How to Boost R&D Tax Credit Relief With a Specialist Advisor

Did you know that a specialist advisor can actually boost your R&D tax credit relief? Discover how in this mini deep dive into how an R&D tax credit specialist uses their expertise to maximise tax credits. Understand the R&D tax credit initiative, the benefits of making a claim, how a specialist can assist in your claim and check out our top tips to choosing the right advisor.

Businesses looking to claim R&D tax credits in the UK, may find that HMRC holds them to a high standard as not only must they ensure that claims are precise, but there are strict guidelines that must be followed.

For those looking to save time without sacrificing accuracy, R&D tax credit specialists are on hand to help. But did you know that they may also be able to maximise the benefits of an R&D claim?

We had a chat with our own specialist team to find out how they boost R&D tax relief, and what you can do to find the right consultant for your claim.

Understanding R&D Tax Credits in the UK

The wonderful thing about R&D tax credits is that they’re designed to inspire innovation by offering businesses financial relief. This means that any business undergoing research and development may be eligible for a reimbursement that covers a portion of their investment, so long as the project meets the following criteria:

- Project must aim to overcome a scientific or technological uncertainty that could not be otherwise solved by an individual

- Project must aim to produce a new product, software, service or process

- Project should aim to make an advancement in the business’s industry

So long as the business responsible for the research and development is liable for corporation tax in the UK, and the advancement isn’t in the arts, humanities or economics, the project may qualify for R&D tax credit relief.

Book a quick call back

Benefits of Claiming R&D Tax Credits

For businesses claiming R&D tax relief, there are an array of benefits, from the financial prospects to the competitive advantages that they can expect from their innovations. Some of the benefits of R&D tax credits include:

- Reduces corporate tax liability

- Provides cash refunds for loss making companies

- Helps fund future research and development

- Supports businesses by freeing up capital

- Increases business reputation by presenting it as innovative

So while the costs of research and development can put many businesses off at first, with the aid of R&D tax credits, innovation is accessible to all.

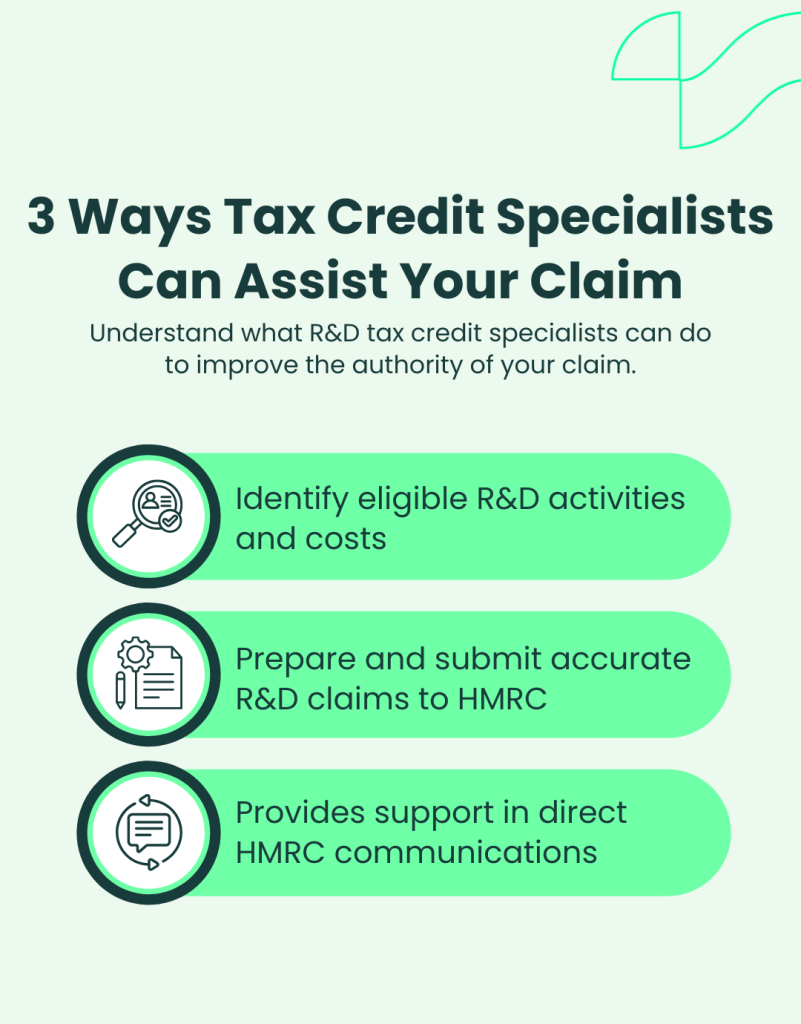

3 Ways a Tax Credit Specialist Can Assist Your Claim

An R&D tax credit specialist is a person that specialises in HMRC policy and legislation, allowing them to collaborate with businesses in order to compile successful R&D claims. This image highlights how they may use their expertise to assist in your claim:

How Tax Credit Specialists Maximise R&D Claims

With a vast knowledge of the R&D tax credits system, specialists can often spot qualifying factors that many businesses miss when they compile their own claims. These qualifying factors could include:

- Additional qualifying projects

- Qualifying activities

- Eligible costs

Not only does this expand R&D claims, but it means that businesses working with an R&D tax credit specialist can expect greater financial relief.

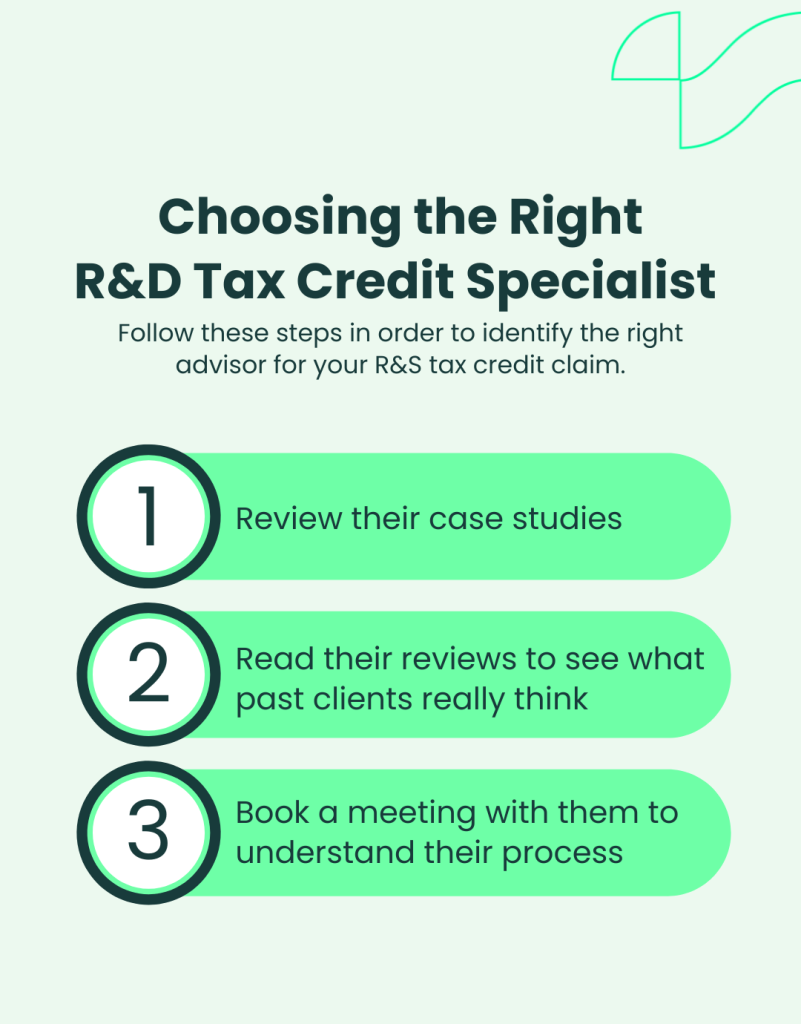

How to Choose the Right R&D Tax Credit Advisor

Choosing the right advisor to represent your business throughout an R&D claim can be challenging, so we wanted to give you our top tips to find the right R&D tax credit specialist for you:

FAQ’s

Believe it or not, working with an R&D tax credit specialist is a collaboration that ensures your business gets professional insights without taking too much of your time. In order to show you how this process works, we wanted to answer a few of your most frequently asked questions.

How Much Involvement is Required From Your Business?

Businesses working with a specialist advisor can typically expect to:

- Undergo a preliminary eligibility check

- Provide relevant documentation

- Undergo a technical call to analyse the specific aims and objectives of the research and development project

- Attend a follow up call for any additional information that may be required

- Attend a final call to review the R&D tax credit claim and information prior to submission

On average these tasks take the client’s business around 5 hours to complete, as opposed to two weeks of time dedicated to compiling and writing an R&D claim.

Furthermore, businesses that work with R&D tax credit specialists can expect to be kept in the loop with any HMRC communications, ensuring that they are fully aware of their progress.

What are the Risks Involved in R&D Tax Credits?

While there are many benefits to R&D tax credits, there are some risks involved. If a claim is incorrect or does not adhere to the guidelines set by HMRC, it may result in an enquiry or even a request to pay back R&D tax credits.

This is why HMRC actually recommends that you work with an R&D tax credit specialist, to ensure that your claim is both accurate and compliant.

Will an R&D Tax Credit Advisor Offer Support Throughout an Enquiry?

Should an enquiry arise, many R&D tax credit specialists will continue to support clients throughout it, ensuring that answers to HMRC’s questions are clear and concise.

Why Alexander Clifford is Your Trusted Choice for R&D Tax Credits

Combining a deep understanding of R&D tax credits with a dedication to supporting clients, Alexander Clifford has built a 5-star service that helps businesses to seamlessly maximise their R&D relief.

With a meticulous eye for detail, our team of specialists have compiled and submitted over 2,400 successful claims on the behalf of clients, allowing businesses to continue investing in innovative advancement.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits.

To get started on your R&D tax credit claim, enter your details in the contact box or book your appointment with a member of our team.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.