Subcontracted R&D Tax Relief Guide: Maximise Benefits for SMEs & Large Companies

Outsourced research and development can boost your R&D tax credit claim, but can you claim R&D as a subcontractor? How do subcontractor costs work under SME and RDEC schemes? This updated guide answers these key questions using the latest HMRC policy changes, FAQs, and visual examples.

For many businesses, there may come a time in their research and development project when there is a necessity to outsource specific activities. These expenses can present for some, as a financial burden – that is unless they have a plan to claim R&D tax credits.

As an initiative formed by the British government, the R&D tax credit relief has a wide range of criteria that businesses must adhere to. In our mission to simplify the R&D claims process, we’ve compiled all of the relevant information on outsourced R&D to help you prepare for your future successful claim.

What is Subcontracted R&D?

Subcontracted R&D refers to research and development tasks outsourced to another party , whether that’s a business, an organisation, or an individual. While the contractor retains overall control, the subcontractor performs specified R&D activities such as:

- Developing new products

- Performing technical research

- Performing technical research

- Creating new technologies

For some businesses, the costs incurred as a result of outsourcing research and development activities may open the doors to additional financial resources in the form of R&D tax credit relief. Similarly, those contracted to carry out research and development activities may benefit from the relief, contingent on the contracting party.

Can You Claim R&D as a Subcontractor?

Yes, but only under specific conditions. If your company is subcontracted to perform R&D, you generally cannot claim under the SME scheme. However, you may claim under the RDEC scheme if you’re:

- An SME subcontracted by a large company

- A research organisation performing R&D for a qualifying body

- Working under HMRC accepted conditions outlined in the merged scheme

What Are Subcontractor Costs?

Subcontractor costs refer to the amounts paid to a third party to perform qualifying R&D tasks on your behalf. These can include fees for technical services, software development, prototype testing, or any R&D function delegated to an external team.

There are two types:

- Connected subcontractor costs – When your company and the subcontractor are controlled by the same people or group

- Unconnected subcontractor costs – Independent third party providers

Subcontracted R&D Under the SME Scheme

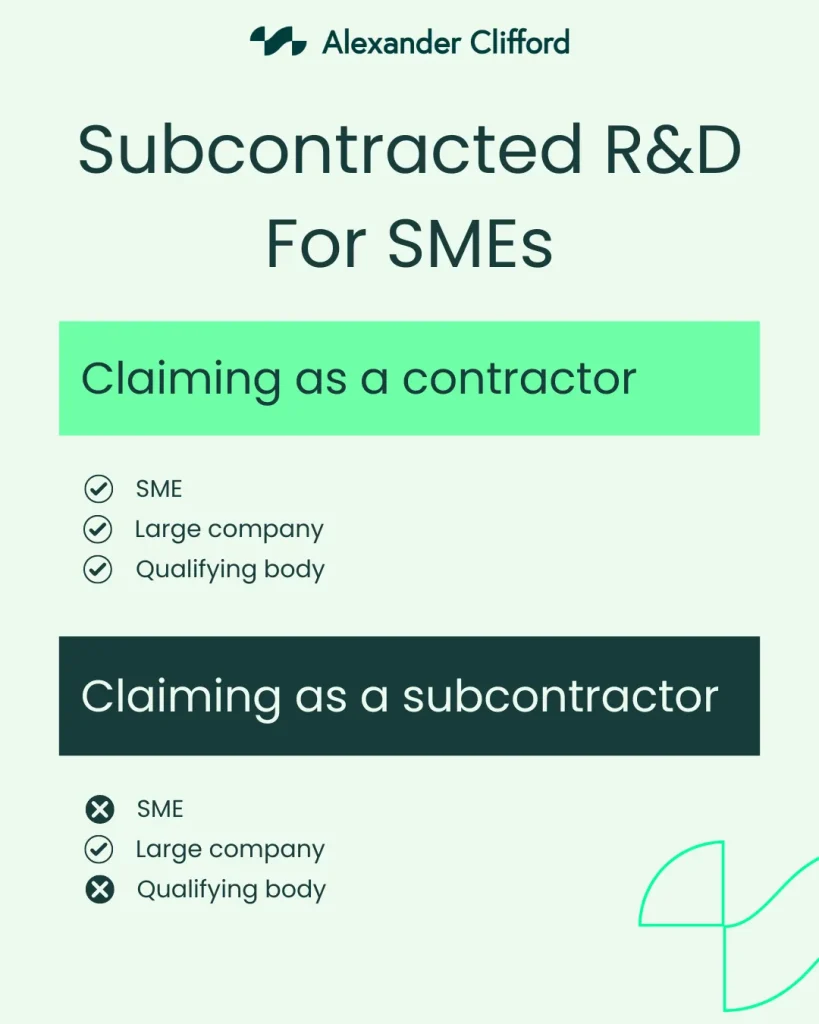

When it comes to subcontracted R&D as an SME (small and medium sized enterprise), claiming R&D tax credits can come with contingencies.

Provided they are the contracting party, SMEs can benefit from R&D tax credits under the SME scheme when they outsource research and development activities to:

- Other SMEs

- Large companies

- Qualifying bodies

As a subcontractor however, SMEs cannot claim the tax relief under the SME scheme. Instead they must claim incurred costs under the RDEC scheme – but even that provides limitations.

The following is a visual example of subcontracted R&D for SMEs:

Subcontracted R&D Under RDEC

SMEs looking to claim R&D tax credits as a subcontractor under RDEC, can only do so if they have incurred qualifying research and development costs for activities performed for large companies.

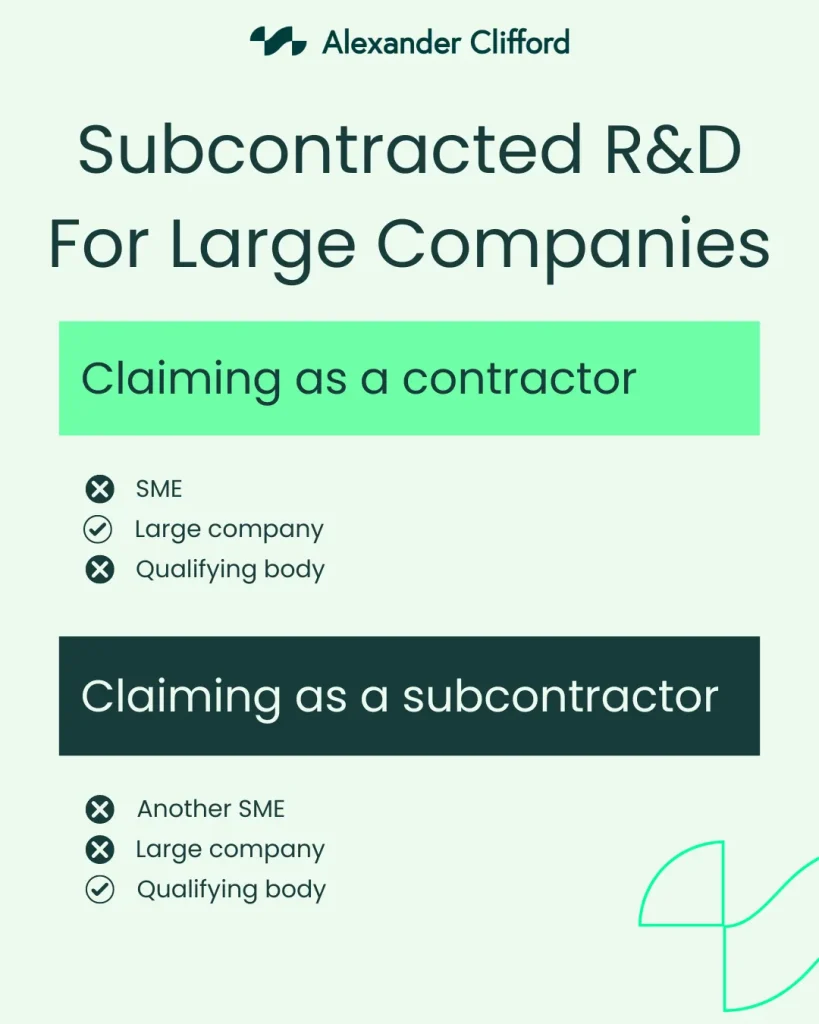

For large companies, subcontracted R&D under RDEC is more straightforward, due to the fact that large companies can only claim as a subcontractor if they are outsourced by another large company or by a group company.

As a contracting company, large companies can claim the costs incurred by outsourcing research and development activities to an individual, a group of individuals, or a qualifying body such as:

- A charity

- A higher education institution

- A scientific research organisation

- A health service body

The following is a visual example of subcontracted R&D for large companies:

How the Merged Scheme Impacts Subcontracted R&D

Subcontracted R&D under the merged scheme changes the eligibility criteria for both SMEs and large companies. These criteria specify that subcontracting costs will only be eligible for R&D tax credit relief if:

- If they undergo independent R&D outside the parameters of their contract

- If the contractor didn’t believe R&D to be necessary but the subcontractor does

- If the contracting company isn’t based in the UK

- If the contractor is a non taxable entity (such as a charity)

In order to determine eligibility for R&D tax credits as a subcontractor under the merged scheme, it’s important to follow these steps:

- Identify qualifying activities

- Determine qualifying expenditure

- Gather necessary documents

- Calculate the total expenditure of your claim (use our R&D tax credit calculator)

FAQs

We want to ensure that you have all the relevant information about subcontracted R&D so that you may plan ahead for future research and development projects. So we’ve taken the time to ask our specialists some of your most frequently asked questions, in order to get you all the information you need to maximise your future claims.

Can you claim R&D as a subcontractor?

Yes, but typically only under the RDEC scheme and if you’re subcontracted by a large company or eligible research body.

What are the subcontractor costs?

These are amounts paid to third parties to perform qualifying R&D work on your behalf, often claimable at up to 65%.

What costs can be claimed for R&D?

Eligible costs include wages, materials, software, utilities, subcontractor fees, and externally provided workers – depending on scheme rules.

How do you calculate subcontractor cost?

Multiply the amount paid to the subcontractor by 65% (if unconnected). If connected, use the lower of cost paid or subcontractor’s actual R&D spend.

What’s the Rate of Subcontracted R&D?

Under both the SME scheme and RDEC, the current rate for subcontracted R&D is 65%, meaning businesses may claim that percentage of costs incurred by outsourced research and development.

The merged scheme upholds the rates of RDEC and the SME scheme, meaning that those claiming subcontracted costs prior to April 1st 2024 will be able to receive up to 65% of the incurred costs.

How Does Ownership of Intellectual Property Impact Subcontracted R&D Tax Credits?

Ownership of intellectual property (IP) is important when it comes to subcontracted R&D, as to be eligible for R&D tax relief under the merged scheme, claimants must either possess the IP or the rights to exploit it. Without ownership or rights, subcontracted R&D costs may not qualify.

How Can I Optimise My Subcontracted R&D Strategy for R&D Tax Credits?

In order to form an optimised R&D strategy that allows you to maximise your R&D claim, we recommend that you follow these steps:

- Secure ownership or exploitation rights through legally binding contracts

- Carefully select experienced partners

- Maintain meticulous documentation

- Balance outsourced research and development with outsourced

- Stay updated with the latest HMRC legislation

- Collaborate with R&D tax credit specialist

How Alexander Clifford Can Help

Our leading team of R&D specialists dedicate themselves to understanding the ins and outs of the R&D tax credits system. Using their expertise, they’ve collaborated with clients in order to compile and submit over 2,400 claims, and they’ve done it with a 100% success rate.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits.

Understand more about how our 5-star service can maximise your claim by filling in our contact form below.