The Link Between R&D Tax Relief and Business Growth

Research and Development (R&D) is the engine behind innovation, enabling businesses to create, enhance, or streamline products, services, and internal processes. R&D is essential for staying competitive, adapting to market trends, and driving sustainable business growth.

In the UK, R&D tax credits for innovation and growth offer a valuable incentive for businesses investing in research and development. These tax reliefs reduce the financial burden of innovation by allowing companies to recover a portion of their qualifying R&D costs, making reinvestment into future projects more achievable.

Since its conception in 2000, the R&D tax credit incentive has become an advocate for business growth in the UK. By reducing the financial burden of innovation, R&D tax relief empower companies to grow strategically while remaining compliant with HMRC’s guidelines.

For businesses prepared to propel themselves to the forefront of their industry, understanding R&D tax relief can be incredibly advantageous, and so today we’re taking an in depth look at the direct link between R&D tax credits and business growth.

What is Research and Development?

R&D is not just about creating something new; it also involves improving existing offerings to adapt to market trends and technological advancements. By investing in R&D, businesses can enhance efficiency, reduce costs, and maintain a competitive edge in dynamic markets.

For example, in the automotive industry, R&D focuses on creating fuel-efficient engines and self-driving technology. In software, it drives innovation in artificial intelligence and cloud based solutions. These efforts not only solve customer problems but also set the stage for future technological breakthroughs. When combined, research and development leads to innovations that have the ability to significantly advance various industries.

Types and Processes of R&D?

There are two primary types of R&D: basic research and applied research. Basic research focuses on building foundational knowledge, while applied research targets specific goals, such as cost reduction or improved safety. The R&D cycle includes ideation, research, development, prototyping, and testing.

Book a quick call back

How Does Innovation Impact Competitiveness?

Businesses that invest in research and development based innovation have a remarkable advantage throughout global markets – especially in rapidly changing industries. By introducing new products, establishing improved processes and presenting advanced technologies, businesses can:

- Cater to evolving customer needs

- Improve efficiency

- Reduce cost of production

- Enhance product quality

Additionally, businesses that prioritise innovation have the ability to adapt quickly to market trends, allowing them to maintain a significant competitive advantage over less flexible companies. This sets the path for sustainable business growth along with market competitiveness.

Research and Development Tax Relief

R&D tax relief encourages businesses to innovate by offering financial incentives for qualifying projects. These projects must aim to resolve technological uncertainties or achieve significant advancements in science or technology. The relief allows businesses to recover a portion of their R&D costs, enabling reinvestment into future growth opportunities. Through the relief, eligible businesses are able to claim a portion of the costs invested in qualifying research and development projects, allowing them to further invest in their own growth.

With various relief schemes, SMEs (small and medium sized enterprises) and large businesses are able to successfully benefit from R&D tax credits, so long as they adhere to HMRC research and development eligibility criteria.

HMRC R&D Tax Credits Eligibility

HMRC defines research and development as a project that seeks to achieve an advancement in science or technology, by overcoming an uncertainty that could not be easily solved by an expert in the field. Ideally the project should aim to produce one of the following:

- Product

- Process

- Service

- Software

In addition to understanding the eligibility criteria for research and development projects, businesses must be able to identify qualifying activities. Qualifying activities are tasks within the project, and in order to be eligible for R&D tax credits, they must meet the following criteria:

- Aim of activity should be to advance knowledge

- Activity should seek to resolve industry uncertainties

- Each activity should be conducted using a systematic approach

- Overall activity should not be easily replicated

Prior to determining qualifying activities, businesses can then begin to evaluate the overall worth of their claim, using the R&D eligible expenditure.

Return of Investment for Claiming R&D Tax Relief

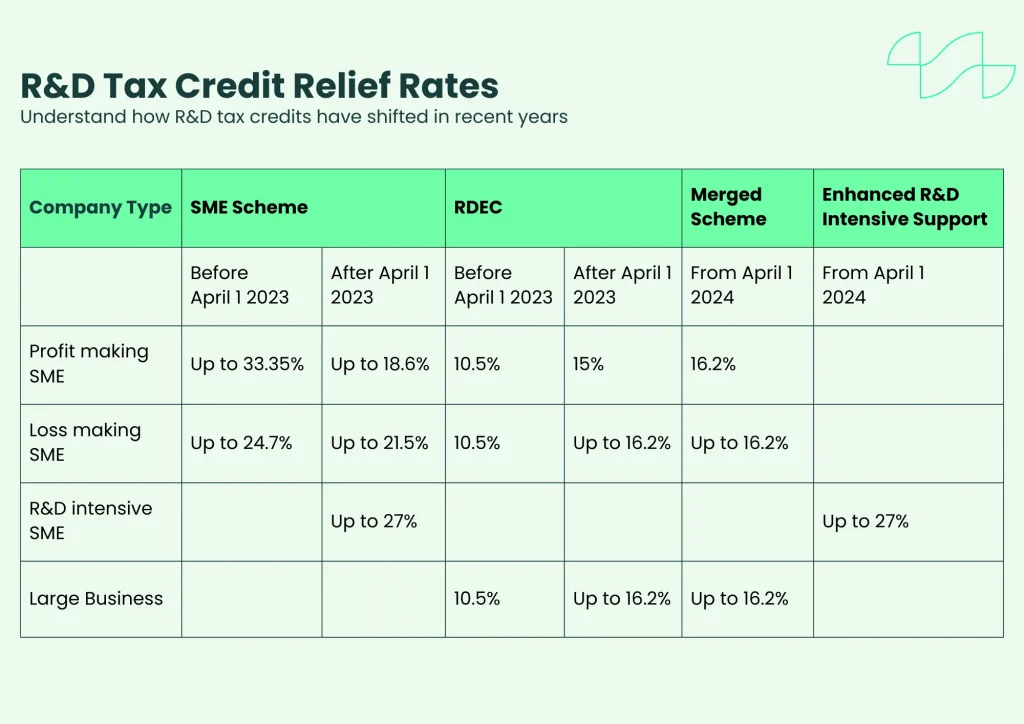

The return on investment (ROI) for claiming R&D tax credits can be incredibly substantial depending on the total eligible expenditure. The exact amount that you may be entitled to depends on a number of factors including:

- The size of your business

- The annual turnover of your business

- The accounting period in which your project falls

These factors help to determine the scheme under which your claim will fall. In order to discern how each scheme may affect your claim, the following table highlights the rates of R&D tax credits over the past few years:

Compliance and Best Practices

In order to ensure that the R&D relief is protected from fraud and error, HMRC requires that claims are compliant. As incorrect or inflated claims can instigate enquiries and even damage a businesses reputation, it is absolutely crucial for businesses to adhere to the guidelines that are set forth by HMRC, so that they may make a successful claim.

Some of the best practices to ensure that claims are compliant include:

- Keep up to date with changes to R&D tax credit policy

- Assess eligibility against any changes

- Regularly update required documentation (during research and development process)

- Work with an R&D tax credit professional to compile your claim

How Alexander Clifford Can Help

As one of the UK’s leading R&D tax advisors, the team at Alexander Clifford ensures that each claim is compliant with the latest HMRC policy.

Combining their advanced knowledge of R&D legislation with their passion for various industries, the members of our team collaborate with businesses like yours to maximise your claim benefits. So far, this has allowed them to compile over 2,400 successful claims, resulting in a 5-star service.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits.

Are you ready to claim your R&D tax relief? Enter your details below, or book an appointment with a member of our specialist team to get started.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.