Cracking the Code: UK R&D Tax Credit Calculation Guide 2025

Calculating R&D tax credits is a necessary part of your overall claim. But as HMRC implements new rates, how can you be sure that your calculations are correct? That’s where an R&D tax credit calculator makes forecasting your claim simple. Learn how it works and how to avoid major mistakes in this guide to R&D tax calculations.

Whether you’re looking for financial clarity or accuracy, calculating R&D tax credits is important to claim success. In spite of that, many businesses miscalculate claims due to confusion over rates or qualifying costs.

But you’re not one of those businesses, because you’ve found our complete guide to calculating your claim. This means you’ll be able to plan your finances, and claim R&D tax credits with confidence.

What is R&D Tax Credit Relief?

R&D tax credit relief is a form of UK innovation funding managed by HMRC. The aim of the relief is to incentivise innovation in science and technology.

So how do R&D tax credits work?

UK based companies that meet the eligibility criteria are able to claim a part of the cost invested in research and development. Businesses can then receive savings in the following ways:

- Corporation tax reduction

- Cash credit (for loss making businesses)

- Carried forward to offset future corporation tax liabilities

This helps businesses reinvest in themselves and in future projects

Who Can Claim R&D Tax Relief?

There’s a common myth about R&D tax credits, where people think that only big tech companies or labs can qualify. Truth is, any business that meets the eligibility criteria can claim.

To meet the R&D eligibility requirements businesses must:

- Be registered in the UK, and subject to corporation tax

- Oversee a project that aims to overcome a technical uncertainty

- Ensure the uncertainty couldn’t be made by a competent professional in the field

- Ensure the research and development is related to the business trade

The project should also aim to make a scientific or technological advancement, producing a new or improved product, process, software or service.

R&D Tax Credit Calculation: Step by Step

Now you’ve established eligibility, you can start calculating your claim. We’ve broken this down into a simple step by step guide.

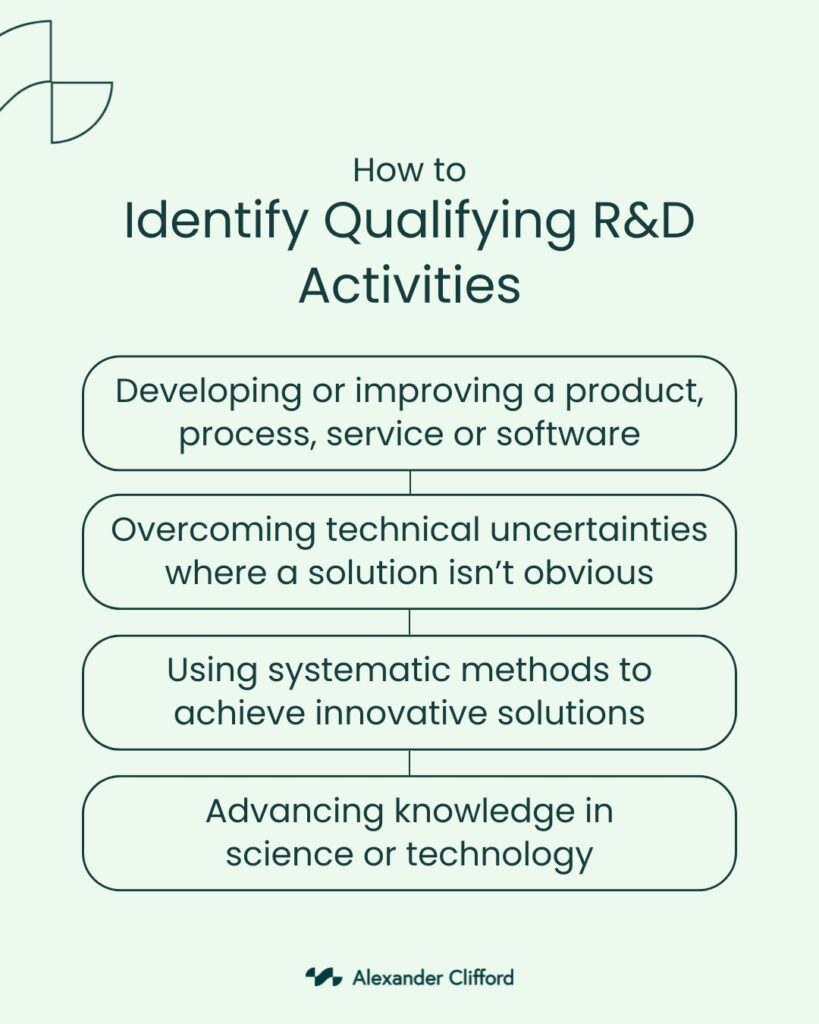

Step 1: Identify Qualifying Activities

Before calculating costs, you have to identify qualifying activities, because the only costs you can claim are those that contribute to overcoming a technical uncertainty. Qualifying activities must meet these criteria:

Step 2: Identify Qualifying Costs

Within your activities, you can find your qualifying costs. This includes:

- Staff costs (including PAYE, NIC and pension contributions)

- Consumables (i.e. materials)

- Software licences

- Subcontracted R&D

- Prototypes

- Clinical trial volunteers

- Data licences & cloud computing software

- Mathematics

Step 3: Apply Enhanced Deduction or Taxable Credit Rates

If you’re claiming under the SME scheme or ERIS, you’ll need to apply an enhanced deduction rate. The enhanced deduction rate is 86% meaning you can deduct 186% of eligible costs from your taxable profit.

For example: if your SME has spent £100,000 on qualifying research and development costs, you can deduct £186,000 from your taxable profit. This vastly reduces your corporation tax liability.

If your business is profitable and you’re claiming under RDEC or the merged scheme, you should apply the taxable credit. The taxable credit rate is 20% meaning 20% of your qualifying costs are added to taxable profits before corporation tax is implemented.

For example: if you’ve spent £100,000 on qualifying research and development costs, then £20,000 would be subject to corporation tax.

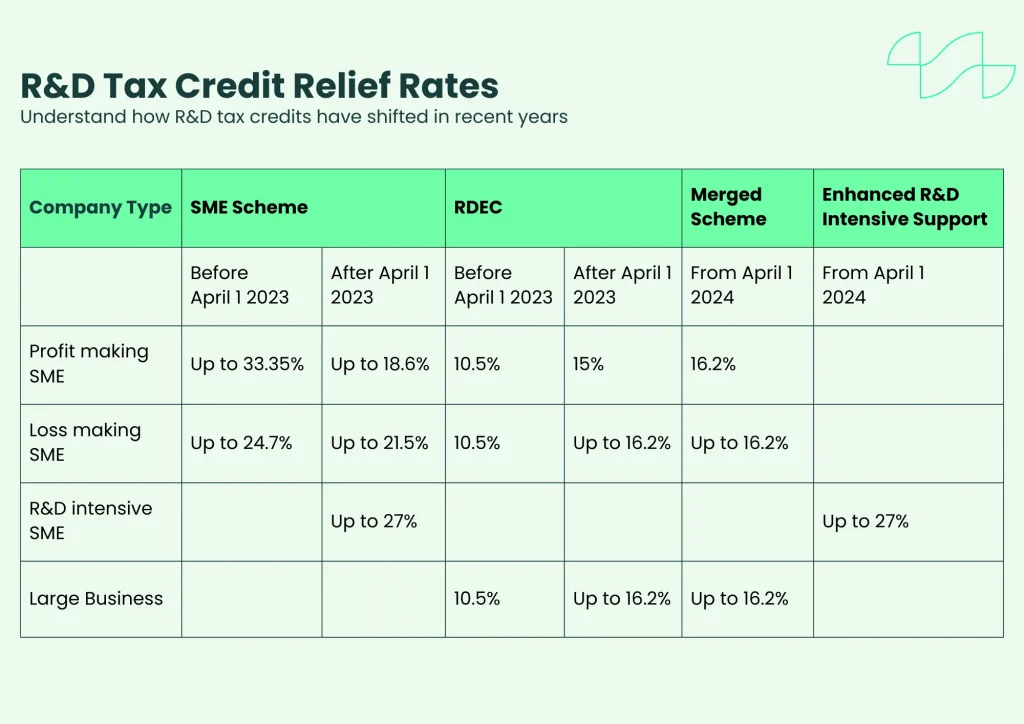

Step 4: Apply R&D Tax Credit Relief Rates

Finally you’ll need to apply the R&D tax credit relief rates to your qualifying costs. These rates vary depending on the scheme you’re claiming under, and are subject to change.

The current R&D rates are:

Use an R&D Tax Credit Calculator

Calculating R&D tax credits can be complicated – especially when you factor in rate changes. So what if we told you that there’s an easier way to calculate your R&D tax credits?

Using our R&D tax credit calculator, you can calculate your total claim benefit in the matter of minutes!

Simply identify your eligible costs, check which R&D scheme your claim falls under, and enter that information for a quick calculation.

How to Avoid Common Mistakes When Calculating R&D Tax Credits

It’s easy to make mistakes when it comes to calculating your R&D tax credits. With HMRC strengthening the relief, it’s more important than ever to ensure your calculations are accurate.

We want you to avoid making common mistakes, so here are our top tips to correctly calculate your claim:

- Know what qualifies

You’ll need to understand the full eligibility criteria, which you can find here - Double check every figure

Checking more than once can reduce mistakes by up to 95% - Understand HMRC compliance

You’ll need to know what HMRC expect of you, click here for a guide to maintaining compliance - Work with an R&D professional

R&D tax credit specialists use their expertise to assess claims, ensure accuracy, and confirm compliance

Claim Confidently With Alexander Clifford

At Alexander Clifford, we don’t just help you calculate your claim. We use our experience as reputable R&D tax credit specialists to help you compile compliant R&D claims.

Our team is thorough in their approach to verify your claim eligibility, and assess qualifying costs and activities. Using our unique process to compile relevant information and documents, we’ve helped over 2,400 clients confidently claim R&D tax relief.

This is what makes Alexander Clifford your trusted choice for R&D tax credits.

Begin your claim with confidence. Fill out the contact form below or book a meeting with one of our specialists to get started.

Book a quick call