards is essential, with new solutions being developed to ensure compliance. These new solutions include the following:

- Serverless architecture

- Edge computing software

- Remote collaboration tools

These trends will shape the future of cloud research and development, driving innovation and keeping companies competitive.

Introduction to R&D Tax Credits for Cloud Computing Software

Using R&D tax credits is a smart strategy for companies developing cloud solutions. These tax incentives provide significant benefits by reducing the costs of innovation in cloud scalability.

R&D tax credits also help drive growth in the cloud computing industry. However, to qualify, companies must follow the rules set by HMRC.

Eligible R&D Activities for Cloud Computing Software

When developing cloud computing software, it’s important to know which activities qualify for R&D tax credits. Eligible activities include:

- Improving cloud infrastructure

- Research data analytics

- Developing efficient strategies & cost management techniques

- Exploring different service models

- Analysing performance metrics

The key to understanding what the qualifying activities within your research and development project may be, is to understand HMRC’s definition of R&D. You see, the idea of R&D tax credits is to encourage scientific and technological innovation, so in order to qualify for the tax relief, projects must aim to overcome a technological or scientific uncertainty that cannot be easily solved by an individual expert in the field.

Understanding which activities qualify is fundamental to maximising the benefits of R&D tax credits in cloud software development.

FAQ’s

In the world of CCS, research and development remains at the forefront of advancement, meaning the scope for qualifying R&D projects remains incredibly wide. This, of course, can make R&D tax credits difficult to navigate.

And so to help you gain a greater understanding of how the R&D initiative may be able to support some of your advancements, we’re exploring some of the most frequently asked questions about cloud computing software and R&D tax credits.

Can Startups or Small Businesses Also Benefit From R&D Tax Credits for Cloud Computing Software?

Yes, startups and small businesses can benefit from R&D tax credits for cloud computing software. These credits offer financial benefits that support growth and innovation, even for smaller companies.

How Do Companies Prove the Eligibility of Their R&D Activities for Tax Credits in Cloud Development?

Companies need to show how their projects address technical challenges, document costs, and improvements, and ensure they follow tax rules to prove eligibility for R&D tax credits. This can be done by following our revised guide to R&D documentation.

What Expenditure Qualifies for R&D Tax Credits?

Qualifying expenditure for R&D tax credits can include staff costs, consumable items and software used in research and development projects. For a full insight into qualifying costs, take a look at our complete guide to R&D expenditure.

Final Thoughts

In summary, R&D tax credits play a crucial role in driving innovation and growth in cloud computing software. By encouraging companies to invest in research and development, these credits pave the way for significant advancements, helping to overcome challenges and shape future trends in the industry.

By focusing on eligible activities and improving cloud security, companies can effectively use R&D tax credits to succeed in the fast changing cloud technology landscape.

How Alexander Clifford Can Help Compile an R&D Tax Credit Claim

Compiling an R&D tax credit claim as a CCS can be incredibly complex. Not only are you required to adhere to the strict guidelines laid out by HMRC, but you also need to provide an in depth technical report that substantiates your claim.

As leading R&D tax credit consultants, our specialists at Alexander Clifford are adept at compiling complex claims that align with HMRC regulations. Their expert knowledge has helped to successfully submit over 2,400 claims that meet approval with HMRC.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits. To better understand how we can help with your claim, enter your details in the form below, and get a call back within 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.