R&D Tax Credit A Practical Guide To Maximise Your R&D Claim

17 October 2024

Looking to understand R&D relief? We’ve got you covered with our complete practical guide to maximise your R&D claim. Delve into the history of R&D tax credits and identify the current schemes. Learn about R&D eligibility, the documents you’ll need and the qualifying expenditure that will help you make a successful tax relief claim.

For over 20 years, R&D tax credits have helped to form a culture of innovation across the UK. With HMRC generously incentivising scientific and technological advancement, thousands of businesses have been able to offset the financial burden of research and development, allowing them to gain a competitive edge throughout global markets. But how does the R&D tax relief work?

We explore the tax credit system in this practical guide, helping you to understand the ins and outs of R&D tax relief. But first, let’s explore the history of the incentive.

What are R&D Tax Credits?

Back in the year 2000, the British government was seeking a way to incentivise businesses to invest in innovative advancement. With the idea that such advancements would support the economy while creating an innovative hub in the UK, they developed a tax relief system that would encourage small and medium sized enterprises (SMEs) to undergo research and development projects.

This tax relief system is what we now know as R&D tax credits.

Throughout the years R&D tax relief has expanded to provide large businesses with financial relief, while it continues to support SMEs. Today, it has helped thousands of ideas become a reality, and has provided businesses with advantageous opportunities.

Book a quick call back

The R&D Tax Credit Schemes

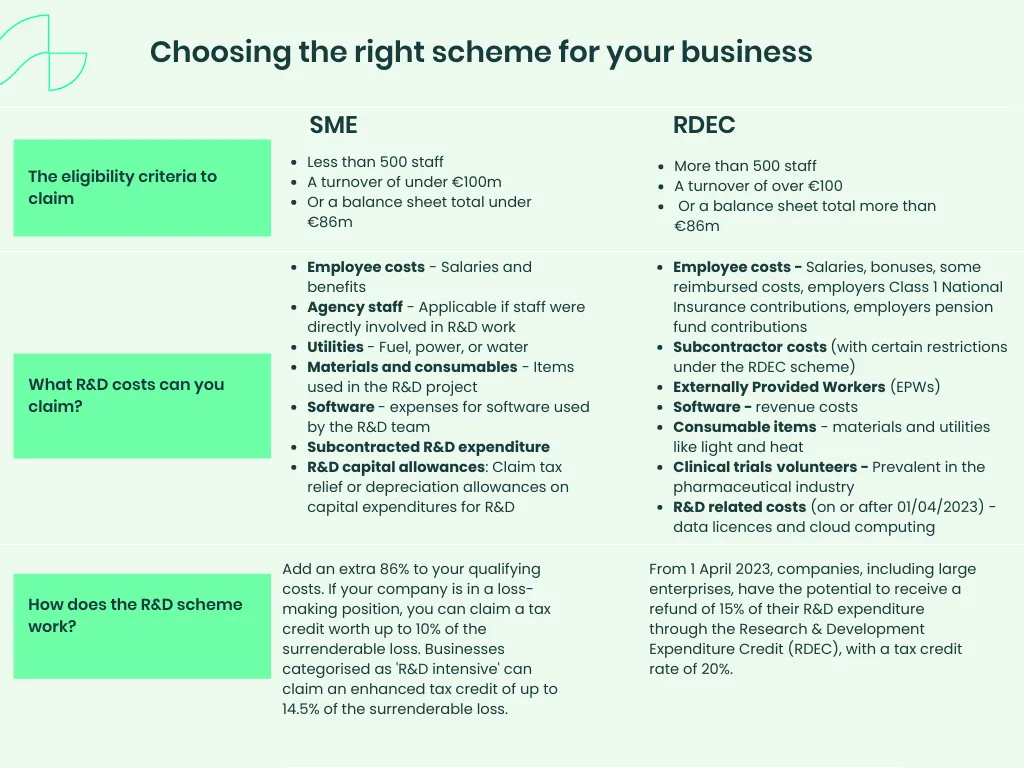

In order to encompass the wide variety of businesses that may be eligible for R&D tax credit relief, HMRC formed two schemes.

While SMEs are offered substantial financial relief from the SME scheme, large companies operate under RDEC (Research and Development Expenditure Credit).

As of April 1st 2024, these two schemes are blending to form the merged scheme. This means that large companies and SMEs will receive the same percentages of R&D tax credit relief for their eligible research and development efforts, if their accounting period begins on or after April 1st 2024.

Claiming R&D Tax Credits

Thanks to the generosity of HMRC, the reach of R&D tax credit relief is so extensive that it is available to most industries. In fact, when discussing eligibility, HMRC state the all businesses may be able to claim unless the advancement is in:

- The arts

- Humanities

- The social sciences (including economics)

As the relief is so extensive that it allows the majority of businesses to benefit from their innovations, understanding the specific eligibility requirements is crucial to making a successful R&D claim.

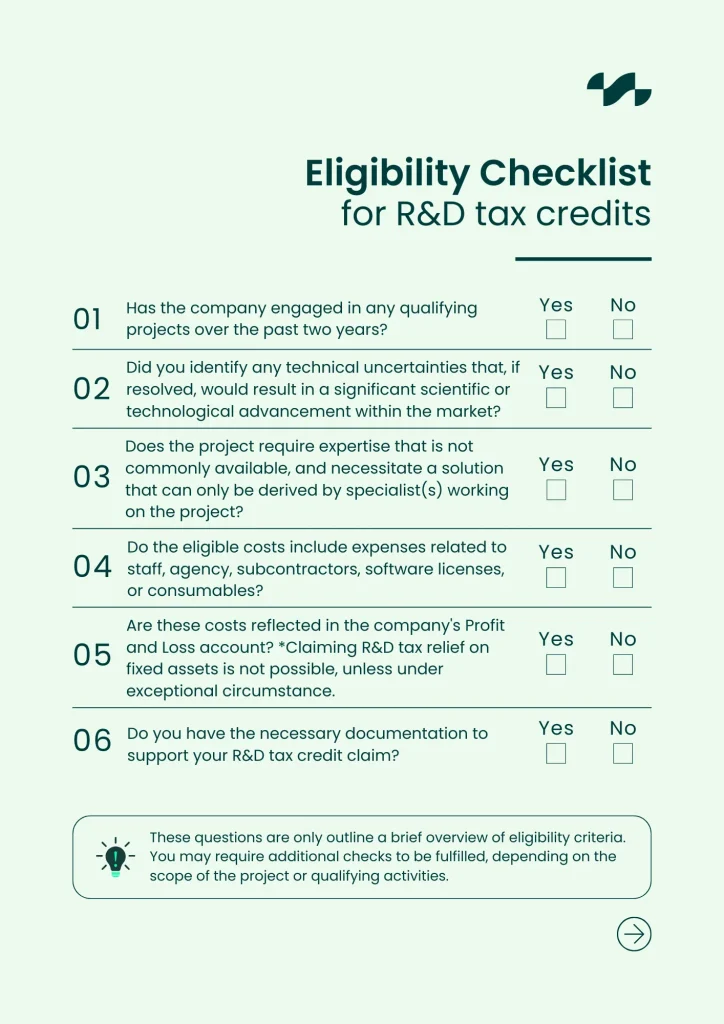

R&D Tax Credit Eligibility

In order to qualify for the R&D tax relief, your business must have undergone a research and development project that aimed to overcome a scientific or technological uncertainty that could not otherwise be solved by an expert in the field.

This serves as the crux of R&D eligibility, as it ensures that work has been done to make an advancement in the industry. Ultimately the research and development should result in the creation of one of the following:

- A new product

- An improved product

- A new software

- A new process

To help you identify the eligibility of your research and development project, we’ve compiled a checklist for R&D tax credit eligibility:

Click here to check your eligibility and get started with your R&D tax credit claim.

Maximising Your R&D Claim

After eligibility has been determined, there comes the task of compiling an accurate account of your research and development project – something that takes a lot of organisation.

In order to streamline the claims process and maximise your claim, we recommend that you follow these steps:

- Determine your eligibility

- Gather necessary documents

- Identify eligible costs

- Calculate eligible costs

- Understand the latest R&D tax credit rates

- Complete relevant forms and reports

- Review and verify the details of your application

- Submit the application to HMRC

While these steps help you to form an eligible claim, HMRC recommends that businesses collaborate with R&D tax credit specialists in order to ensure that their claims are compliant with the latest policies.

Documents Required for R&D Tax Relief

A successful R&D tax credit claim consists of accurate and detailed documentation that paints a clear picture of the research and development. While the required documentation typically depends on the nature of the project, there is an outline of documentation that every business should include in their R&D claim. This includes:

- Project descriptions

- Technical narratives

- Financial records

- Tax computations

A full list of required documentation.

About the Claim Notification Form

Some businesses are required to notify HMRC of their intent to claim R&D tax credits in what’s known as the claim notification form. Typically this form is a requirement for businesses that have not yet claimed the tax relief, but there exists a rule that may allow some businesses to forgo the claim notification altogether.

Here’s what HMRC say about the 3 year exemption rule:

“Claim notification will only be required where a customer has not made an R&D claim during the period of three years ending with the day before the first day of the accounting period.”

Source: HMRC

This means that those claiming under the SME scheme do not need to submit a claim notification form, so long as they have claimed R&D tax credits within the previous three years according to their accounting period dates. For this reason, it’s vital that businesses evaluate whether they qualify for this exemption by:

- Verifying whether or not the claim qualifies under the SME scheme

- Confirm that the exemption integrates with the existing R&D claim

If you do not meet the criteria for the 3 year exemption, you must submit your claim notification form within 6 months of the conclusion of the relevant accounting period. Failure to do so could result in an invalid claim.

Click here to learn more about the claim notification form and the 3 year exemption rule.

R&D Qualifying Expenditure

Considering your R&D tax credit claim is a return on investment into innovative advancement, understanding the qualifying expenditure is vital.

While these costs may vary depending on the industry of the business and the nature of the research and development, there are some expenses that are universally recognised as qualifying costs. They are:

- Direct research and development staff costs

- Externally provided research and development staff costs

- Consumable items

- Software used directly in research and development

Businesses outsourcing research and development activities, developing pharmaceuticals, or working on prototypes may be able to claim additional relief.

Calculate the overall worth of your upcoming claim with our R&D tax credit calculator.

Learn more about qualifying expenditure.

The Benefits of Claiming R&D Tax Credits

A successful claim has the ability to elevate your business by providing a financial boost and a competitive advantage over others. Here’s what else a claim could do for your business:

- Tax credits or deductions

You pay less tax meaning you have a pot of funds to use and reinvest into your project – whether that’s to make more hires, drive your marketing strategy or invest in new equipment - Offset costs

Successful R&D claims may allow businesses to recover a portion of their invested expenses, offsetting the financial burden of research and development - Attract investment opportunities

A successful research and development project is highly regarded by prospective investors, as it’s proof that you’re dedicated to advancement - Obtain a competitive advantage

With the ability to expand the release of your innovations that are a direct result of your research and development, you place your business ahead of competitors as you present something new to customers or clients

Truthfully, R&D tax credits open the window of opportunity to further invest in the future of your business, allowing you to obtain sustainable growth. Here’s how capitalising your research and development aids in this:

Example of a Successful R&D Tax Credit Claim

In order to highlight just how beneficial R&D tax credits can be, we want to take a close look at one of our clients.

This particular client oversaw a major research and development project that sought to produce an industrial process that would convert waste into high quality biofuel. By developing both a new process and a new technology, they were able to easily qualify for R&D relief, given that the project overcame both scientific and technological uncertainties that required an expansive team.

Given the fact that their project went way beyond the usual scope of research and development that is often seen by HMRC, our team of specialists spent a lot of time collaborating with this client, ultimately helping them to secure a return of £82,570.25.

How Alexander Clifford Provide Additional Support During R&D Claims

As leading R&D tax credit specialists, our team streamlines the claims process, ensuring that eligible businesses receive the maximum benefit available to them. By dedicating their expertise to compiling compliant claims, our team of specialists have submitted over 2,400 successful R&D tax credit claims on the behalf of our clients.

Making Alexander Clifford your trusted choice for R&D tax credits.

Is your business ready to make its claim? Fill in the contact form below or book an appointment with one of our specialists.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.