2025 Updates to Subcontracted R&D: The New Rules

HMRC’s recent shake up to R&D tax credits includes changes to subcontracted R&D. What could this mean for your claim? We answer your burning questions about subcontractors including eligibility requirements, and how you can stay compliant with the latest UK rules on subcontracted R&D.

If your business outsourced research and development activities to subcontractors, the latest R&D tax credit policy updates could impact your claim. Along with new schemes designed to simplify R&D tax relief, HMRC updated their policies on outsourced research and development – so if you’re not prepared, you could miss out on significant savings!

We want you to get the full benefit that you’re entitled to, so we broke down the new rules to show what these changes mean for your business, and how your subcontracted R&D costs can qualify.

What is a Subcontractor in R&D?

Subcontractors in R&D are companies, organisations or individuals hired to carry out research and development activities. Businesses often hire subcontractors when their in-house team lacks expertise to carry out certain parts of the project.

As subcontractors usually have specialist knowledge, they can have a major impact on the outcome of research and development, but that’s not the only reason that a business may choose to outsource R&D!

Truth is, many subcontractors have access to additional resources or facilities necessary to research and development. This means the symbiotic relationship between subcontractors and business can be more cost effective while improving knowledge sharing opportunities.

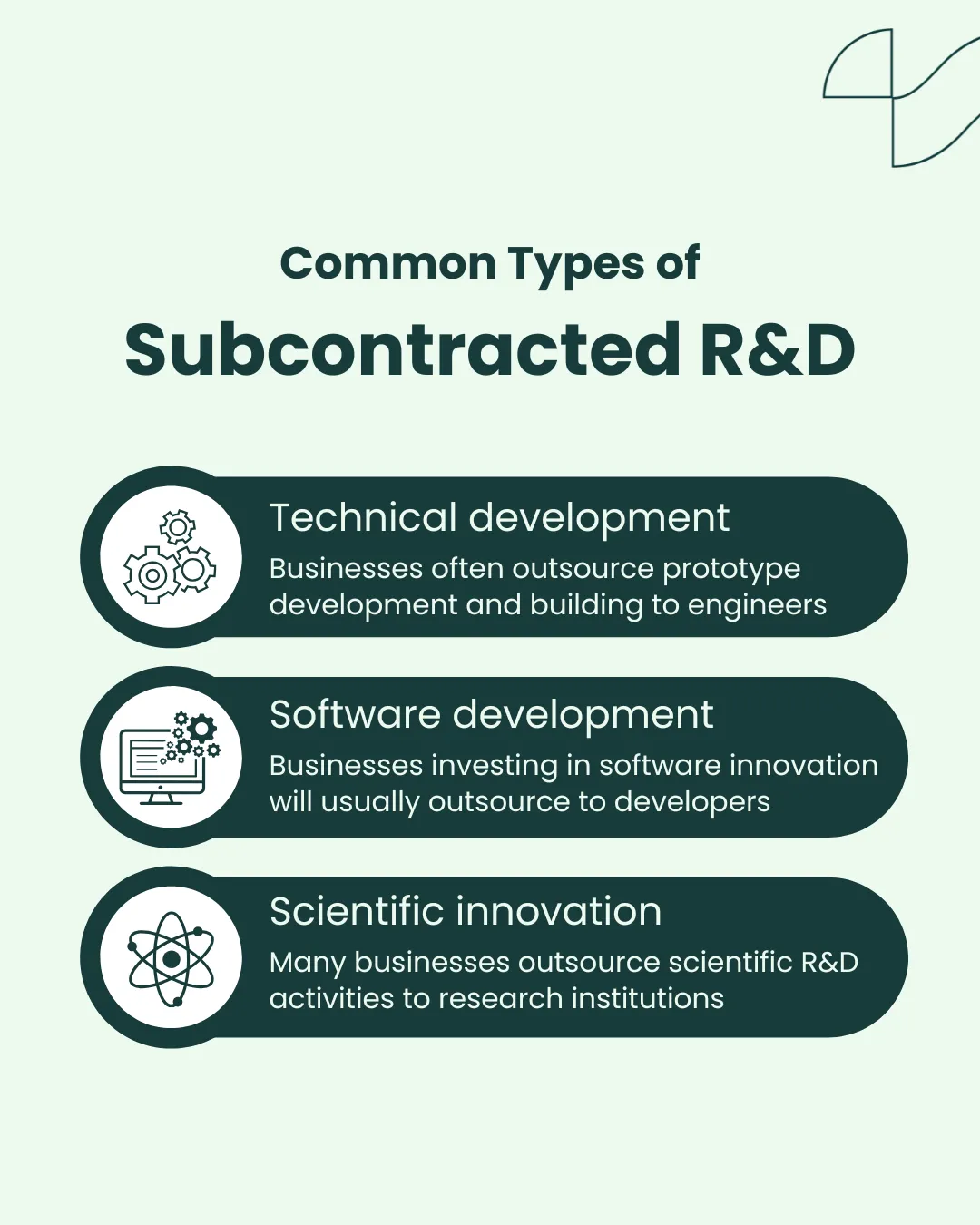

Common Types of Subcontracted R&D

There are many forms of subcontracted R&D, as it’s dependent on the contracting business and scope of the project. Some of the most common types of subcontracted R&D are:

Previous HMRC Rules on Subcontracted R&D

Before the rollout of the merged scheme and ERIS (enhanced R&D intensive support), the treatment of subcontracted R&D was dependent on R&D tax credit schemes. Here’s how the schemes impacted subcontracted R&D costs:

- SME Tax Credit Scheme

SMEs (small and medium sized enterprises) could only claim subcontracted R&D if the work was outsourced to research organisations, charities or universities - RDEC Tax Credit Scheme

Large businesses could claim subcontracted R&D costs that were outsourced to UK based third parties

Many businesses found these rules constricting, which is why when the new schemes were implemented on April 1st 2024, subcontracted R&D was transformed.

2025 Updates to Claiming Subcontracted R&D

As the merged scheme combines previous forms of the relief, the rules regarding subcontracted R&D have transitioned. So we’re exploring the 2025 updates to claiming subcontracted R&D to share what qualifies for this cost, and how you can be compliant with new subcontracted R&D rules.

Subcontracted R&D Eligibility Requirements

Under new rules set out by HMRC, UK businesses can claim subcontracted R&D costs if they meet specific criteria. Eligibility requirements for claiming subcontracted R&D costs are:

- Subcontracted contributions must be needed

Businesses can only claim relief on subcontracted work if research and development was a necessary part of fulfilling the contract - Subcontracted R&D must be UK based

Overseas restrictions state subcontracted R&D must take place in the UK - Your business must hold the intellectual property (IP) rights

You must possess the IP resulting or have the rights to exploit it – without ownership or rights, subcontracted R&D costs may not qualify - Your business must be eligible for R&D tax credit relief

Your business must meet the basic criteria for R&D tax credit relief, meaning you must be liable for corporation tax

Compliance for Subcontracted R&D

All of these changes are part of HMRC’s crackdown on fraud and error, meaning compliance is more important than ever. This means your business needs detailed information on:

- Specific work being carried out

- How it contributes to innovation

- Clear breakdown of costs

This is why we recommend you keep records of all finances throughout the project, while updating documentation about the project progress. Failure to do so may result in rejected claims.

How Alexander Clifford Can Help With Your Claim

At Alexander Clifford, we work with businesses to prepare strong claims that adhere to the latest policies, meaning we’re on hand to review subcontracted R&D agreements to ensure they’re compliant with 2025 rules.

Using our professional knowledge of HMRC policy, we ensure every qualifying cost and activity is accounted for, ultimately maximising your R&D benefit. It’s this level of dedication that gives our R&D service a 5-star rating!

Protect your claim with R&D tax credit advisors that believe in your innovation. Get started today by filling out the form below, or click here to book an appointment with one of our specialists.

Book a quick call