R&D Tax Relief for Unsuccessful Projects

A failed research and development project is no longer the end of the road. Minimise financial risk with R&D tax credits, understand what happens if your project is cancelled, delve into the eligibility criteria for R&D tax relief, and review the additional documents you need to make a successful R&D claim for an unsuccessful project.

Did you know that your research and development project may be eligible for R&D tax credits even if it’s unsuccessful? That’s right, as long as the project meets the eligibility criteria set forth by HMRC, you can receive financial relief for your invested time and resources spent on qualifying activities.

So how does it work? We asked our team of specialists the most important questions surrounding R&D tax relief for failed projects, so that your business can form a successful claim that aligns with the latest policy and legislation.

Are Failed Research and Development Projects Eligible for R&D Tax Credits?

As the existence of R&D tax relief is aimed at encouraging innovation, the British government wanted to ensure that all eligible projects – whether they are successful or not – are able to successfully claim the relief. So yes, failed projects are eligible for R&D tax credits.

Book a quick call back

Although you can claim for failed research and development projects, there are a number of additional circumstances that may affect your R&D claim.

Claiming R&D Tax Credits for Cancelled Projects

Here in the UK, businesses can claim R&D tax credits for failed projects, but they must be able to prove the aim of the overall project. In addition to this, businesses must be able to present accurate documentation that details the work done, the monetary investment, and the reasons for the project being abandoned.

Some of the key aspects to making a successful R&D tax credit claim for a cancelled research and development project, are that businesses must have done the following:

- Undergone qualifying activities

- Invested in qualifying costs

Handling R&D Tax Credit Claims for Multiple Failed Projects

Provided each project meets eligibility requirements, businesses may claim R&D tax credits for multiple failed projects at once. The following image highlights some of the guidelines involved in claiming for multiple projects simultaneously.

By following these guidelines, businesses are able to effectively maximise R&D tax credit relief by building compliant claims.

The Difference Between SME Scheme and RDEC for Failed Projects

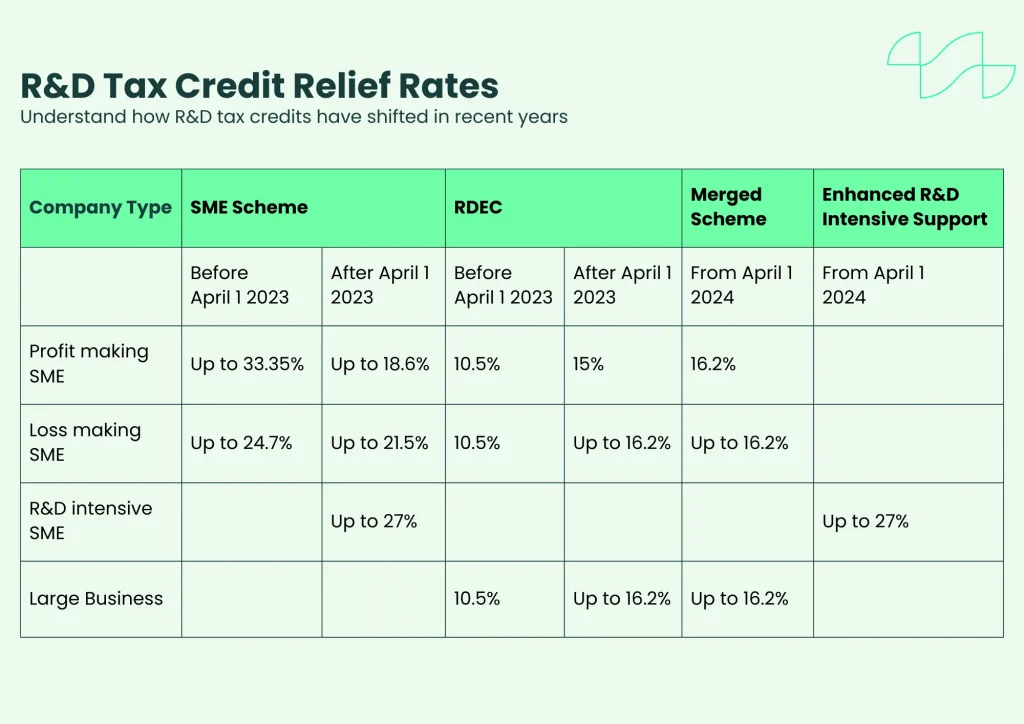

Businesses claiming R&D tax relief in the UK (prior to April 1st 2024) operate under different schemes dependent on their size, meaning there are some differences when it comes to those claiming for failed projects.

Under the SME scheme, businesses are able to claim up to 33% of their total qualifying expenditure, even for failed projects. Large businesses operating under RDEC have a lower relief rate of 13%.

Those claiming for a project that took place in an accounting period that began either on or after April 1st 2024, will fall under the new merged scheme. Under this scheme, both large businesses and SMEs will still be able to make claims for failed research and development projects, but there will be some slight changes in regards to the rates.

Example of R&D Tax Credit Rates for Failed Projects

The following table highlights how the different rates affect R&D tax credit claims.

What Type of Projects Qualify for R&D Tax Credits?

HMRC has a specific definition of research and development when it comes to R&D tax credits. Essentially they state that a qualifying research and development project must aim to overcome an industry uncertainty that cannot be otherwise solved by an expert in the field.

Additionally, qualifying projects must aim to make a scientific or technological advancement that results in one of the following:

- A new product

- An improved product

- A new software

- A new system

Although your project may have failed to produce a final result, the project aim, the qualifying expenditure, and other documentation that helps to produce a successful claim.

What Costs Can Be Claimed for R&D Tax Credits?

The R&D tax credit relief is incredibly generous to claimants, allowing them to claim an array of costs. Some of these include:

- Staff costs (including PAYE, NIC and pension contributions)

- Consumable items (including materials and some utilities)

- Test stage prototypes

- Software used directly in research and development

For a full list of qualifying expenditure.

How to Document Failed Research and Development Projects

Successful R&D tax credit claims rely on accurate and specific documentation that details the journey of a research and development project. Some of the required documents include:

- Project descriptions

- Technical reports

- Financial records

For a full guide to R&D documentation, click here.

For projects that didn’t meet the intended result, it’s essential to include the following additional documents:

- Detailed report of the aims and objectives of the project

- Record of each activity undertaken throughout the project

- Additional report of reasons for project failure or abandonment

This additional documentation helps to paint a clearer picture of the project, allowing the R&D tax credit claim to stand up to any potential scrutiny from HMRC.

Final Thoughts

Considering the fact that HMRC supports not only innovation but intent to innovate through the R&D tax credit relief, potential failure is no longer a factor when it comes to planning a research and development project.

In fact, with the relief being available for eligible failed projects, businesses are able to approach innovative advancement with fewer risks.

In recent years, one of HMRC’s recommendations for businesses looking to make an R&D claim is that they consult with an R&D tax credit specialist. By collaborating with the right specialist, businesses can receive professional guidance throughout the course of their claims.

How to Compile a Successful R&D Claim With Alexander Clifford

As leading R&D tax credit specialists, the team at Alexander Clifford are dedicated to simplifying the claims process, and giving business leaders their time back. By collaborating with clients to form project timelines and build accurate technical reports, our team has compiled and submitted over 2,400 claims with a 100% success rate.

That’s why Alexander Clifford is your trusted choice for R&D tax credits.

Discover how our specialists can use their expertise to assemble your claim. Submit your details below, or book an appointment.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.