How R&D Tax Credits Are Advancing EV Technology

12 September 2024

The world of electric vehicles is rife with innovative advancement, allowing businesses within the sector to benefit from R&D tax credits. Explore the nature of research and development in EV tech, from the change that it inspires to the future trends in the technology. Build an in depth knowledge of how the R&D tax credit initiative delivers financial relief to innovative EV technology projects, how to maximise an R&D claim, and how you can identify key qualifying criteria.

As the world becomes increasingly eco-conscious, the demand for more sustainable transport has approached the forefront of the automobile industry. This demand has led to an inspiring advancement in electric vehicles (EVs).

While EV’s grow in popularity, the industry faces a range of challenges in areas such as material optimisation, battery life, and even basic infrastructure. Such challenges place research and development at the forefront of EV technology – but advancement can be costly.

For the innovative businesses willing to invest their time and money into EV tech, there exists a government backed financial incentive that goes by the name of R&D tax credits. So let’s take a deeper look at the development of EVs and the tax credit relief that’s helping to advance the industry.

What is EV Technology?

EV technology represents a vital innovation in the automotive industry. EVs are vehicles powered by electricity stored in batteries, eliminating the need for traditional fossil fuels like petrol.

These vehicles produce zero emissions at the tailpipe, making them environmentally friendly and contributing to a greener future.

As the automotive industry continues to evolve, the advancements in EV technology play a vital role in shaping a sustainable transportation future.

The Role of Research and Development in EV Technology

In the domain of EV tech, continuous innovation and progress are driven by the pivotal role that research and development plays.

Research and development in EV technology involves the systematic investigation, experimentation, and innovation processes aimed at improving the design, performance, and efficiency of electric vehicles.

Through research and development, engineers and scientists explore a variety of advancements that focus on addressing key challenges such as:

- Extending driving range

- Reducing charging times

- Enhancing overall vehicle performance and safety

By investing time and resources into R&D, companies and research institutions contribute to the evolution of EV technology, making electric vehicles more accessible, reliable, and sustainable for consumers.

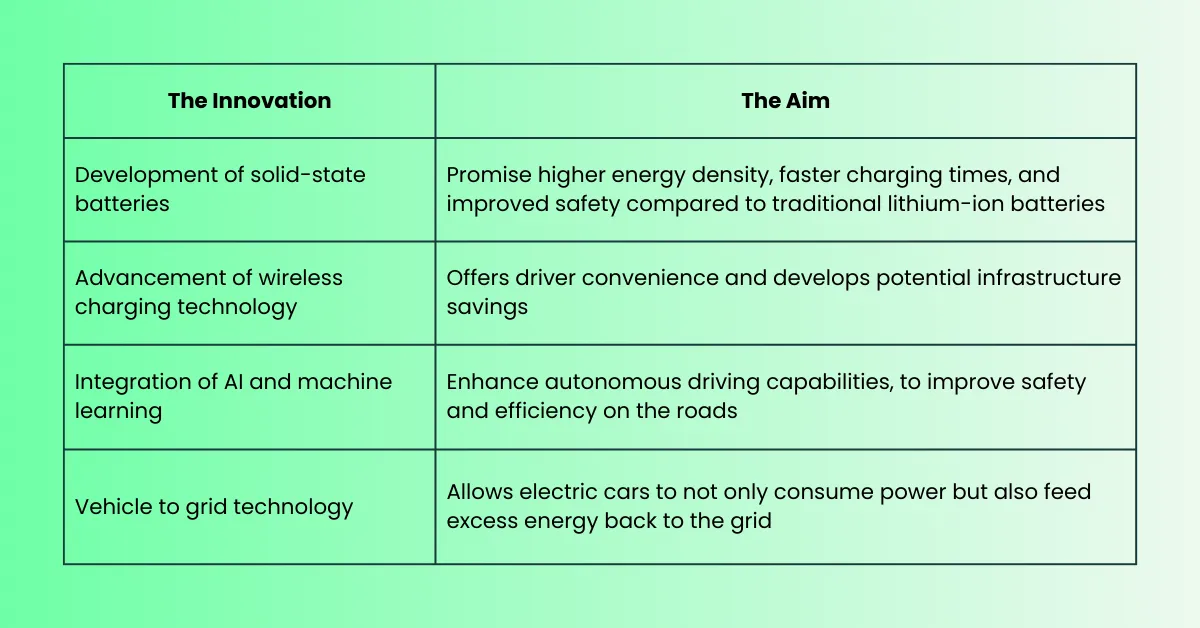

Future Trends in Electric Vehicle Advancement

Pioneering innovations in electric vehicle technology are propelling the automotive industry towards a future characterised by enhanced sustainability and efficiency.

These trends underscore the dynamic nature of electric vehicle advancement, shaping a future where eco-friendliness, performance, and innovation converge to redefine the automotive landscape.

How Do R&D Tax Credits Support EV Advancement?

Amid the rapid evolution of electric vehicle technology, a vital catalyst in driving innovation forward is the utilisation of R&D tax credits.

These government funded credits play a significant role in supporting the advancement of EVs by providing financial incentives to companies engaged in research and development activities related to EV technology.

By offsetting a portion of the costs incurred during the development of new EV technologies, R&D tax credits encourage businesses to invest in innovation, ultimately leading to the creation of more efficient, sustainable, and affordable electric vehicles.

Qualifying Activities in EV Research and Development

As we explore EV research and development, it’s imperative that businesses understand the qualifying activities for R&D tax credits. When engaging in EV innovation, the following activities may be eligible for tax credits:

- Conducting experiments to expand battery efficiency

- Developing software for enhancing autonomous driving systems

- Designing and testing new lightweight materials for vehicle construction

- Studying ways to increase energy conversion efficiency in EVs

- Investigating methods to improve the charging infrastructure for electric vehicles

Identifying qualifying activities involves documenting the technical uncertainties faced, the systematic approach taken to overcome these challenges, and the innovative nature of the solutions developed.

By focusing on these key aspects, companies can ensure that their EV research and development efforts meet the criteria for claiming R&D tax credits. Find out how the specialist consultants at Alexander Clifford can aid in your claim, by filling in the contact form below.

Book a quick call back

How to Maximise Your R&D Tax Credits

The key to maximising your R&D tax credit benefits, is understanding the incentive. By doing this, you will have a deep insight as to how to identify your qualifying activities, the qualifying costs, and how to compile a claim that adheres to HMRC policy.

Some of the ways that you can understand the R&D tax credit system are as follows:

- Subscribe to HMRC policy and legislative updates

- Follow relevant industry publications and blogs

- Engage with R&D tax credit specialists throughout the course of your claim

Not only will this allow you to identify key aspects of your claim, but it will also allow you to prepare for an R&D tax credit claim by showcasing the relevant documentation that you will require.

FAQ’s

Navigating the R&D tax credit system for EV tech can seem complicated, especially considering the terminology used in official guidelines. But we here at Alexander Clifford are on a mission to simplify the claims process, and to prove it, we’re answering a range of your most frequently asked questions.

What Costs Qualify for R&D Tax Credits?

When identifying the qualifying costs for R&D tax credits, it is essential to understand the specific expenses that can be included in your claim. Here are some key costs that typically qualify for R&D tax credits:

- Employee costs (such as PAYE and NIC contributions)

- Costs for supplies and materials used in the R&D process

- Payments made to third-party contractors for their work on qualifying R&D activities

- Costs associated with developing or improving test stage prototypes or processes

- Software expenses directly related to R&D activities

These costs must be directly linked to research and development activities that seek to make advancements in EV technology.

Can Start-ups in EV Technology Claim R&D Tax Credits?

Startups actively engaged in developing EV technology can indeed claim R&D tax credits, provided they are undertaking activities that qualify as research and development according to the guidelines set forth by the tax authorities.

These activities typically involve seeking to achieve technological advancements or resolving scientific or technological uncertainties through systematic processes such as experimentation, testing, and analysis.

Can R&D Tax Credits be Carried Forward?

Carrying forward R&D tax credits is a valuable option for companies looking to optimise their tax strategies and financial planning. This practice allows businesses to benefit from unused credits in future tax years, providing a cushion for potential fluctuations in income and expenses.

Here are five key points to contemplate when thinking about carrying forward R&D tax credits:

- Plan ahead

Strategically map out how and when to utilise carried forward credits to maximise their impact on future tax liabilities - Maintain accurate records

Keep track of all R&D activities and associated expenses to guarantee proper documentation for claiming and carrying forward tax credits - Stay informed

Stay up to date with any changes in tax laws and regulations that may affect the eligibility or utilisation of carried forward credits - Seek professional advice

Work with R&D tax credit specialists to navigate the complexities of carrying forward R&D tax credits effectively - Utilise credits wisely

Allocate carried forward credits towards new research and development initiatives to continue fostering innovation and qualifying for future credits

How Do R&D Tax Credits Differ for Battery Technology in EVs?

When it comes to battery technology in electric vehicles, R&D tax credits can vary based on the nature of the development.

Understanding these nuances is essential for maximising benefits and driving innovation in electric vehicles.

Final Thoughts

To summarise our exploration of R&D tax credits and their impact on EV technology, it is essential to emphasise the strategic importance of leveraging these credits effectively.

R&D tax credits play a vital role in fostering innovation and driving advancements in electric vehicle technology, and by incentivising companies to invest in research and development activities, these credits serve as a catalyst for progress in the EV industry.

Businesses that maximise their R&D tax claims not only benefit financially but also contribute to the overall growth and development of electric vehicles.

How Alexander Clifford Can Enhance the Success of Your Claim

Using expert knowledge of the latest HMRC policy and legislation, our specialist team is dedicated to helping businesses just like yours to compile successfully R&D tax credit claims.

Combining their expertise with a determination to leave no stone unturned, the specialist consultants at Alexander Clifford have helped to maximise the benefits in over 2,400 claims.

That’s what makes us your trusted choice for R&D tax credits.

To maximise your R&D claim, fill in the contact form below and get a call from one of our specialists within 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.