Integrating R&D Tax Credits into Cash Flow Planning for Business Success

Cash flow planning typically involves strategic analysis that leads to a clear allocation of business funds – but how can you integrate R&D tax credits into the overall financial projection? To gain a better insight, we’re exploring the world of cash flow management. Understand the facts and the challenges in cash flow management, how R&D tax relief affects cash flow, and when to include R&D credits in cash flow forecasts.

There’s no denying that understanding finances is a crucial part of business success. With frequent amendments to tax legislation and economic fluctuations, businesses benefit immensely from strategic cash flow planning.

For innovative businesses, there may be an additional revenue stream in the form of R&D tax credit relief, and today we’re taking a look at how strategically implementing the relief into cash flow projections can lead to business success.

What is Cash Flow Planning?

Cash flow planning is the strategic process of analysing and monitoring money as it flows in and out of a business, with the aim of optimising financial flexibility and operational stability.

While cash flow planning requires an adept understanding of finance and mathematics, there are a range of cash flow forecasting tools, such as:

- CashAnalytics

Combines data points to help with forecasting - Xero

Allows small businesses to keep track of their cashflow - Float

Allows users to create budgets and run financial scenarios

Book a quick call back

How Cash Flow Management Improves Business Success

By building a balance of ingoing and outgoing finances, cash flow management ensures that businesses maintain liquidity, allowing them to meet operational needs. What’s more, this strategic approach helps reduce the risk of encountering a financial crisis.

When cash flow planning is brought into the picture, businesses are able to build a solid financial projection that estimates the future income and expenses. This effective planning ensures that all outgoing expenses are paid in a timely manner, preventing the possibility of incurring additional late fees.

Optimising cash flow in this manner enables businesses to:

- Preempt and address shortfalls

- Reduce financial strains

- Strategically allocate financial resources

This newfound financial stability encourages leaders to reinvest in the business. Additionally, cash flow management encourages innovation, improves investor confidence, and ultimately provides a haven of financial stability. The ability to maintain this form of stability helps maintain a steady flow of business, making it the pinnacle of business success.

Key Challenges in Cash Flow Planning

While cash flow planning is the pinnacle of business success, it’s not without its challenges. Some of these key challenges in cash flow planning include:

- Insufficient cash reserves

- Fluctuating revenue streams

- Excess inventory

- Business complexity

- Increasing operational expenses

In order to overcome most of the challenges seen in cash flow planning, it is essential to ensure that incoming revenue streams are closely monitored and taken into consideration as cash flow forecasts are being drawn up.

How do R&D Tax Credits Affect Cash Flow?

In the UK, R&D tax credit relief is a government initiative that offsets up to 33% of the costs incurred during eligible research and development projects.

Available as a deduction in corporate tax liability or as a cash flow injection, R&D tax credits provide a predictable revenue stream that can not only be reinvested in day to day operations, but it can enhance the budget for upcoming projects, ultimately producing a cycle of sustainable growth via innovation.

Additionally, this relief can be used as a monetary reserve to be used against economic uncertainties and financial downturns, allowing a business to further reduce potential financial risks.

So for innovative businesses investing in cutting edge research and development, cash flow planning can be made simpler with the verified income of R&D tax credits.

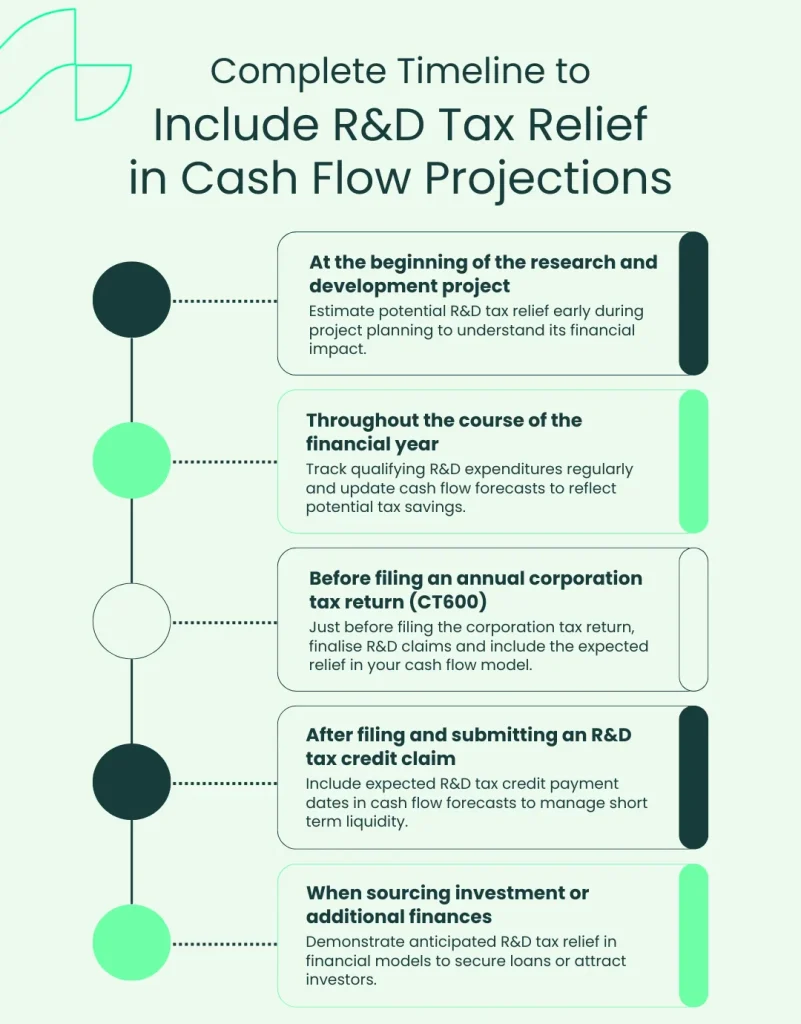

When to Include R&D Tax Relief in Cash Flow Projections

In order to optimise cash flow projections using R&D tax credits, it’s important to build a strategic plan that takes into account transitioning HMRC policy.

As research and development projects typically evolve depending on specific challenges and needs, it’s necessary to align cash flow plans with the project. This requires frequent reviewing of project spend and calculation of R&D tax credits.

To successfully factor R&D tax credit relief into cash flow projections, we suggest following this timeline:

Maximising R&D Tax Credits for Improved Cash Flow

The key to maximising R&D tax credits to improve cash flow throughout business, is to understand the eligible expenditure in which you are able to claim back through the relief. Qualifying R&D costs can include:

- Direct staff costs (including NIC and pension contributions)

- Externally provided worker (EPW) costs

- Consumable items (including materials used)

- Software costs (used directly in research and development)

By understanding these costs, additional funds that may have been obtained for research and development can be distributed strategically in order to bolster the effectiveness of R&D tax credit relief.

In order to successfully execute this strategy, meticulous documentation skills are crucial, due to the fact that HMRC requires clear financial records that clearly show the allocation of funds.

Using R&D Tax Relief for Reinvestment

By reinvesting R&D tax credits in research and development, businesses are able to form a cycle of sustainable, innovative growth that enables them to build stable financial infrastructures. This in turn, paves the way to improved scaling operations, talent acquisition, and can even improve market competitiveness.

Some of the most effective reinvestment strategies include:

- Prioritising high impact investments

- Plan for long term research and development projects

- Increase reinvestment with business grants

- Increase market reach

Each of these strategies ensure that the return of R&D tax relief is used to propel the business forward. In order to incorporate these reinvestment strategies into cash flow planning, it’s important to remember these best practices:

- Coordinate with business strategy and goals

- Keep track of overall return on investment (ROI)

- Consult with R&D tax credit advisors

How Alexander Clifford Can Help

As one of the UK’s leading R&D tax credit advisories, the team at Alexander Clifford has a profound approach to maximising R&D claims, ensuring that our clients are able to improve their overall cash flow.

Combining their meticulous eye for detail and their deep knowledge of the latest HMRC policy and guidelines, our specialist team have the ability to identify qualifying activities and costs that may often go unnoticed. This has allowed them to produce over 2,400 successful claims, resulting in over £83 million in R&D tax credits for our clients.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits.

Don’t miss out on an additional revenue stream. Enter your details below or book a meeting with one of our specialist advisors, to discuss your R&D tax credit claim.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.