HMRC Compliance Check Guide: How to Avoid Tax Enquiries in 2025

As HMRC doubles down on compliance, innovators throughout the UK fear for the safety of their R&D tax relief. Thankfully our compliance check guide is on hand to help you understand why compliance checks happen, and why certain claims are scrutinised, with tips on what to do after receiving an enquiry letter. What’s more, we reveal the golden rules to stay compliant throughout future claims.

Facing an HMRC compliance check can be daunting – especially when your R&D tax credits may be at stake!

Afterall, you put a lot of hard work into your research and development project, and you’re sure that you correctly calculated the R&D costs. So what happened to trigger a compliance check?

To help you make sense of it all, we’re taking a deeper look at compliance checks and answering all of your burning questions.

What is an HMRC R&D Compliance Check?

An HMRC R&D compliance check is a review process where HMRC verifies the accuracy of a business’s R&D tax relief claim. These checks are often randomised but aim to reduce fraud and error, which cost taxpayers £1.13 billion in 2021 (HMRC). During a check, HMRC may ask for:

- Proof of your project’s scientific or technological advance

- Details of uncertainties your team overcame

- Documentation for claimed costs (e.g., staff time, materials)

- Evidence that the project meets the HMRC guidelines for r&d tax relief

Book a quick call back

Why are R&D Tax Credit Claims Scrutinised?

HMRC has a duty to prevent fraud and error throughout the tax system. To protect the integrity of the R&D tax relief system, they issue compliance checks on some claims.

The aim of HMRC compliance checks is to make sure that R&D tax credit claims adhere to tax regulations, which prevents businesses from abusing the relief.

According to HMRC’s guidelines, an initial compliance check can be issued within 12 months of the claim submission date. However, if a claim fails to meet HMRC’s standards during a compliance check, they might review past claims.

What Triggers an R&D Tax Credit Compliance Check?

There are many reasons why HMRC may issue a compliance check on your R&D tax relief claim. The main reason for a compliance check is that HMRC noticed errors in the R&D claim. Errors in an R&D tax credit claim could be:

- Lack of evidence to support the claim

- Over inflated costs

- Project doesn’t clearly qualify

Other common reasons for an HMRC compliance check include:

- Reports that are too long

- Sudden increases to the size of the claim

- Use of elaborate language

In recent months, HMRC have announced that they plan on randomly selecting claims for compliance check. This means that your business may receive an enquiry letter – even if your R&D claim is compliant.

Guide to Avoiding an HMRC Compliance Check

Although HMRC is starting to select claims at random, the best way to avoid compliance checks is to submit an accurate and thorough R&D claim. This requires a strong attention to detail, and a deep understanding of the R&D policy.

To avoid a compliance check, we recommend you follow this step by step guide:

- Understand the eligibility criteria

From the beginning of your research and development project, you should take note of the eligibility criteria, so that you’re certain that your project qualifies, and which activities may be involved - Keep notes on project progress

As your project gets under way, you should keep updated notes with obstacles and hurdles your team faces, and the actions that helped you to overcome them - Keep track of time spent on research and development

Staff costs are one of your most important qualifying costs (but also the easiest to get wrong) so using software or time sheets to keep track of the time your team spends on the project is necessary - Segment financial records

To easily locate qualifying costs, segment the costs of your project from the costs of your business (to simplify this further, segment costs from qualifying activities) - Consult R&D tax credit advisors

Work with professionals who actively display their understanding of the R&D tax credit relief, to ensure your claim is compiled correctly and concisely in accordance with HMRC policy

By following this guide to R&D tax credits, you’ll be able to optimise the way you gather information for your claim, while adhering to the golden rules of HMRC compliance.

The Golden Rules of HMRC Compliance

While compiling an R&D tax credit claim, compliance should always be in the forefront of your mind. But how can you confidently ensure your claim is compliant?

We recommend following these golden rules of HMRC compliance:

- Know what’s happening with R&D policy

- Maintain accurate and complete documents

- Be transparent and honest with your claim

- Avoid high risk practices

- File on time

- Work with R&D professionals

- Keep documents and details after claim submission

Abiding by these rules will help to protect your claim against compliance checks – even if it is pulled at random by HMRC.

The Compliance Check Process for R&D Tax Credit Enquiries

If you do receive notice of a compliance check, it may seem intimidating at first – especially if it means you might have to pay back your R&D tax relief. Luckily the process of a compliance check is pretty simple, so it’s easy to understand where you’re at.

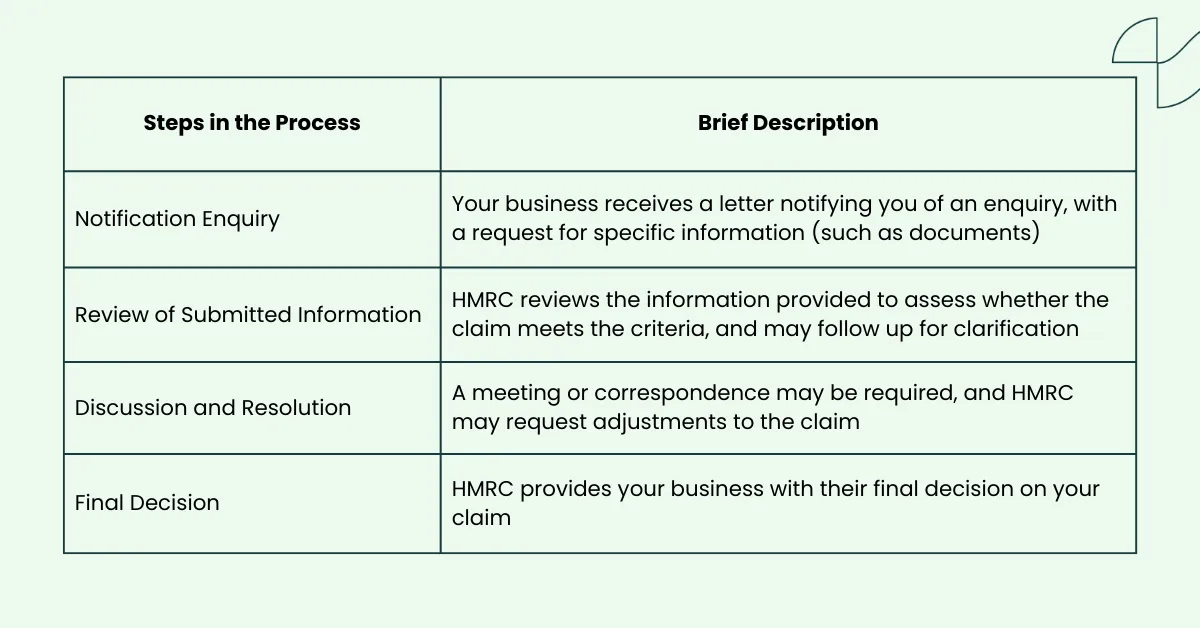

This table highlights the steps in the compliance check process for R&D tax credit enquiries:

What to do After Receiving an HMRC Enquiry Letter

A calm approach to a compliance check is the key to helping it run smoothly, and protecting your R&D tax credit benefits. So if you receive an HMRC enquiry letter, don’t panic – do this instead:

- Read the letter carefully

Understand the reason for the enquiry, and note deadlines - Gather relevant information

Concisely present information and compile relevant documents - Seek professional advice

Consult an R&D tax credit consultant to verify your claim and assist in HMRC responses - Respond swiftly and accurately

Maintain a professional tone and be transparent (even if you recognise you made a mistake) - Cooperate with HMRC

Address all questions HMRC may have, and be prepared for a potential meeting or call with an official

Get Enquiry Support with Alexander Clifford

Have you received a compliance check notification? At Alexander Clifford, we’re here to take the stress off your plate and help you confidently validate your R&D tax credit claims.

That’s the heart of our Enquiry Support Service.

Unlike advisors who promise the moon without even reviewing your claim, our specialist team takes a more thoughtful approach. We start with a no obligation assessment to ensure your claim is eligible and accurate. Once we’ve confirmed your claim’s viability, we’ll roll up our sleeves and help you every step of the way by:

- Collaborating with you to compile any additional documentation requested by HMRC

- Drafting clear, detailed responses to HMRC’s questions

With our hands on support, you’ll feel equipped to communicate calmly and effectively with HMRC, turning a potentially stressful process into one you can approach with confidence.

If you’ve received an R&D tax credit enquiry, let Alexander Clifford guide you to a successful resolution. Click here to get professional Enquiry Support today.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.