Planning Client Finances With R&D Tax Credit Relief

19 November 2024

R&D tax credits have the ability to fuel the future of innovative business in the UK, but how can you incorporate R&D relief into financial plans for your clients? We reveal all as we delve into the financial impact of R&D tax relief, how it impacts profitability metrics, our guide to structuring financial plans, and how a partnership can elevate the success of client claims.

For accountants, venture capitalists and investors, establishing ways to optimise client finances is the key to attaining sustainable growth and increasing long term valuations. This is where R&D tax relief can play a major role for innovative businesses, strengthening their financial plans and opportunities.

But how can you ensure that you’re utilising R&D tax credits in client financial planning?

Well today we’re taking a look at how the relief improves financial planning, and how you can leverage the benefits of R&D tax relief to produce sustainable business growth on behalf of your clients.

How Can R&D Tax Relief Improve Your Clients Finances?

By reducing corporate tax liabilities and providing substantial cash savings, R&D tax relief has the ability to reduce the financial burden of research and development. This allows businesses to continue investing in innovation and expand operations, ultimately strengthening their market competitiveness.

Additionally, R&D tax credits have the ability to improve valuation metrics, which may make them more attractive to investors.

Ultimately this relief provides your clients with a significant opportunity to maximise their resources and overall profitability.

Book a quick call back

How R&D Tax Credits Support Sustainable Growth

Sustainable growth enables a business to adapt to evolving market conditions, and improve market competitiveness. For innovative businesses, R&D tax credits can support this sustainable growth by:

- Increasing cash flow

- Encouraging continuous innovation

- Reducing financial risk

- Enhancing talent acquisition

- Optimises resource allocation

How R&D Tax Credits Impact Profitability Metrics

Given their ability to reduce corporation tax or provide cash refunds for eligible expenditure, R&D tax credits can directly improve net income. They are able to do this by:

- Raising net profit margins

- Increasing return on assets (ROA)

So for clients that are seeking scientific or technological advancements via research and development, R&D tax relief is a great opportunity to establish healthy profitability metrics, as they gain additional resources without increasing debt or external capital.

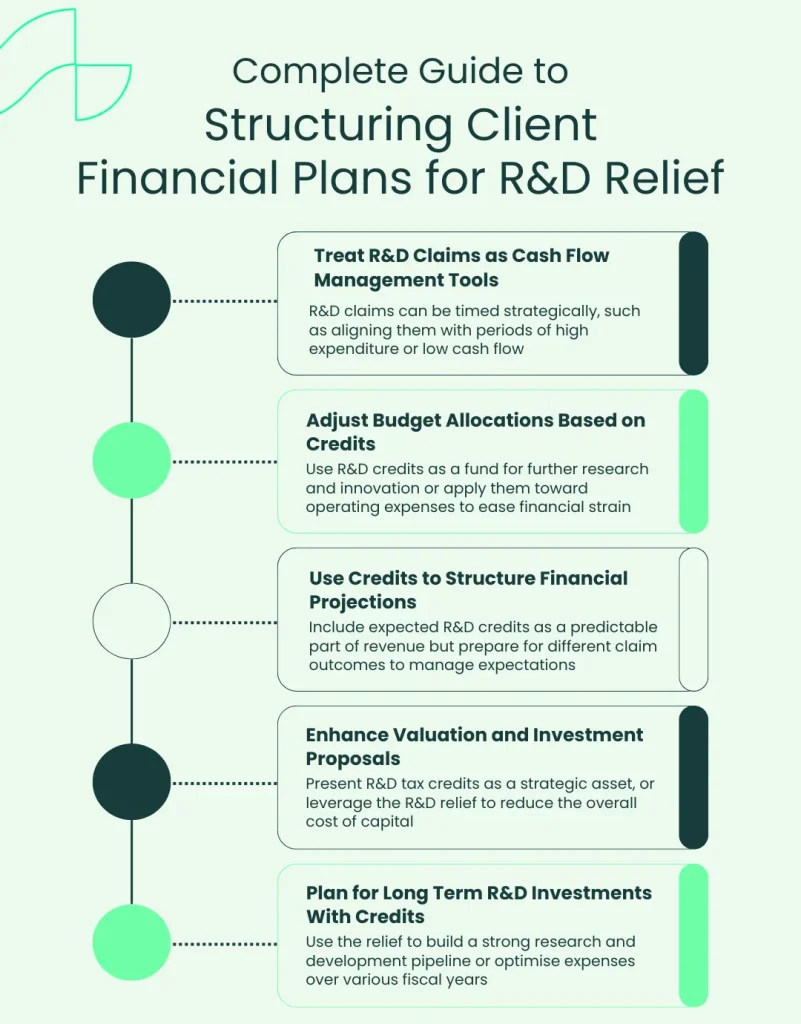

Guide to Structuring Financial Plans for Clients Claiming R&D Tax Relief

In order to help clients to optimise R&D tax relief, accountants, investors and venture capitalists are able to structure financial plans that incorporate R&D claims in a way that supports overall growth goals. The following infographic highlights a few key strategies that could assist in structuring a financial plan for clients claiming R&D tax credits:

How Alexander Clifford Can Assist You With Client R&D Claims

As one of the UK’s leading R&D tax credit advisor firms, we aim to simplify the process of compiling R&D claims. With this in mind, we’ve created our Partner Programme – the partnership that benefits you and your innovative clients.

When in partnership with us, your clients will receive a 5-star service from our dedicated team of specialists, ensuring that even the most complex research and development projects can maximise the financial benefits of R&D tax credits.

But how does it benefit you and your business? Well, by partnering with Alexander Clifford, you can:

- Provide premium R&D tax credit services to clients

- Increase your annual revenue

- Raise your business reputation

So what exactly do you have to do within this partnership? Really, there are four simple steps to successfully engaging in the Partnership Programme. They are as follows:

- Share your new service with your community

Upon signing up with the Partner Programme, promote your service to your existing clients and email lists - Refer innovative clients for R&D tax credit assessment

Refer clients that are investing in cutting edge research and development, as well as those that show interest in the service - Resume your regular business

While we handle your client’s claims, your time is freed so that you may focus on other aspects of your everyday business - Receive payment for your referral

Upon the completion of a successful claim, we send you a monetary reward for your referral

Communicating the Benefits of R&D Tax Credits to Clients

At Alexander Clifford, we understand how busy running your business can be. So in order to make the Partner Programme as straightforward as possible, we asked our marketing team to help out.

When you sign up to the Partner Programme, you receive expertly crafted materials that will help you to showcase your new service, and share the benefits of R&D tax credits with your existing clients.

Become a Partner With Alexander Clifford

Are you ready to work with R&D advisors to further support your most innovative clients? Well, becoming a partner with Alexander Clifford has never been easier.

Click here to head to our Partner Programme page, submit your details, and one of our senior specialists will give you a call with all the relevant information.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.