Overcoming HMRC Enquiries: A Guide to Successful R&D Tax Credit Claims

Did you know that HMRC are cracking down on fraud and error by launching enquiries into some R&D tax credit claims? Understand the common causes of an HMRC enquiry, the process and ratings systems involved, what to do if you receive a request to repay your R&D tax credits, and how our enquiry support services can help you to maintain your R&D tax relief.

As R&D tax credit specialists, we’ll be the first to admit that the claims process can often be complicated. Given their complexity, many R&D tax credits claims may contain errors that could raise red flags with HMRC, causing them to open an enquiry.

While this may seem like a scary situation, the fact of the matter is that most R&D tax credit enquiries are resolved by providing extra documentation and answering a few questions to support the claim. But what happens if an enquiry is launched due to more than just a few simple mistakes, and you’re asked to pay back the tax credit relief?

Well today we’re navigating the HMRC enquiry process, to help you fully understand your options, next steps, and when to seek professional advice with your R&D tax credit claim.

Why Do HMRC Enquiries Take Place?

When it comes to R&D tax credits, HMRC has a duty to ensure that all claims are accurate, legitimate and compliant with specific criteria laid down in tax legislation. In order to protect the integrity of R&D tax credit relief, HMRC challenges some claims in what’s known as an enquiry.

Enquiries can happen for various reasons, but while the first enquiry must start within 12 months of the claim being submitted, being notified of an enquiry could lead to investigations of older R&D tax credit claims.

Book a quick call back

Common Reasons HMRC Challenges R&D Claims

As they work to prevent specific businesses from taking advantage of the R&D incentive through fraud and error, HMRC may challenge claims for a range of reasons. Most often, it’s because they find discrepancies in the claim such as:

- Insufficient evidence to support the claim

- Overstated costs

- Project doesn’t clearly qualify for the tax relief

While they are some of the most common reasons a business may face challenges, enquiries may also be instigated by unusual patterns such as:

- Sudden increases in the size of a claim

- Repeated claims from the same business

HMRC Enquiry Ratings

Ahead of making an enquiry, HMRC uses an internal ratings process in order to determine the likelihood that an R&D tax credit claim may be either incorrect, or non compliant. These enquiry ratings operate via a risk based approach aimed at prioritising which R&D claims to investigate.

Once a claim is selected, HMRC approach the enquiry based on the severity of the discrepancies in which they’ve found. Depending on whether they find general mistakes, carelessness, or deliberate mistakes, the initial enquiry could generate further investigation into a businesses previous R&D claims. Here’s how these deliberations could affect an enquiry:

- General mistakes

Honest errors made by the claimant could prompt HMRC to review claims from the previous 4 years - Carelessness

When the claimant makes mistakes due to general carelessness within a claim, HMRC may review claims from the previous 6 years - Deliberate mistakes

Claimants that knowingly make mistakes and file incorrect R&D claims could prompt HMRC to investigate claims made over the past 20 years

If your business recognises any mistakes – be them general, careless or deliberate – voluntarily disclosing this to HMRC can help to reduce the severity of potential penalties, while limiting the scope of the enquiry.

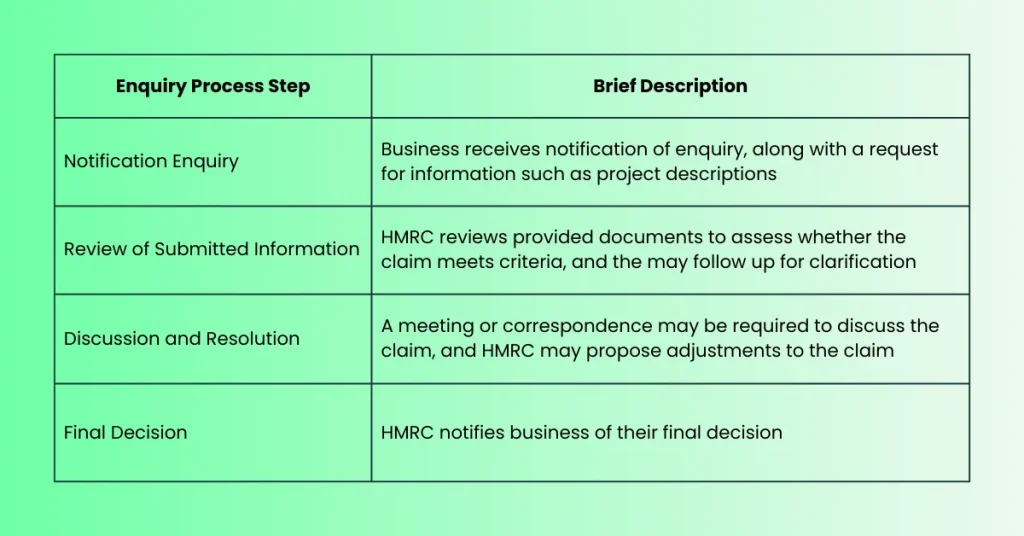

What is the HMRC Enquiry Process?

The enquiry process can often seem a little overwhelming for claimants, as there are a lot of different actions involved in clarifying the authenticity of the claim. The table below outlines each step in the enquiry process.

Potential Outcomes of an HMRC Enquiry

Following a full enquiry, HMRC will determine if the claim is invalid or whether it simply requires adjustments in order to verify its authenticity. If the claim is deemed invalid, the claimant has the option of appealing the decision by following HMRC’s appeals procedure.

In some cases, invalid claims may be subject to a compliance check. Prior to a compliance check, HMRC could issue penalties or seek repayment of the claim amount.

What Happens if HMRC Requests Repayment of R&D Tax Credits?

In the event that HMRC requests repayment of R&D tax credits, the following steps typically occur:

- Repayment notification

The claiming company receives a formal request of repayment, that details the reasons for the request - Review and response

The notification should be carefully reviewed – preferably with a tax consultant or accountant – after which the claiming company can either choose to accept the the repayment request and arrange to pay it, or if they believe that the decision is incorrect, they may challenge it - Repayment or appeal

This final step is the action of repayment or undergoing the appeals process

Businesses that are going through the enquiry process or those that have received repayment requests, have the ability to consult with an R&D tax credit consultant. At Alexander Clifford, our R&D tax credit specialists may be able to provide necessary support through the enquiry or repayment request, in many cases this may be done on a contingent basis.

Appealing HMRC’s R&D Repayment Request: The Appeals Process

Appealing HMRC’s repayment request is a lengthy process that is structured to ensure that businesses have the opportunity to contest HMRC’s decision. Given the fact that the appeals process requires careful preparation, it’s important to understand each step ahead of making the decision to appeal HMRC’s request.

After reviewing the repayment request, businesses looking to appeal HMRC’s decision can expect the following steps to take place:

- Request a review by HMRC

When a business believes the repayment decision to be unjust, they must formally request an internal review within 30 days of receiving the repayment request - Independent HMRC review

Following notification, an independent HMRC officer (not involved in the original decision) will review the case which may uphold, amend or overturn the repayment decision - Appealing to first tier tribunal

Should the original decision be upheld by the internal review and the business chooses to continue to appeal, the business has 30 days to appeal directly to the First Tier Tribunal (the tax chamber) with relevant documentation and evidence - Tribunal hearing

Tribunal will undergo a hearing where both the business and HMRC may formally present their cases which will be considered by an independent body, who will issue a ruling which could uphold or overturn the HMRC decision

Should either the claiming business or HMRC disagree with the tribunal’s ruling, they can appeal to the Upper Tribunal. In rare cases, these appeals may be escalated to the Court of Appeals or even the Supreme Court.

When undergoing the tribunal process, businesses may seek legal representation or support from a tax professional to argue the specifics of the case.

What Impact Does an HMRC Enquiry Have?

Following an HMRC enquiry, businesses may encounter a variety of significant impacts. Not only do they face financial strain if repayment of R&D tax credits is requested, but for those that have discrepancies throughout various claims, more significant penalties may be imposed.

Additionally, businesses that have undergone an HMRC enquiry may experience increased scrutiny throughout future claims. This makes attention to detail all the more important when making future claims.

Enquiry Support With Alexander Clifford

Working with an R&D advisor can relieve the stress of navigating the enquiry process, while affording businesses the opportunity to successfully validate their R&D tax credit claims. And that’s exactly what our Enquiry Support service aims to do.

Unlike other R&D advisors that guarantee successful outcomes without taking a peek at your claim, the specialist team at Alexander Clifford provides a no obligation assessment to ensure the eligibility and viability of your claim. Following a successful assessment, our team will then:

- Collaborate with you to compile additional documents requested by HMRC

- Write detailed responses to HMRC’s questions

With the attentive assistance of our advisors, your business will have the ability to communicate calmly and effectively with HMRC officials, allowing you to overcome your enquiry successfully. Have you been notified of an R&D tax credit enquiry? Let Alexander Clifford guide you through the process. Click here to get started with Enquiry Support.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.