HMRC: Providing Financial Relief for the Future of Business

Ever wondered how HMRC elevates businesses? Take a step back with us as we analyse the incredible support of R&D tax credit relief. Delve into the meaning of R&D tax credits, how they drive business growth, the role of HMRC, the eligibility criteria, and how to navigate complex policy changes.

Did you know that HMRC has an initiative that provides financial support for innovative businesses? Well, with their R&D tax credits initiative, businesses that invest in research and development are able to improve their economic status while putting themselves at a competitive advantage.

This is what enables HMRC to become the driving force behind the future of business in the UK. But in order to understand how they have such a powerful impact, we must first explore the tax relief itself.

What is the Meaning of R&D Tax Credit Relief?

The overall meaning of R&D tax credits is that the relief is an incentive designed by the British government to improve scientific and technological advancement throughout the UK. This is all a part of their UK Innovation Strategy that outlines a plan to make the UK the home of innovation by 2035.

For businesses engaging in qualifying research and development, this relief provides the opportunity to claim back a portion of their invested expenditure in the form of tax credits. These tax credits can then be used to reduce corporation tax, or can be used as cash credit.

What’s more is that the R&D tax relief is available to a range of industries, such as:

- Technology and software development

- Engineering and manufacturing

- Agriculture and agritech

- Energy and renewables

- Healthcare and pharmaceuticals

- Aerospace

By allowing such a wide range of businesses to benefit from R&D tax credits, HMRC is assisting in the birth of a new era in technological innovation.

Book a quick call back

How R&D Tax Credits in Business Support Growth

When a business invests in research and development, they invest in their own market competitiveness. When they then claim R&D tax credits, businesses can expect a range of benefit, some of which include:

- Increased cash flow

- Enhanced capacity for hiring skilled staff

- Reduced financial risk for experimental projects

- Improved financial stability

- Support for long term development

Combining all of the benefits provides a foundation of support that enables and encourages growth.

The Role of HMRC in Research and Development Tax Credits

HMRC are tasked with overseeing R&D tax credits, incentivising innovation one claim at a time. But while their support is rewarding, they play a significant role in:

- Establishing eligibility criteria

- Defining qualifying projects

- Specifying eligible expenditures

- Ensuring claims adhere to guidelines

By thoroughly reviewing the standards of each submitted claim, HMRC is upholding the integrity of the R&D tax credit relief, and allowing genuinely innovative businesses to thrive.

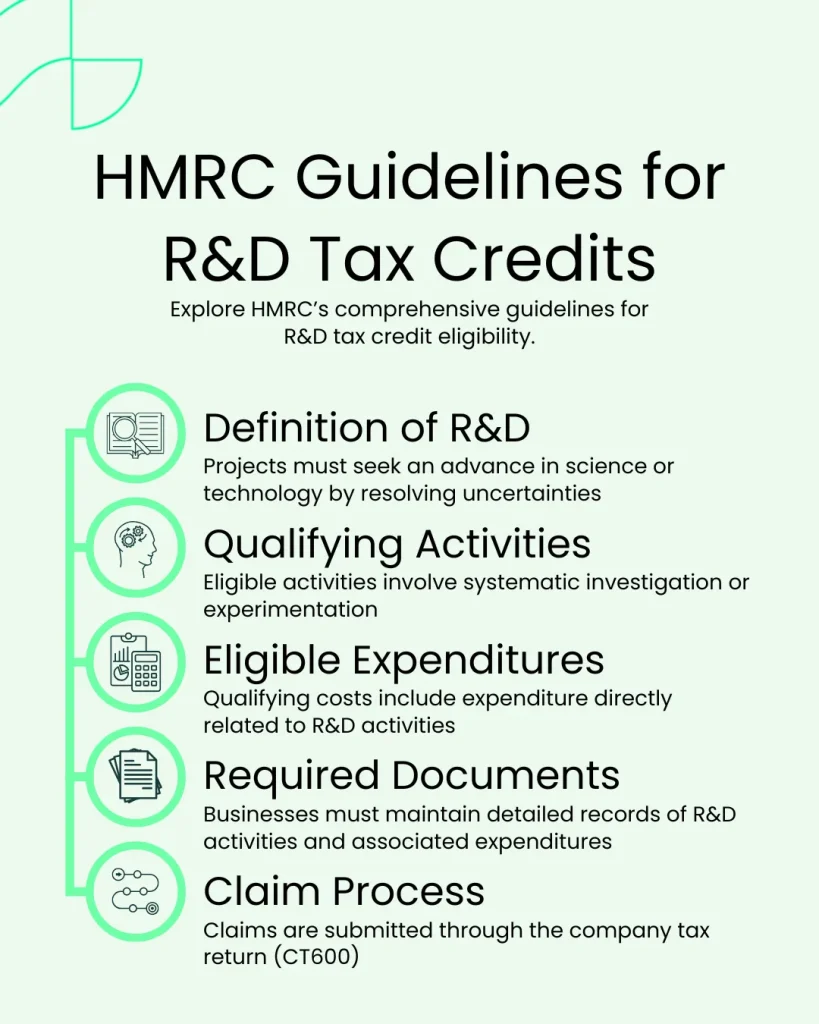

HMRC Guidelines for R&D Tax Credits

In order to maintain the efficacy of R&D tax relief, HMRC has a specific range of guidelines that outline their eligibility criteria. The following image outlines these guidelines that each claimant must adhere to:

Eligible Expenditure and Required Documentation for R&D Tax Relief

Two of the biggest parts of an R&D tax credit claim are the eligible expenditures and the documentation. While qualifying costs set forth the overall worth of a claim, the documents help to verify eligibility and produce an overall technical narrative of the project.

When it comes to R&D tax credits, some of the eligible expenditures include:

- Internal staff costs (including PAYE, NIC and pension contributions)

- Subcontractor costs

- Consumable materials and utility costs

- Clinical trial volunteer costs

While HMRC presents a wide range of qualifying costs, some may have a few caveats. For example, the clinical trial volunteer costs are primarily for pharmaceutical innovation. You can find more information on these caveats in our deep dive into qualifying expenditure.

As HMRC requires in depth documentation, it’s crucial that businesses keep meticulous records throughout the life of their research and development projects. Required documentation may include:

- Project descriptions

- Technical reports

- Financial records

- Tax computation

As with all great things, the R&D tax credit policy is forever morphing. This allows HMRC to improve compliance, and better support innovation throughout the UK. Businesses can keep up with evolving R&D policy by following these steps:

- Regularly review HMRC’s guidelines

- Frequently assess eligibility against ongoing projects

- Follow R&D tax credit topics online

- Seek specialist advice

Pursuing these steps allows businesses to ensure that they are proactively adapting to HMRC requirements, and thus strengthening their future claims.

How to Maintain Compliance Throughout R&D Tax Credit Claims

When it comes to compiling R&D tax credit claims, compliance is key. Following the advice given above, businesses are able to gain a deeper insight of the comprehensive guidelines put in place to protect the tax relief.

In order to maintain compliance with new policies and guidelines, businesses would do well to adopt the following strategies:

- Train staff on essential compliance

- Participate in HMRC’s advance assurance

- Monitor research and development activities and documents with an internal R&D team

- Work closely with an R&D tax credit advisor

Failure to maintain compliance when compiling an R&D tax credit claim may result in an HMRC enquiry. As these enquiries are time intensive, they may delay payouts, and could even result in reduced or denied claims. This is why compliance is crucial.

How Alexander Clifford Can Help Produce Compliant R&D Claims

As one of the UK’s leading R&D tax credit advisors, the team at Alexander Clifford pride themselves on their deep understanding of HMRC legislation. Their keen eye for detail and meticulous reporting allows them to produce compliant claims on behalf of our clients, and has led to over 2,400 successful R&D claims.

That’s what makes Alexander Clifford your trusted choice for R&D tax credits.

Learn more about how our 5-star service can help your business with an R&D claim. Fill in the contact form below, or book an appointment with one of our advisors.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.