Claiming R&D Tax Relief for Startups and Small Businesses

Delve into the ever growing world of startups and small business, and the part that research and development has to play in their growth. Understand the government funding that inspires innovation for emerging companies, and how R&D tax credits could unlock new financial opportunities.

In the fast paced world of startups and small business, research and development is the key to gaining a competitive advantage, but for those looking to bolster their young businesses with innovative ideas, finding financial resources may prove to be one of the biggest challenges.

For businesses investing in their advancement, there exists a financial initiative designed to relieve the financial burden of innovation, and it goes by the name of R&D tax credits. So today we’re going to take a look at the role of research and development in small businesses and startups, the benefits it may have, and how R&D tax credits can help assist in scientific and technological growth.

The Role of Research and Development

With innovation paving the way for industry progress, research and development (R&D) helps aid progress throughout a variety of industries. With the existence of funding opportunities, small businesses and startups may find the opportunity to invest in their own innovations, but how could they benefit from these efforts?

The Benefits of Research and Development For Small Businesses

By investing in research and development, small businesses have the ability to create new products and services or to build upon ones already available.

Not only do these innovations help to attract new customers, but they also help small businesses to stay ahead of larger competitors. They’re able to do this by:

- Innovating to meet customer needs

- Keeping up with market trends

- Gaining a competitive advantage

The Benefits of Research and Development For Startups

The foundation of startups is innovation, whether they’re creating a new product, solving a problem or shaking up an entire industry. This is why research and development is a fundamental aspect of startup businesses.

Given the phenomenal effort that goes into successfully launching a startup, the research and development that goes into seeing innovations come to light, there are a range of substantial benefits. For example:

- Making new ideas and products a reality

- Protecting intellectual property

- Testing market assumptions

Overcoming Challenges in Research and Development

Although research and development is essential for small businesses and startups, it also comes with a range of challenges that can often seem frustrating to those involved. Whether it’s facing funding issues or dealing with skill gaps, with the right strategies, these challenges can be overcome.

Overcoming with Funding Issues

One of the primary challenges faced by small businesses and startups is the funding of innovative progress. While grants and state aid can offer substantial funding throughout the course of a project’s life, there exists one option that UK businesses can depend upon to assist with the funding of research and development.

R&D tax credits are a financial incentive dedicated to funding innovative advancement. With an R&D tax credit claim, businesses can offset the financial burden of research and development. Every year our experts at Alexander Clifford assist clients in compiling and submitting R&D tax credit claims that continue to inspire innovation.

Book a quick call back

Navigating Market Uncertainties

Given the fact that the market can be so unpredictable, research and development can be risky. This is why it’s important that small businesses and startups must be flexible and willing to adapt quickly.

One way to do this is by using agile research and development methods. This involves breaking down projects into smaller, manageable tasks that can be completed quickly. By testing and refining ideas in small steps, businesses can respond to market changes more effectively and reduce the risk of failure.

Filling Skill Gaps

Another challenge is finding the right people with the skills needed for research and development. Small businesses and startups might not have the budget to hire a full team of experts, but there are ways to fill these skill gaps.

One solution is to invest in training for existing employees. By upskilling current staff, businesses can build the expertise they need for research and development related activities without having to hire new people.

Another option is to bring in temporary or freelance experts to work on specific projects. This allows businesses to access the skills they need without committing to full time hires.

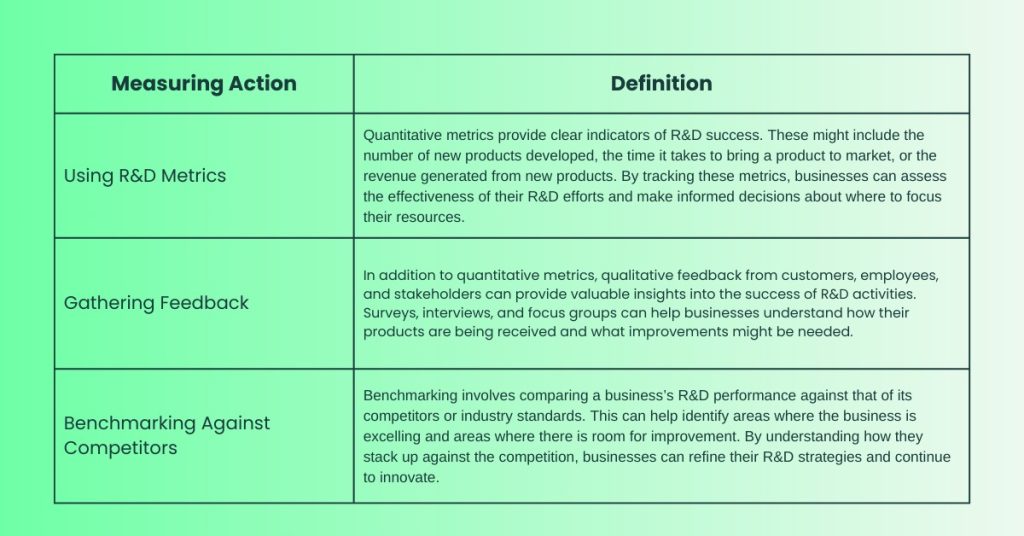

Measuring the Success of Research and Development

Measuring the success of research and development is important to ensure that the investment is paying off and that the business is moving in the right direction. There are several ways to measure this success, as can be seen in the table below:

How R&D Tax Credits Help to Fund Innovation

Funded by the British government, R&D tax credits have the power to offset the cost of research and development. However, this is subject to eligibility.

To be eligible for R&D tax relief, businesses must adhere to HMRC guidelines put in place to certify the authenticity of research and development activities. These guidelines include:

- Aligning with HMRC’s definition of research and development

- Calculating qualifying expenditure

- Providing supporting documentation

What is HMRC’s Definition of Research and Development?

With the aim of aiding in the advancement of business in the UK, HMRC are very specific with their definition in relation to R&D tax credits. Under their definition, research and development is a project that aims to use science or technology to overcome an uncertainty that is not easily solved by experts in the industry.

Given the fact that this specific definition allows a range of projects to qualify, HMRC has a few more rules in order to protect the incentive. For example:

- Claims cannot be made if the advancement is in the arts, humanities or social sciences (including economics)

- Qualifying projects must aim to advance the industry of the claimant (i.e. an agricultural business looking to better drone surveying using AI)

- Qualifying projects should research or develop a new process, product or service, or seek to improve an existing one

What is Included in R&D Expenses for Small Businesses?

The wonderful thing about R&D tax credits is that they offer an array of reliefs. In order to understand their full extent, the following is a list of qualifying expenditure for small businesses and startups:

- Direct R&D staff costs

- Externally provided R&D staff costs

- Subcontracted R&D

- Consumable items

- Software used directly in R&D

- Clinical trial volunteer costs

- Prototype production

- Collaborative working

How is an R&D Claim Calculated?

Before calculating the qualifying expenditure on an R&D claim, it’s important to decipher which scheme that the claim will fall under. As of April 1st 2024, there are three different R&D tax credit schemes, and they are as follows:

After establishing the correct scheme, and calculating the overall costs of qualifying R&D activities, businesses can use an R&D tax credit calculator to analyse how much their claim may be worth.

Final Thoughts

The relationship between R&D tax credits and research and development by startups and small businesses is symbiotic. Not only does the tax relief allow businesses to innovate, it enables them to stay ahead of competition and even to broaden their scope to a larger global market.

By embracing scientific and technological advancement as part of their plans, small businesses and startups can expect to experience sustainable growth – so long as they make sure to evolve with the markets, and allow themselves to be agile when they don’t get the desired results.

How Can Alexander Clifford Help Startups and Businesses With R&D Tax Credits?

Navigating R&D tax credit claims can be time consuming – especially to small business owners and startup entrepreneurs. As leading R&D tax credit consultants, our experts have helped over 2,400 busy business owners to save time by compiling and submitting claims on their behalf.

With extensive knowledge of the claims process and HMRC compliance, our dedicated team is on hand to aid in your claim from start to finish. That’s what makes Alexander Clifford your trusted choice for R&D tax credits. Get started on your R&D tax credit claim by filling in the contact form below, and get a call from one of our experts in 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.