Drive Sustainability in R&D with UK Tax Relief

As businesses battle for a competitive edge, research and development becomes the key to progress. But do innovators have a responsibility to make sustainability in R&D a priority? Today we look at the endurance of innovation to understand why sustainability in research and development is important, and how UK tax relief can play an important role in promoting sustainable practices in innovation.

As the British government doubles down on their support for eco-friendly solutions, it’s clear that “sustainability” is more than an expression, it’s become an obligation on both a personal and corporate level, as we venture into more mindful practices that protect our environment.

With that in mind, should businesses be thinking about sustainable practices while undergoing research and development projects? And if so, how?

Throughout this article, we delve into the topic of sustainability in R&D to highlight how industries can unite in their efforts to innovate without having a negative impact on the future of the planet.

Why Sustainability in R&D is Important

As science and technology advance, the impact of research and development can lead to resource depletion, pollution, and long term environmental damage, which can hinder future progress. As there is a direct link between progress and the economy, a reduction in effective research and development would likely lead to societal and economic disruption.

This makes sustainability in R&D essential, as it ensures that today’s innovations do not come at the cost of future generations or economic structures.

So what is it that sustainability in R&D entails?

What is Sustainability in R&D?

Sustainability in R&D is the process of making scientific or technological progress without harming the environment or depleting resources. The whole idea is to ensure that future generations can continue to invest in progress.

Sustainability in R&D can involve:

- Using eco-friendly materials

- Minimising waste

- Optimising energy efficiency

While these actions can reduce the environmental impact of the research and development process, sustainability in R&D extends to the consideration of the long term impact of new products and technologies, to ensure they are safe, ethical, and long lasting.

You see, sustainable R&D is not just about the environment, as there is a social and economic responsibility to ensure that innovations are both accessible and beneficial to society.

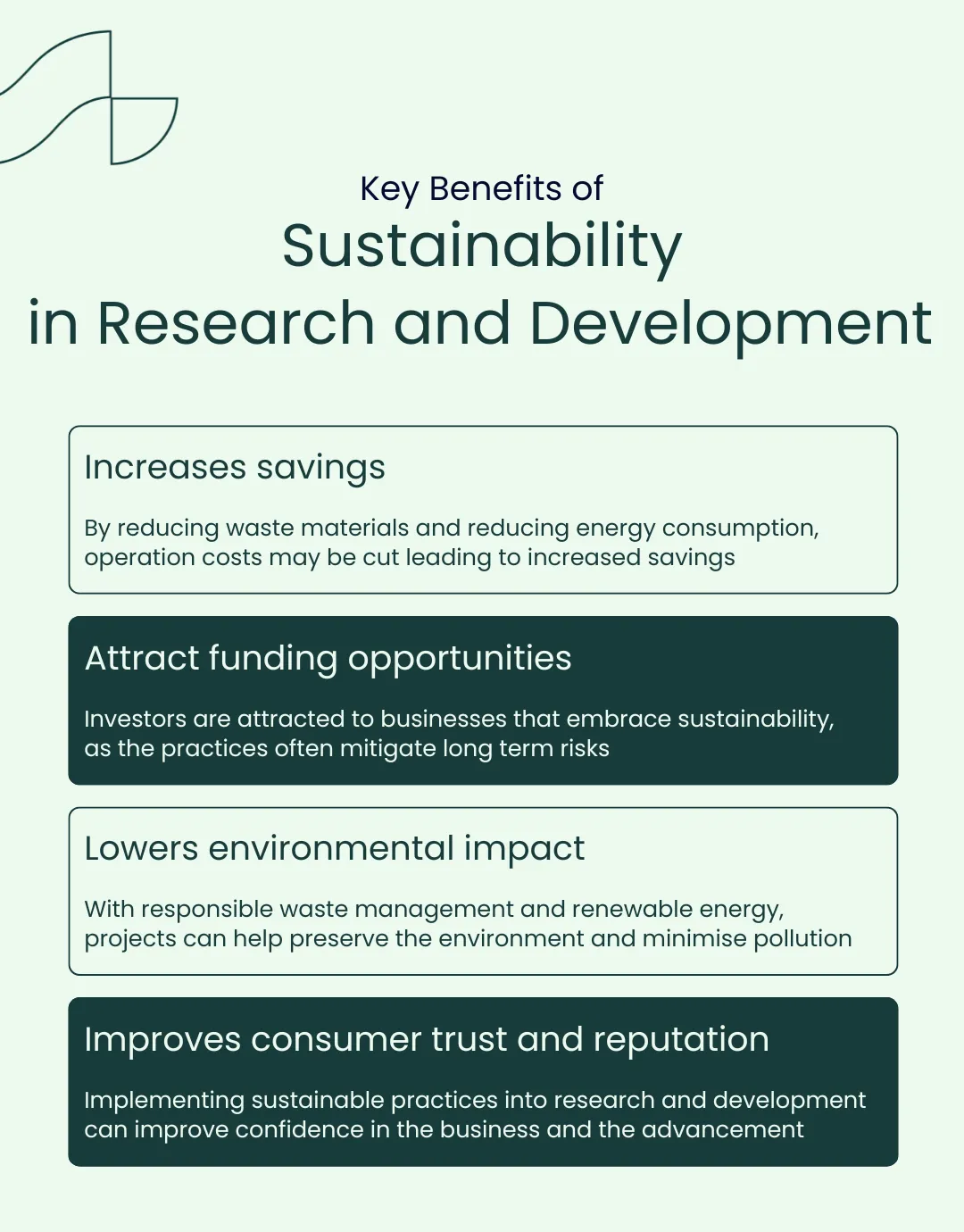

Benefits of Sustainable Practices in R&D

The knowledge that future generations could be positively impacted by sustainable practices can encourage businesses to envelope a more conscious approach to research and development. But there’s more to sustainability in R&D than that.

Businesses that optimise sustainability throughout research and development will notice a range of benefits as they make the transition to more eco-friendly options. Some of the benefits of sustainable practices in R&D include:

What Makes Sustainability in R&D Possible?

While sustainability in R&D may seem tricky to navigate, there are teams all over the world working on sustainable alternatives that allow future progress to be made with minimal impact or harm to the environment and on future generations. This is some of what they’re doing to make sustainability in R&D possible:

- Eco innovation

Researchers are working on the development of new technologies and materials that can be incorporated into other innovative projects - Circular economy development

Single use items increase waste and have a significant impact on the environment, so a lot of work is being done to develop long life alternatives - Waste management innovation

While circular economy development introduces reusable materials, there are some materials that are still single use – so researchers are working on waste methods that prevent harm to the environment

Industries That Implement Sustainability in R&D

While the world races to ease the effects of climate change, there are many industries opting to elevate their sustainability practices. This often extends into their research and development projects.

These are some of the industries that are implementing sustainability in R&D.

Renewable Energy

As one of the leading pioneers in eco-friendly technology, the renewable energy industry typically prioritises sustainability at every stage of research and development. This includes producing renewable energy sources using recycled materials, researching long life energy storage technologies that rely on fewer raw materials, and developing energy efficient grids using smart technology to reduce waste.

Some of the UK based clean energy businesses that implement sustainability in R&D include:

Pharmaceuticals

In recent years, the pharmaceutical industry has ramped up their sustainability efforts. They integrate sustainability in R&D by using green chemistry to develop safe biodegradable medicine, reducing water and energy consumption in research labs, and developing practices to reduce toxic by products.

Some of the UK based pharmaceutical businesses that implement sustainability in R&D include:

Agriculture

As the agriculture industry relies on a healthy environment to raise healthy crops and livestock, they advocate for sustainability at every level. Those working in agriculture apply sustainability in R&D by innovating in alternative farming practices such as precision farming to reduce land use, develop high yielding drought resistant crops to reduce water, and reduce food waste via supply chain advancement.

Some of the UK based agriculture businesses and organisations that implement sustainability in R&D include:

How UK Tax Relief Supports Sustainability in R&D

With a net zero target of 2050, and a goal to establish the UK as an innovation hub, the British government actively encourages businesses to integrate sustainable practices into research and development projects.

One of the ways they encourage this is through advising businesses to reinvest R&D tax relief savings into sustainable research and development practices.

You see, R&D tax credit relief is a form of innovation funding that enables businesses to claim back a portion of their invested research and development costs as tax credits. The money saved from offsetting these credits against tax liabilities, can be reinvested into additional innovative projects.

As this funding comes in the form of tax relief, businesses must be liable for UK corporation tax. To ensure that the R&D tax credit relief is protected against possible fraud and error, HMRC (the governing body that oversees the relief) has a range of eligibility criteria in place that outline what qualifies for R&D tax credits.

How to Qualify for R&D Tax Credits

To qualify for R&D tax credits, you must ensure that your research and development project seeks an advance in science or technology by overcoming a technical uncertainty that couldn’t be solved by an expert in the field.

If your project meets this definition, you probably qualify for R&D tax credits. The next step is to identify your qualifying activities.

Within every research and development project, there are different activities that help you to achieve your goal of producing a new or improved:

- Product

- Service

- Process

- Software

While some of these activities may be administrative, qualifying R&D activities are the tasks that contribute to overcoming the scientific or technological uncertainty. This can include:

- Planning to resolve the uncertainty

- Scientific or technological design (with testing and analysis to resolve the uncertainty)

- Creation or adaptation of software, materials or equipment required to overcome the uncertainty (as long as it is produced solely for use in R&D)

After identifying all of the qualifying activities within your project, you can then turn your attention to identifying the qualifying costs. Qualifying costs are only recognised if they are costs incurred throughout qualifying activities. These costs can include:

- Test stage prototype costs

- Software costs (for software used directly in R&D)

- Consumable items (such as materials and some utilities)

- Direct staff costs (including PAYE, NIC and pension contributions)

After establishing your eligibility, HMRC recommends that you work with an R&D tax credit consultant to ensure that your claim is compliant with the latest policy and legislation. That’s where Alexander Clifford comes in.

Compile a Successful R&D Tax Credit Claim with Alexander Clifford

As one of the UK’s leading R&D tax credit advisories, we’re here to help you identify every qualifying activity and expense, ensuring you maximise your claim with confidence and accuracy.

Our specialist team has a strong understanding of HMRC’s policies and processes, and with a proven track record of securing over £83 million in tax credits for our clients, we believe that every innovation should be recognised and rewarded.

That is why Alexander Clifford is your trusted choice for R&D tax credits.

Don’t let the value of your pioneering research and development go unclaimed. Fill out the contact form below or book an appointment with one of our specialists.

Book a quick call