4 Steps to Compiling an HMRC Compliant R&D Tax Credit Claim

The R&D tax credit claims process may seem complicated, but it doesn’t have to be! Unravel the world of R&D relief and how to successfully build a claim that adheres to HMRC’s guidelines.

Understand every step in the claims process, why an R&D tax credit consultant could help maximise your claim, how to identify a credible specialist and more!

There’s far more to an R&D tax credit claim than simply telling the tax authorities about your expenditure. In fact, forming a credible claim is a process that requires you to be organised, while maintaining a superb understanding of HMRC rules and regulations surrounding R&D tax credits.

In order to ensure that the claims process is as straightforward as possible, we deciphered the key steps that will help you to form the basis of your claim. With information on eligible projects and activities, qualifying costs, documentation and identifying reputable consultants, this is the ultimate step-by-step to building your R&D claim.

What is the R&D Tax Credit Claims Process?

Initially the R&D tax credit claims process describes the process that allows businesses to claim R&D tax credits in the UK. This process includes the following steps:

- Identifying eligible projects and activities

- Identifying and calculating the qualifying expenditure

- Compiling the relevant documents

- Submitting the claim in accordance with HMRC’s strict guidelines

It is important while progressing through the claims process, that you ensure that every aspect of the claim is in accordance with HMRC’s policy and guidelines. For those looking to get expert advice in regards to this, it’s helpful to build a claim with a credible R&D tax credit specialist such as those at Alexander Clifford.

Book a quick call back

Step One: Identifying Eligible R&D Projects and Activities

When identifying eligible R&D projects and activities, we must all take into consideration the specific definition that HMRC has of research and development.

In their eyes, research and development is a project that seeks to overcome an industry uncertainty using science or technology. Furthermore, this uncertainty should not be easily solved by an expert or individual in the industry.

By aligning with this definition, research and development projects should in turn aim to make an advancement by producing one of the following:

- A product

- A service

- A material

- A process

- A device

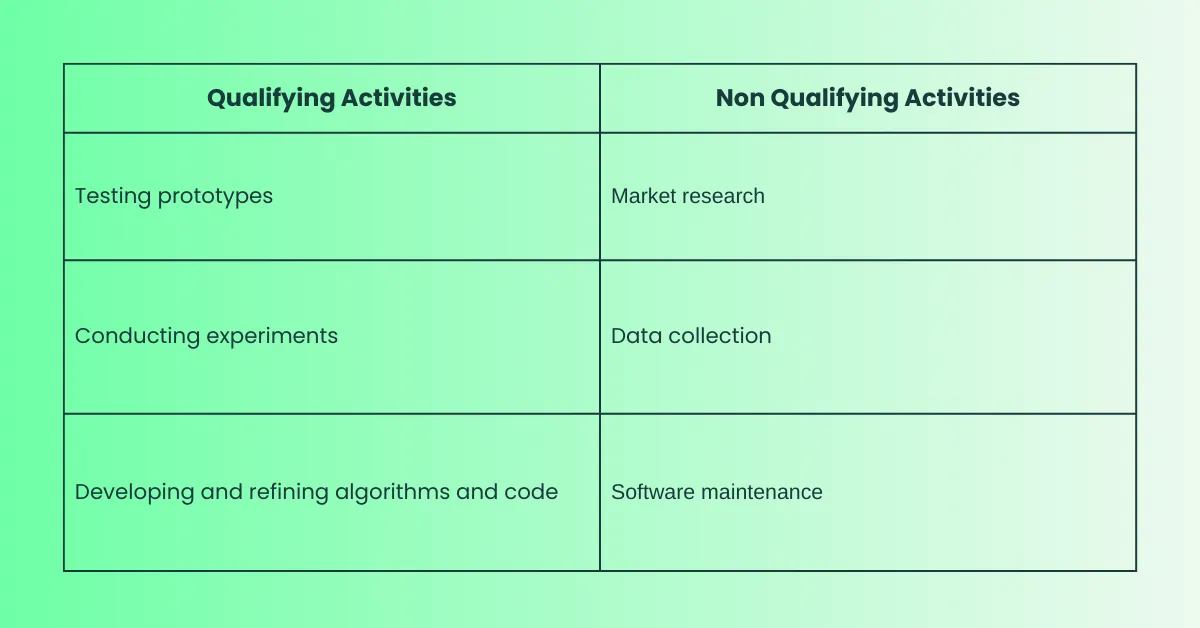

Throughout each project, there will be a healthy mix of qualifying and non qualifying activities. Qualifying activities should aim to advance knowledge and capability, while seeking to resolve the industry uncertainty. To highlight the difference between qualifying and non qualifying activities, the following table provides a few examples.

When compiling documentation, it’s important to include both the qualifying and non qualifying activities in your technical report. Not only does this help to establish the qualifying projects, but it helps to provide a project narrative. Although all activities should be included in your claim, you can only claim R&D tax credits for qualifying activities.

Step Two: Identifying and Calculating Qualifying R&D Expenditure

After identifying your qualifying activities, it’s necessary to understand the qualifying R&D costs. In this area, HMRC are quite generous as they allow businesses to claim:

- Direct and externally provided staff costs

- Subcontracted R&D

- Consumable items

- Software used in R&D

- Clinical trial volunteer costs (for pharmaceutical and medical innovation)

- Test stage prototypes

- Collaborative R&D

Once you’ve identified the qualifying costs, calculating your total expenditure is vital. With this final number, you are able to determine the overall worth of your claim with an R&D tax credit calculator.

Step Three: Compiling Relevant R&D Documentation

Possibly the biggest part of an R&D tax credit claim, the documentation should outline the key aims of your research and development project, present the finances involved, and tell a technical narrative of your business’s approach to overcoming uncertainty.

Some of the relevant R&D documentation may include:

- Project description

- Financial records

- Technical reports

- Supporting documentation

Understanding the documentation requirements is one of the most integral parts of compiling a claim, as incorrect documentation can lead to an enquiry, thus subjecting your future claims to enhanced scrutiny. This is why we suggest that you compile your claim with someone that has an in depth insight into the HMRC policies in relation to R&D tax credits.

Bonus Step: Consulting With an R&D Tax Credit Specialist

In order to develop an R&D tax credit claim that adheres to guidelines, HMRC actually recommend that you work alongside an R&D tax credit specialist consultant.

A great R&D tax credit expert will make it their responsibility to identify your qualifying activities and expenditure, and then work with you to compile and submit the documentation that supports your claim. Additionally, they will typically communicate with HMRC on your behalf, while making sure to keep you informed of the developments in your claim.

While there are a range of great R&D tax credit specialists out there, there are unfortunately, some who abuse that title. To ensure that a consultant is both credible and reputable, we recommend that you do the following:

- Check qualifications and experience

- Request references or case studies

- Verify industry expertise

- Review fees and payment structure

By doing this research, you’re able to gain an insight into the way that a consultant works. Furthermore, we recommend that you check their reviews in order to determine the overall satisfaction of previous clients.

FAQ’s

The area of R&D tax credits is often rather complex. From determining the qualifying factors to understanding the accounting treatment, there’s a lot of confusing information out there.

But we’re in the business of simplifying the process, so we wanted to take a moment to ask some of the most common questions regarding R&D tax credits.

Is There a Limit on R&D TaxCredits?

In short, yes. The limitations of R&D tax credits are determined by the size of the business, and therefore the scheme under which you’re claiming. The limitations are as follows:

- SME scheme: the amount of R&D tax credit can be capped based on the company’s PAYE and NIC liabilities, particularly for loss-making companies. There’s also an overall cap of £20,000 plus three times the company’s total PAYE and NIC liabilities

- RDEC scheme: large companies, or SMEs claiming under the RDEC scheme, the credit is calculated at 20% of qualifying R&D expenditure (as of April 2023), which is then subject to corporation tax

- The merged scheme: includes a cap on the amount of qualifying R&D expenditure that can be claimed. For SMEs, this includes a PAYE and NIC cap similar to the previous SME scheme, with adjustments to align more closely with the RDEC scheme rules

How Far Back Can I Claim R&D?

You can claim R&D tax credits for research and development that has taken place over the past two years. So if you’re claiming at the time this is published (September 2024), then you can claim for research and development between September 2022 – September 2024.

What Happens to Unused R&D Tax Credits?

Similar to limits on R&D tax credits, what happens with unused credits is dependent on the size of the business and the scheme under which the claim was filed. The following shows what may happen to your unused R&D tax credits:

- SME scheme

If a company is loss making and cannot use the R&D tax credits to offset its tax liability, it can choose to surrender the loss in exchange for a cash credit from HMRC, however if the company does not opt for a cash credit, it can carry forward the unused R&D tax credits to offset future profits or carry them back to offset profits from the previous year - RDEC scheme

If a large company under the RDEC scheme has unused R&D tax credits, they can be used to offset the company’s current or future tax liabilities. If there is no immediate tax liability, the credit can be carried forward to offset future taxes, however, in some cases, RDEC credits can be paid out as a cash sum, especially for loss making companies, though this often occurs after other taxes or liabilities have been offset - The merged scheme

Loss making companies under the merged scheme have the ability to surrender their unused R&D tax credits in exchange for a cash payment from HMRC, or carry the payment forward to offset future profits

For companies that are currently profit making but have more R&D tax credits than they need to offset their tax liability, the excess credits can be carried forward to reduce future tax liabilities

Under the RDEC part of the merged scheme, any unused credits that exceed the current tax liability may not immediately result in a cash payment – instead, these credits can be carried forward to offset future tax liabilities, similar to the existing RDEC rules

How Alexander Clifford Can Help

Producing an R&D tax credit claim can be time consuming – especially when you’re trying to understand the strict guidelines set out by HMRC.

As leading R&D tax credit consultants, our specialists draw upon expert knowledge in order to help clients to form their R&D tax credit claims. With over 2,400 successfully submitted claims and an enquiry rate of less than 1%, our specialists have a proven track record of producing high quality claims that adhere to HMRC guidelines.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits. To kickstart your claim, fill in the form below and get a call from one of our expert specialists within 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.