A Complete Guide: What Qualifies as R&D Expenditure (Infographic)

Discover all that R&D tax credits have to offer with an in depth look at the qualifying costs. Discover the extent of the R&D relief, how your business may qualify, the eligible costs, and take an in depth look at subcontracted R&D, collaborative projects and contributions to independent research with this complete infographic guide.

When a business chooses to invest in research and development, there are many things to consider surrounding the financial impact that it will have. But for UK based businesses, R&D tax credits can help to offset the financial burden of innovative elevation.

For first time claimants however, the question arises as to what costs are eligible for R&D tax relief. So to help you to make the most of your claim, we’re taking a deep dive into the qualifying expenditure and how understanding the available R&D schemes can enhance the scope of financial relief.

What Are R&D Tax Credits in the UK?

In the UK, R&D tax credits are a form of tax relief given to businesses that invest in the innovative advancement of their industries. The greatest part about these tax credits are that they are offered to businesses of all sizes, so long as they meet the qualifying criteria.

What Qualifies for the R&D Tax Credit?

In order to qualify for R&D tax credit relief in the UK, businesses must undergo a project that uses science or technology to overcome an uncertainty that cannot be easily solved by an expert.

Businesses looking to make an R&D tax credit claim should also be mindful of the following qualifying criteria:

- Claimants must be a limited company (other than limited liability partnerships) that’s subject to pay corporation tax in the UK

- Claimants must have participated in or carried out qualifying research and development activities

- Claimants must have spent money on the research and development project(s) in the UK

With all this in mind, it is important to note that projects that aim to reproduce an existing product, service, material or software may only qualify for R&D tax credits if they are seeking to make significant improvements that may instigate an advancement in the field.

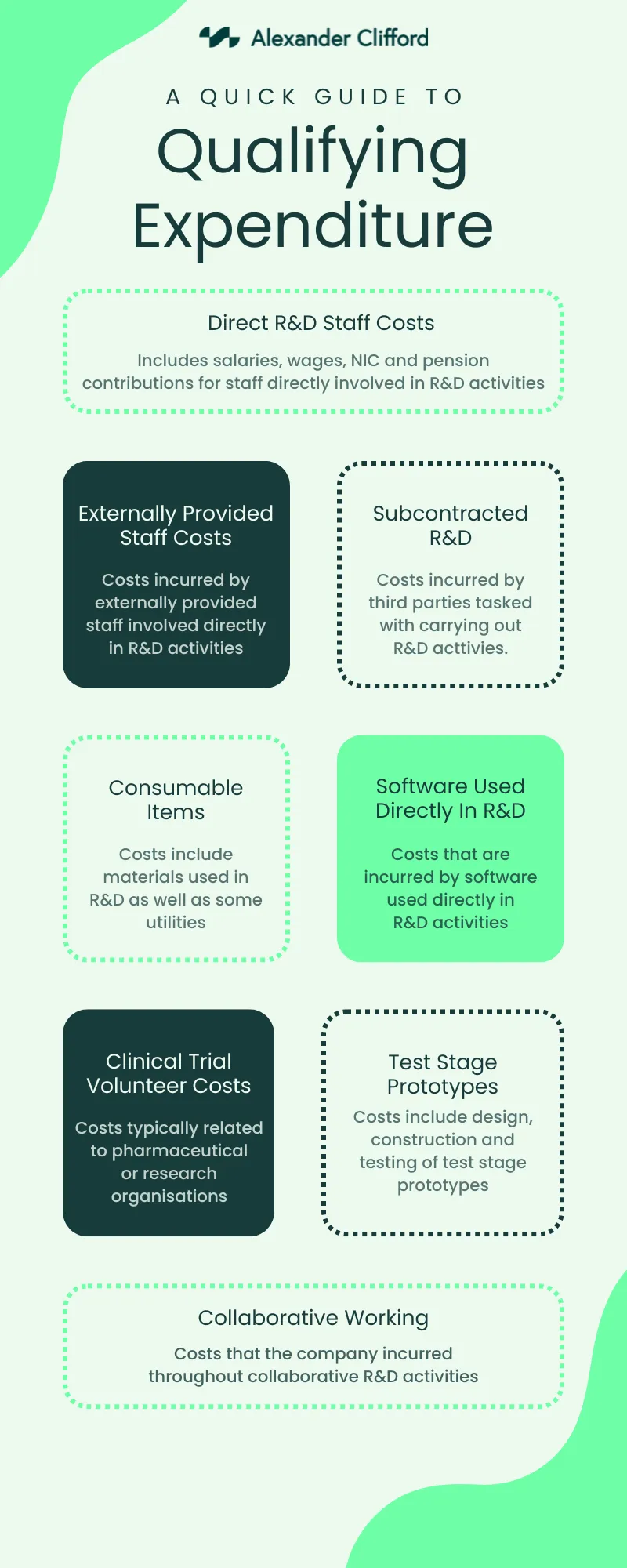

Categories of Qualifying R&D Expenditure

Understanding the specific costs that qualify for R&D tax credits is key to maximising your claim. Below is a breakdown of eligible expenses:

1. Staff Costs

Salaries, wages, Class 1 National Insurance contributions, and pension contributions for employees directly involved in R&D activities qualify. For employees who split their time, an appropriate proportion of their costs can be claimed.

2. Consumables

Costs of materials and utilities consumed or transformed during R&D activities can be included. Examples include chemicals, lab supplies, and electricity used directly for R&D.

3. Software Licences

Expenses for software used exclusively or partially in R&D projects are eligible. If software is shared between R&D and other activities, you can claim a proportionate amount.

4. Externally Provided Workers (EPWs)

You can claim 65% of costs paid to staff providers for EPWs directly engaged in R&D activities. Specific restrictions apply to EPWs paid via non-UK payrolls.

5. Subcontracted R&D

SMEs can claim costs for subcontracted R&D work, while large companies can claim only under certain conditions. From April 2023, restrictions apply to overseas subcontracted work.

6. Prototypes

Designing, creating, and testing prototypes used exclusively for R&D qualify. Claims exclude prototypes intended for sale.

7. Clinical Trial Volunteers

Payments to volunteers participating in pharmaceutical trials can be claimed.

8. Data Licences and Cloud Computing Services (Effective April 2023)

Costs for data licences and cloud computing directly linked to R&D activities are eligible under both schemes.

9. Mathematics (Effective April 2023)

Pure mathematics research costs are now explicitly included as qualifying expenditure.

What Costs Qualify for R&D?

One of the most essential parts of an R&D claim are the qualifying costs. The following infographic highlights the costs that you can include in a claim.

While we’ve included a little information about the qualifying R&D expenditure, there are a few areas that need a little more explanation as the size of your business may affect your ability to claim under certain R&D schemes.

Can SMEs claim R&D tax relief on subcontracted work?

Under the SME scheme, small and medium sized enterprises (SME) may claim costs on subcontracted R&D if they are the contracting company. This means that if an SME hires another SME, a large company or a qualifying body to carry out research and development activities, they may claim the costs.

As a general rule, SMEs that have been subcontracted to carry out research and development may not claim R&D costs unless they have been subcontracted by a large company. In this situation, the SME must make a claim under the RDEC scheme.

Large companies (companies over with 500 or more employees and an annual turnover of over €100million) however, may only claim subcontractor costs if they are the contracting company that hires a qualifying body, individual or partnership to carry out research and development activities.

Those making a claim under the merged scheme (available to those whose accounting period begins on or after April 1st 2024), the contracting company may claim R&D tax relief if they intend or expect that research and development would be necessary to achieve the intended result. Essentially this means that the contractor must have subcontracted with the intent of investing in R&D activities.

Subcontractors under the merged scheme may only claim R&D tax relief under specific circumstances, for example:

- If the carry out independent R&D that isn’t written into a specific contract

- If the contractor didn’t expect research and development to be necessary, but the subcontractor deems it essential

- If the contractor isn’t based in the UK or is a non taxable entity such as a charity

For more information about subcontracted R&D and whether you can claim it, have a chat with one of our experts.

Book a quick call back

Can businesses claim R&D tax credits when collaborating on research projects?

In an effort to further alleviate the financial burden of research and development, many businesses opt to collaborate on R&D projects. Under these circumstances, both businesses may each make an R&D tax credit claim for the costs that they each incurred.

In the event that a business collaborates with a university or another research organisation, only the business may make an R&D claim for the qualifying costs that it has incurred.

Can large companies claim R&D tax relief for funding independent research?

When it comes to contributing to independent research, only large companies can claim R&D tax relief for contributions made towards funding independent research and development, however this comes with the caveat that the project must:

- Be carried out by the recipient

- Be related to the company’s trade

Furthermore, the contribution must be made to a qualifying body such as:

- A charity

- A higher education institution

- A scientific research organisation

- A health service body

- An individual

- A partnership of individuals

FAQ’s

With all of the information about qualifying R&D expenditure, it’s understandable that you may still have a range of questions. In order to ensure you have access to all the information surrounding your potential claim, we sourced some of the most frequently asked questions in relation to qualifying costs.

How Do I Calculate R&D Tax Credits?

When it comes to calculating R&D tax credits and the worth of your claim, there are three vital steps. They are as follows:

- Identify the scheme under which your claim will operate

- Determine the total qualifying expenditure

- Use an R&D tax credit calculator

How Do I Account for R&D Tax Credits UK?

Under the SME scheme, R&D tax credits are non-taxable, meaning they only impact tax liability.

In relation to RDEC, R&D tax credits can be treated as above the line in the accounts, resulting in profit before tax. This means that the financial boost is subject to taxation.

Those claiming under the merged scheme can treat R&D tax credits as either of the following:

- A reduction in payable tax (directly offsetting tax liability)

- A government grant (treating the credit as profitable income across the course of the R&D projects life)

What Are Eligible Expenses for R&D?

Eligible expenses for Research and Development (R&D) typically include costs directly related to your innovation efforts. This can cover things like:

- Salaries: Wages for employees working on R&D projects.

- Materials: Costs of raw materials used in developing new products or processes.

- Software and Equipment: Technology and tools essential for R&D activities.

- Overheads: Utilities and other indirect costs directly related to R&D.

What Qualifies for R&D Expenditure?

To qualify as R&D expenditure, costs must be associated with activities aimed at advancing scientific or technological knowledge. This includes:

- Experimental Work: Testing new ideas or methods.

- Prototyping: Creating and refining models of new products.

- Scientific Research: Investigations to gain new insights or improve existing technologies.

What Qualifies as R&D Expenses?

R&D expenses qualify if they are incurred while seeking to achieve an advance in science or technology. This includes:

- Lab Costs: Expenses for experiments and trials.

- Employee Costs: Pay for staff directly involved in R&D.

- Development Costs: Expenses related to developing prototypes and new technologies.

What Does Not Qualify as R&D?

Certain costs do not qualify for R&D tax relief, including:

- Routine Work: Standard activities or maintenance that don’t advance technology.

- Commercialisation Costs: Expenses related to marketing or selling new products.

- General Administrative Costs: Overheads not directly linked to R&D projects.

What Are Qualifying Indirect Costs for R&D?

Qualifying indirect costs for R&D can include:

- Utilities: Electricity and water used in R&D facilities.

- Rent: Costs for space used for research activities.

- Administrative Support: Costs of support staff directly involved in R&D activities.

How Do I Claim R&D Expenses?

After determining eligibility and calculating qualifying costs, businesses must compile R&D related documentation in order to prepare and submit a claim to HMRC. This documentation must support the claim and authenticate the qualifying expenditure.

In order to ensure that your claim aligns with HMRC policy and guidelines, it is advisable that you consult with R&D tax specialists to compile your claim.

Final Thoughts

Understanding the qualifying costs of research and development is a necessary part of making a claim. Not only can it help businesses to understand the scheme in which they should be claiming under, but it also encourages them to keep accurate financial records in relation to their R&D project(s).

By closely monitoring the guidelines surrounding qualifying R&D expenditure, businesses are able to broaden the scope of the financial relief that the initiative has to offer.

How Alexander Clifford Can Help

Considering HMRC’s extensive guidelines in relation to R&D tax credits, making a claim can seem a little complicated. As leading R&D tax specialists, we’ve simplified the claims process by compiling and submitting over 2,400 on behalf of our clients. With extensive knowledge on HMRC compliance, our dedicated team are easily able to navigate the complex world of R&D tax credits, providing expert insight from the start of a claim through to the very end.

Make Alexander Clifford your trusted choice for R&D tax credits by filling in the contact form below, and one of our experts will call you within 15 minutes.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.