ERIS Explained: Your Guide to R&D Tax Relief in 2025

As the landscape of R&D tax credits continues to evolve in 2025, HMRC ramps up support for certain SMEs with their Enhanced R&D Intensive Support. Find out what ERIS is, how the UK government is giving a little extra to startups and small businesses, the key benefits of the relief, and how you can make a compliant claim with R&D tax credit advisors.

While most businesses begin to claim R&D tax relief under the new merged scheme, some cutting edge SMEs that rely on higher relief rates to support their research and development efforts, turn to ERIS.

But what is ERIS and who qualifies for its more generous rates?

We explain all that and more with this deep dive into the ERIS relief.

What is ERIS?

Enhanced R&D Intensive Support (ERIS) is an R&D tax credit scheme for research and development intensive businesses, that allows them to claim a total deduction of 186% on qualifying costs. What’s more, qualifying businesses can claim a payable tax credit of up to 14.5% of their surrenderable loss.

This means that businesses who qualify for ERIS are able to receive more from the R&D tax relief than those claiming under the merged scheme.

Book a quick call back

How is ERIS Different from Other R&D Schemes?

There are a few reasons that ERIS stands out from other R&D schemes, as it aims to focus on businesses with high levels of investment in research and development. The key differences between ERIS and other R&D schemes are found in these key benefits:

- Tailored for R&D intensive businesses

- Provides enhanced R&D benefits

- Simplified claims process

- Specialised support for qualifying businesses

While ERIS is vastly different from other existing R&D schemes, it is aligned with the core goal of the R&D tax credit relief – to enhance economic growth through scientific and technological innovation.

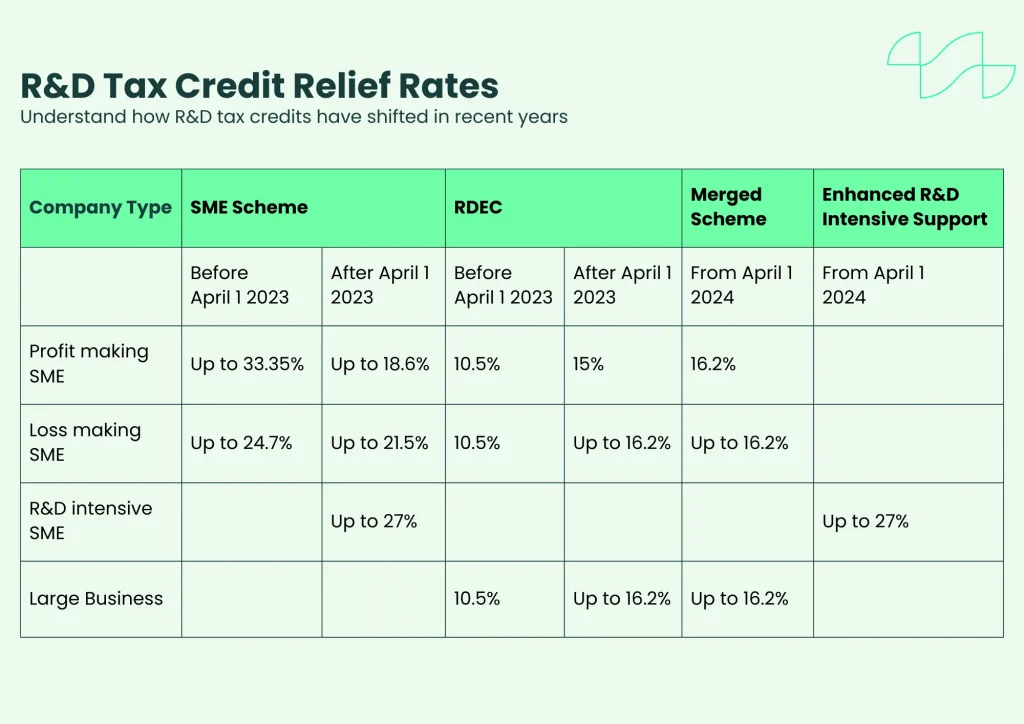

In addition to the key aspects of ERIS being different from other R&D schemes, those claiming under ERIS will notice that they have a higher rate of tax relief for qualifying expenditure. The following chart details the difference in R&D tax credit relief rates:

Who Qualifies for ERIS?

While other R&D tax relief schemes support a wide range of businesses, ERIS is a little more exclusive. The only businesses eligible for Enhanced R&D Intensive Support are loss making SMEs that are R&D intensive.

A loss making SME is a small or medium sized enterprise that reports a trading loss for tax purposes, before applying deductions. To determine whether it qualifies as R&D intensive, a business must meet HMRC’s intensity condition:

- It’s claiming for an accounting period starting on or after April 1st 2024

- At least 30% of its total spending is on R&D (including spending by connected companies)

The business must meet those criteria for the accounting period they are claiming for, although there is a grace period where they can still claim if:

- It met the 30% condition in the previous accounting period

- It made a valid claim for SME relief or ERIS during that period for R&D costs incurred on or after 1 April 2023

This means that if your R&D intensive SME is operating at a loss and you’re preparing to make an R&D tax credit claim under ERIS, you have to pay close attention to your accounting period.

Why ERIS Matters in 2025

The way that innovative businesses claim R&D tax relief is changing. While HMRC introduces their new merged scheme that’s designed to streamline the claims process and improve accuracy, ERIS exists to do the same for R&D intensive SMEs.

With its many benefits – as well as its increased financial support – ERIS plays a major role in helping businesses sustain and expand their research and development efforts.

But why is that so important in 2025?

In recent years, innovation has become the focal point of economic growth. As businesses invest in innovation, they are able to expand their work forces, their profit margins and their competitiveness.

So as ERIS supports loss making SMEs and their research and development projects, the scheme actively enables them to help strengthen the local economy.

Claiming ERIS with Alexander Clifford

Although ERIS helps simplify the claims process, compliance is still a necessity – and that’s where Alexander Clifford comes in!

Our ethical, accurate, and personalised approach ensures every claim is tailored to your needs while staying fully compliant.

Our specialist team supports you every step of the way by uncovering qualifying activities and costs that others often overlook.

With over £83 million secured for our clients, we’ve built a reputation as a trusted choice for R&D tax credits.

Let’s get you the R&D tax credit you truly deserve. Simply fill out the contact form or book a free consultation at a time that suits you.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.