Unified R&D: The Merging of Two Major Schemes

What you need to know about the The Merged Scheme and how it will impact your R&D tax credits claim .

Since 2013, there have been two schemes that assist businesses – both large and small – in their research and development efforts. As of April 1st 2024 however, these schemes are intertwining in order to form a united R&D tax credit incentive.

As with all big changes, there are even bigger questions as to how much of an impact it can have. So in order to clear the air and answer some of your queries, we’re going to explore the merging of these pioneering schemes, and how it may affect your future research and development tax credit claims.

The History of SME R&D Tax Relief and RDEC Schemes

Back in the year 2000, the British government was intent on incentivising businesses to invest in research and development projects that aimed to enhance their prospective industries. The idea behind it was that industry advancements would form a culture of innovation in UK business, while bolstering the British economy. And so they began with support for small and medium sized enterprises.

SME R&D Tax Relief Scheme

When the government first introduced R&D relief, they began by forming the SME R&D Tax Relief Scheme – a financial incentive that gave SMEs tax credits for qualifying expenditure throughout their research and development activities. To qualify for this incentive, businesses had to meet the following criteria:

- Have less than 500 employees

- Have an annual turnover of less than €100,000

Alongside this criteria, businesses would have to align with HMRC’s definition of R&D – a project that seeks to make scientific or technological advancements by aiming to solve an uncertainty that cannot be overcome by industry experts.

RDEC Scheme

After seeing success with the SME scheme, the British government decided to expand the R&D incentive by creating a new form of relief for large businesses, which they named Research and Development Expenditure Credit (RDEC). Businesses looking to make an R&D claim under the new scheme would have to meet the following criteria:

- Be a part of a specific project that aims to make an advance in science or technology

- Meet the standard definition of R&D

When put together, RDEC and the SME R&D tax relief schemes would then forever fall under the phrase R&D tax credits. While these schemes may seem similar, there are some incredible differences that set them apart – so how will they merge?

Breakdown of the Merged R&D Scheme

This merger combines two of the most affluent R&D tax credit schemes in order to form a simplified scheme from which all businesses undergoing qualifying research and development projects will benefit. The idea behind the merger scheme is to simplify the R&D tax incentive and to further protect it from unsubstantiated claims.

Who the Merged R&D Scheme Will Impact

Considering the fact that R&D tax credit claims generally fall under either RDEC or the SME tax relief scheme, it’s safe to say that the new R&D scheme will impact any business looking to make a claim. Businesses impacted by the merged R&D scheme include:

- SMEs with less than 30% total R&D expenditure

- SME subcontractors (or an SME with subsidised R&D)

- Large companies with 500+ employees

How the Merged Scheme Impacts R&D Rates

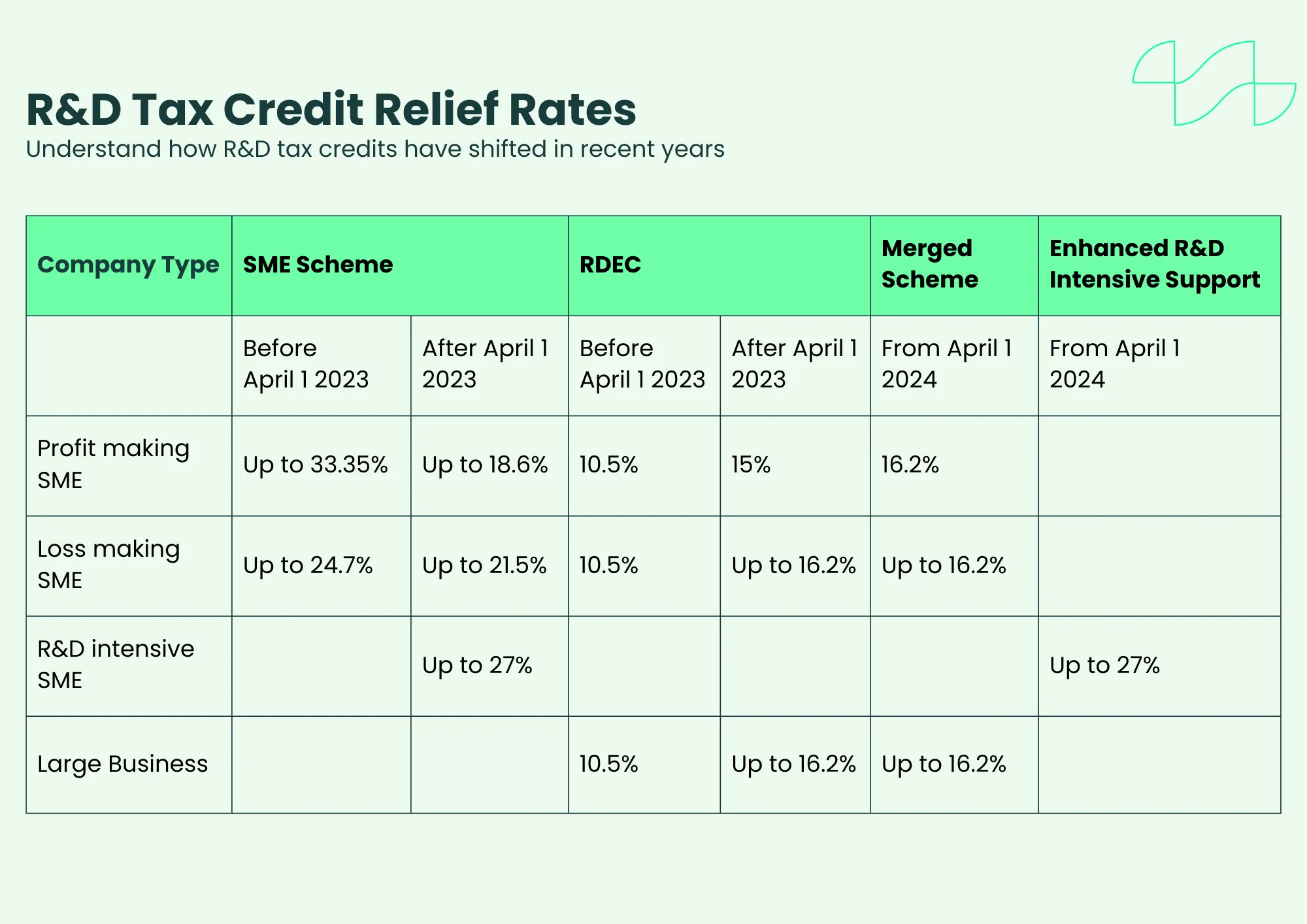

Over the past few years there have been an array of changes to R&D tax credits and the amount that businesses can expect to receive from their claims. With the changing rates, and how they impact each scheme it has often been difficult for companies to determine the worth of their claim without the use of an R&D tax credit calculator.

Under the new scheme however, these calculations are expected to become easier to understand, given the fact that the rates are inherently unified. The following table highlights the changes that this merger will have on the rate of R&D tax credits:

As you can see, the merger means that there is an equal rate for all businesses making an R&D claim. While there is a significant drop in some places, this updated rate allows claimants to easily calculate their claim.

How the Merged Scheme Impacts R&D Intensive SMEs

A loss-making R&D intensive SME is an SME that currently operates at a loss, but has a research and development expenditure of at least 30%. This distinction has in the past, ensured that these companies receive higher R&D tax credit rates – something that the government is intent upon keeping.

You see, while loss-making R&D intensive SMEs fall under the SME R&D tax relief scheme meaning they should technically fall under the merger, HMRC have confirmed that these companies will continue to operate under the old initiative. This distinction means that their rate will continue to be up to 27% for the foreseeable future.

Preparing for R&D Tax Credit Policy Changes

This merger came into effect on April 1st, 2024, however, it only immediately impacts your claim if your accounting period ends on or after that date. This means that if your accounting period ends prior to that date, your claim will still operate under the SME R&D tax relief scheme or the RDEC scheme for now, but changes will eventually come into effect.

With such big changes just upon the horizon, let’s take a quick look at what you should be preparing ahead of time.

Understanding the Eligibility Criteria

As we’ve already stated, HMRC defines research and development as a project that seeks to make scientific or technological advancements by aiming to solve an uncertainty that cannot be overcome by industry experts. In order to prove that your activities align with this definition of research and development, you should be able to concisely answer the following questions:

- What’s the scientific or technological advance?

- What scientific or technological uncertainties did you encounter?

- How and when were the uncertainties overcome?

- Why wasn’t an industry expert able to solve the uncertainty?

These are the core questions that determine the validity of your claim, but there is a specific way in which they should be answered through your documentation.

Necessary Documentation for R&D Tax Credits Claims

Compiling your documentation can be a lengthy process, as there are many elements required in order to file a successful claim. The following is a list of what documentation is generally required to substantiate an R&D tax credits claim:

- Project descriptions

- Financial reports

- Tax computations

- Technical reports

- Supporting documents

Keeping track of this documentation while your project is in progress can help to ensure that you don’t miss anything – in our experience as R&D tax credit consultants, we always say that having a lot of accurate documentation is better than having too little.

Monitoring Changes to R&D Tax Credit Policy

While you continue to prepare your business for changes in R&D tax credit policy, taking a proactive approach by monitoring legislative changes is going to be the most effective way for you to understand what’s to come. Put simply, staying informed is going to provide you with all you need to know!

While there are a range of ways that you can continue to stay informed, here’s what we recommend:

- Schedule a monthly check on HMRC policy changes

- Evaluate business news

- Follow an R&D tax credit consultant on social media

While all of these points are great ways to stay informed, we highly recommend the final one, simply because it offers you bite-sized breakdowns of all policy updates and changes.

Making an R&D Tax Credit Claim

So you’re prepared to make your tax credit claim – you understand which scheme your project falls under, you’ve gathered a variety of documentation, and you’re aware of HMRC policy – but what comes next?

Well HMRC actually recommend that you work with a consultant throughout the claims process. The fact that R&D tax credit consultants have extensive knowledge on the eligibility requirements, documentation, and the claims process in general, can give your claim a significant advantage.

How Alexander Clifford Can Help

We’ve helped over 2,400 clients save time with their successful R&D tax credit claims. As leading R&D tax credit experts we simplify the claims process, enabling innovative businesses to grow.

With a vast knowledge of policy, the claims process and HMRC, our experts provide high quality advice and deliver successful results. Which is why Alexander Clifford is your trusted choice for R&D tax credits.

Begin your claims process by filling in the contact form below, and get a call back from an expert in 30 minutes.