A 21st Century Union: R&D Tax Credits and the Digital Age

For the past 50 years, the technology industry has been an inspiring story of innovative advancement, encouraging up and coming thought leaders to invest in research and development. Take a look back at the history of technology, and understand how R&D tax credits have paved the way for competitive advancement. Explore the 20th century tech advancements, the digital revolution, trends in the tech industry, the future of technology, and the powerful impact that the R&D tax credit relief has on innovators.

In the world of technology, innovation has the ability to present startups as thought leaders, large businesses as household names, and small businesses as revolutionaries. While the cost of advancement can be hefty, for innovative businesses there are R&D tax credits.

While the tech industry continues to flourish on a global scale, there are a range of challenges that allow businesses to continue investing in research and development that improves the safety, capacity and implementation of technology.

Today we’re reflecting on the history of the digital age, how it’s set to expand, and the role that R&D tax relief will play in future innovations.

The Advancement of Technology Prior to the R&D Tax Credit Initiative

Prior to the implementation of the R&D tax credit initiative, technology had been steadily advancing at a rapid pace.

Businesses were investing heavily in research and development to remain competitive in the evolving market, and scientific discoveries were shaping the technological landscape, paving the way for groundbreaking inventions that would revolutionise industries.

During this time, key advancements such as the development of the internet, the creation of personal computers, and the introduction of mobile phones were changing the way people communicated and accessed information.

These technological progressions laid the foundation for the up and coming digital age.

The Digital Revolution of the 20th Century

Throughout the 20th century, the technological landscape was experiencing significant advancements that laid the groundwork for a digital revolution.

This digital revolution transformed society in profound ways, shaping how we communicate, work, and interact with the world around us. The following list highlights some of the largest influences of the digital revolution, inspiring enhanced research and development in technology:

- Invention and enhancement of computer power

- Invention and commercialisation of the internet

- Development of mobile communications technology

- Digitalisation of mainstream and social media

As a variety of businesses sought to innovate the technology sector, these advancements set the stage for the rapid technological progress that continues to shape our modern world.

The Introduction of the R&D Tax Credit Initiative in the UK

The introduction of R&D tax credits in the UK marked a significant milestone in the innovative advancement of science and technology.

Introduced by HMRC in 2000, the initiative aimed to encourage businesses to invest in research and development activities by providing tax incentives. Initially conceptualised for small businesses, this programme allowed companies engaging in qualifying research and development projects to claim tax relief, thereby reducing the financial burden associated with innovation.

The Impact of R&D Tax Credits on the Tech Industry

With the implementation of R&D tax credits in the tech industry, there has been a notable surge in innovative activities. This initiative has had a profound impact, shaping the industry in various ways. For example:

- Drives growth of tech startups and small businesses

- Attracts foreign investment in UK based tech innovation

- Provides various job opportunities

- Inspires collaborative work between tech companies and research organisations

- Facilitates technological advancement

What’s more is that the R&D tax relief has the ability to financially support further innovation by offsetting the financial burden of research and development. Find out how your own research and development project may benefit from R&D tax credits by speaking with one of our specialist consultants.

Book a quick call back

Trends Throughout The Technological Era

Throughout the technological era, we’ve seen a variety of trends that have made technology and all of their capabilities more accessible around the globe. These innovations have marked a range of shifting trends, including:

- Miniaturisation of devices

- Enhanced global connectivity and digital communication

- Increase in software driven solutions

- Development of automation and artificial intelligence (AI)

- Expansion of e-commerce

- Enhanced cybersecurity solutions

- Advancement in quantum computing research

- Development of 5G and widespread wireless technologies

In addition to these trends, innovative businesses are increasing their focus on ethics and regulations across existing and emerging technologies, setting a new standard for the future of tech.

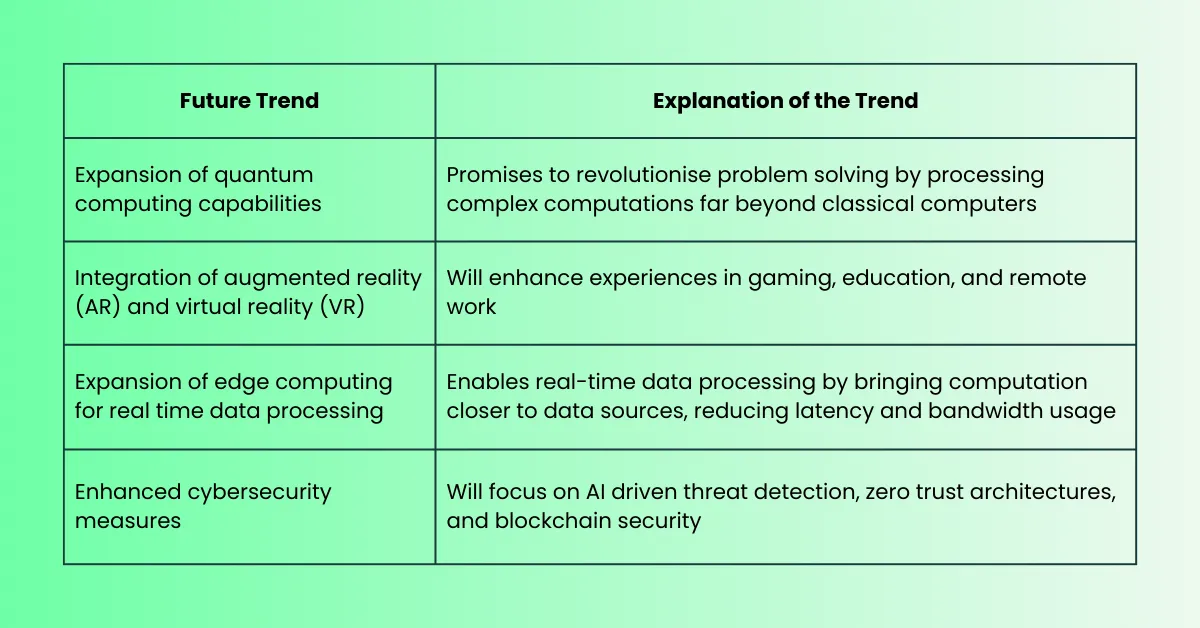

The Future of Technology

While technology has come a long way in the past 50 years, the focus throughout the tech industry is shifting to provide world class advancement with an emphasis on safety and security. The following table highlights how future trends in technology aim to do this:

Applying R&D Tax Credits to Future Innovation

When planning your research and development projects, it’s important to keep in mind the funding opportunities that may be available. As we’ve established, one of these opportunities are R&D tax credits – the government funded incentive for innovative businesses.

Throughout the application process, HMRC requires a variety of documentation including project planning and updated records made throughout the course of the project. This means that not only must you plan ahead of your innovation, but you should also be prepared to keep a schedule that affords you time to add to the required documents.

Maximising R&D Tax Credit Benefits

Maximising your R&D claim begins with understanding HMRC policy. This can be done by:

- Researching the latest legislative updates

- Following R&D specialists on social media

Furthermore, you can enhance your R&D benefits by recognising your qualifying activities, keeping track of the qualifying expenditure, and identifying the R&D tax credit scheme under which your claim will operate.

FAQs

When it comes to R&D tax credits, there’s a lot to understand – and with hundreds of pages of information on the government website, it can be tough. So to help you make light of this powerful incentive, we’re answering some of your most frequently asked questions.

How Do R&D Tax Credits Differ From Other Tax Incentives for Innovation?

R&D tax credits uniquely reward companies for investing in innovation. Unlike traditional tax breaks, the R&D incentive directly supports research and development efforts, fostering technological and scientific progress.

What Are the Key Challenges Faced by Companies in Maximising R&D Tax Credits?

Businesses often encounter challenges such as manoeuvring through complex regulations, proving project eligibility, and documenting expenses effectively. This can be overcome with proper planning and expert guidance.

How Can I Ensure That My R&D Activities Meet the Criteria for Tax Credits?

To guarantee R&D activities qualify for tax credits, collaborating with specialist consultants can help identify eligibility criteria, organise documentation, and write detailed technical reports that adhere to HMRC guidelines. This approach optimises chances for successful claims.

How Alexander Clifford Can Provide Support Throughout an R&D Tax Credit Claim

As leading R&D tax credit experts, our team draws on their expertise to identify qualifying criteria and form solid claims that adhere to the latest HMRC policy.

Using this approach, our specialist consultants have assisted in submitting over 2,400 successful claims on the behalf of our clients, resulting in an average return of over £50,000.

With our track record of supporting the tech industry with their claims, Alexander Clifford is your trusted choice for R&D tax credits.

Begin building your claim with an expert insight by filling in the contact form below, and get a call from one of our specialist consultants within 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.