Infographic: A Revised Guide to R&D Tax Credit Documents (2024)

Discover the ins and outs of R&D tax credit documents for your 2024 claim, in our updated approach to the documentation process. From what qualifies as R&D to how you can get expert guidance in compiling your documents, we take a dive in our complete guide to R&D tax credit documentation.

When it comes to making an R&D tax credit claim, documentation will become your greatest asset. Not only will documents highlight the financial aspects of your claim, but it will also solidify the intent of your research and development project along with the actions that your business took in order to help bring your innovative ideas to life.

Navigating the R&D tax credit documentation requirements can seem a little daunting however, considering the amount of components that go into compiling a successful claim. So we thought we’d simplify the process for you, to ensure that you’re gathering all the right information during every step of your research and development project.

The Importance of R&D Tax Credit Documentation

When filing a research and development tax credit claim, it’s important to remember that HMRC has a very specific definition as to what qualifies as R&D . In 2024, they stand by the meaning that research and development is recognised as a project that aims to overcome an industry uncertainty via scientific or technological advancement.

With a mutually beneficial relationship, HMRC and innovative businesses have the ability to bolster the economy while positioning the UK as a home for industry advancement. But in order for this relationship to remain strong, businesses are required to be transparent throughout the R&D tax credit claims process.

This is where documentation comes in. R&D tax credit claims are made up of a variety of documents that should do the following:

- Highlight the aims of the research and development project

- Track the progress of the project

- Prove the costs related to a project

- Verify the eligibility of the business

For this reason, HMRC requires specific documentation that will establish authenticity in your initial claim and prove your eligibility.

What Documents Does an R&D Tax Credit Claim Require?

HMRC require you prove to them that your research and development project:

- Meets eligibility requirements

- Is authentic and true to nature

Given this, they state that they require six different documentation types in order to verify eligible claims.

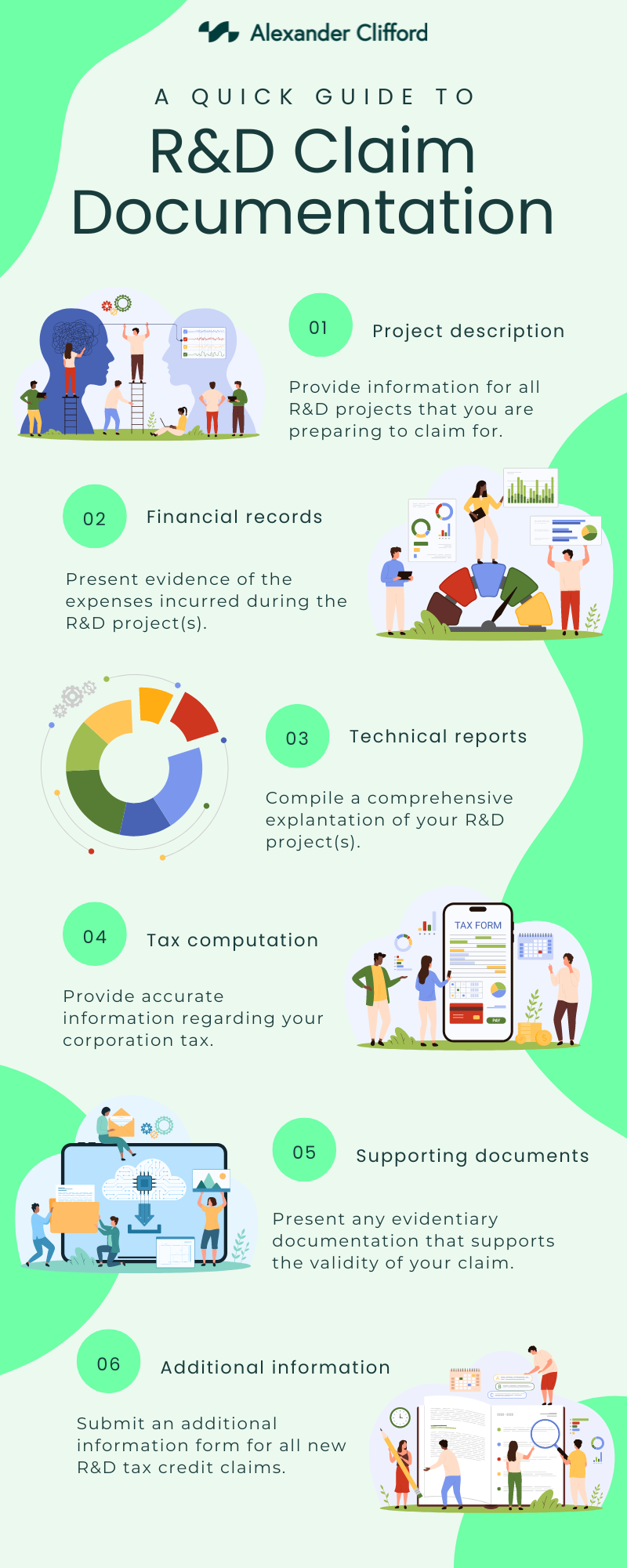

The Six Types of Required R&D Tax Credit Documentation

There’s a wide range of documents that you may feel compelled to include in your claim in order to validate its authenticity, but HMRC are really only interested in the following:

Although all R&D tax credit claimants are expected to compile project descriptions, financial records, technical reports, tax computation, supporting documents and additional information, first time claimants have an additional form that they must file ahead of making their claim.

Claim Notification Form for First Time R&D Tax Credit Claimants

The claim notification form is a pre-claim form that allows businesses making their first R&D tax credit claim to alert HMRC to their research and development activities.

To file this, you will need the following information:

- Business UTR (unique taxpayer reference)

- Primary senior internal contact

- Contact information for additional agents involved in the claim

- Accounting period start and end date

- Brief description of your R&D projects(s)

What Are Supporting Documents for R&D Tax Credits?

The idea of supporting documents is really simple; they are the documents and records that support the validity of your R&D tax credit claim.

At the time of publishing (July 23rd 2024), there are no specific outlines to describe what supporting R&D documents must be. However, we suggest that these documents should include the following:

- Project timeline

- R&D progress reports

- Research papers

- Patent documentation (if applicable)

Supporting documents such as these will showcase a clear outline of your activities, allowing your business to benefit from research and development tax credits.

What is an R&D Tax Credits Additional Information Form?

Since April 1st 2023, HMRC have requested that claimants fill out an additional information form for R&D tax relief. The additional information form should be submitted ahead of your CT600 (corporate tax return), and should include the following information:

- Business details (UTR number, employer PAYE reference number, VAT registration number, classification code)

- Contact details of connected agents

- Accounting period start and end dates

- Details of qualifying expenditure

- Details of indirect activities

- Project details

- Project descriptions

For many businesses this additional information form (AIF) will be the first part of the claims process, and the first opportunity to showcase the uncertainties that they aim to overcome during the course of their project.

Compiling Your R&D Tax Credit Documents

Considering the amount of documentation that is required to make a successful R&D tax credit claim, it’s imperative that you begin gathering documents from the moment that your project begins. Additionally, it would make sense to set some time each month to gather more information that may further support your claim.

The plus side of doing this, you will find that you have a mass of information by the time that you’re ready to begin the R&D claims process, however it will prevent you from having to search for everything later down the line. On the downside, that mass of information means that you may spend a long time trying to find what is relevant to your claim.

This is the reason that HMRC recommends that businesses work with an R&D tax consultant to help present your compiled documents in a way that meets requirements.

How Alexander Clifford Can Help

We’ve helped over 2,400 clients compile their documentation to submit successful R&D tax credit claims. As leading R&D tax credit consultants, we simplify the claims process, enabling innovative businesses like yours to grow.

With an in-depth knowledge of policy, the claims process and HMRC requirements, our consultants provide expert advice that leads to significant benefits for our clients. Which is what makes Alexander Clifford your trusted choice for R&D tax credits.

Start your claims process by filling in the contact form below, and one of our expert consultants will get back to you within 30 minutes.