R&D Tax Credits Simplified: How to Claim RDEC

Build a greater understanding of R&D tax credits with an in depth look at RDEC Scheme. Gain insight into the R&D incentive designed to give large businesses a financial boost for their investment in innovative research and development. Learn about RDEC eligibility, the four part test to qualify, the seven steps of your RDEC claim and how to calculate your qualifying expenditure!

In order to understand R&D tax credits, it’s important to know about the scheme under which your business is eligible to claim under. For larger businesses and some SMEs (small and medium sized enterprises), RDEC provides the opportunity to reduce the financial pressure of innovative research and development, allowing advancement to take centre stage throughout UK based businesses.

Given the immeasurable amount of seemingly confusing information available, understanding RDEC can seem impossible. But in our effort to simplify the claims process, the specialists at Alexander Clifford have collaborated to present an easy to understand guide to the RDEC scheme.

What is RDEC?

The Research and Development Expenditure Credit (RDEC) is a United Kingdom government scheme that exists to provide innovative businesses with a financial incentive for their investment in research and development.

With the ability to offset a portion of their corporation tax, businesses benefiting from RDEC credit can reinvest some of their financial resources in future advancement. However, in order to make a successful R&D tax credit claim under RDEC, businesses must adhere to a range of eligibility criteria.

Eligibility Criteria for RDEC Scheme

As an R&D tax credit scheme that was established specifically for large companies, businesses claiming RDEC must meet the following criteria:

- Have a headcount of 500+ staff

- Have an annual turnover of over €100 million

- Or have a balance sheet total of or above €86 million

As this incentive is provided by HMRC, claiming businesses must be incurring costs related to research and development within the UK. Furthermore, businesses looking to benefit from R&D tax relief must be liable to corporation tax in the UK.

When was RDEC introduced?

The RDEC scheme was introduced in April 2013 to replace the large company scheme. It later became the standard option for many SMEs in specific circumstances.

Understanding the eligibility criteria may be straightforward, but navigating the claims process can be time consuming. Thankfully the specialists at Alexander Clifford are able to save you time with R&D tax credits, by dedicating their expert knowledge to your claim.

Book a quick call back

Claiming RDEC as an SME

The SME R&D scheme has a range of limitations that prevents some research and development projects from qualifying, and so in some circumstances, an SME can claim R&D tax credits under the RDEC scheme.

These circumstances are as follows:

- Subsidised R&D or grant funding

- Subcontracted R&D for large companies

- SMES with connected enterprises

For loss making SMEs, claiming under the RDEC scheme can aid in presenting additional financial strategies that improve cash flow.

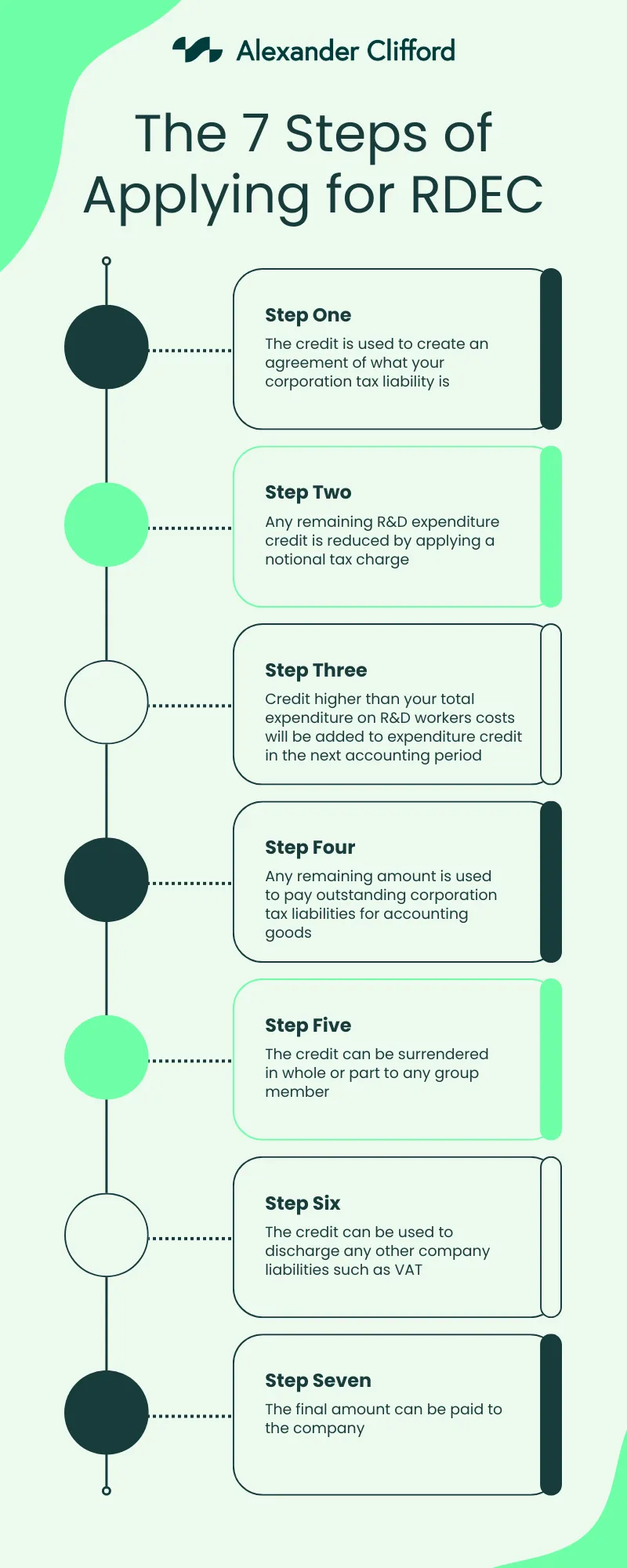

The 7 Steps of Applying for RDEC

When applying for RDEC, there is a lot of information to take in – some of which can be incredibly confusing. To ensure that you get the greatest information available, we’ve simplified applying to RDEC by separating the process into seven easy steps, as shown in the infographic image below.

Calculating an R&D Tax Credit Claim Under RDEC

In order to calculate the value of your R&D tax credit claim, you must first understand the rates of the RDEC scheme and the qualifying costs.

The Current RDEC Rate

As of April 2023, the rate for the RDEC scheme is established at 20%. This means that businesses claiming R&D tax credits under RDEC are able to recover 20p for every £1 of qualifying expenditure.

Qualifying RDEC Costs

Given the vastness of the R&D tax credit incentive, there is a wide range of qualifying RDEC costs. The expenditure includes:

- Staff costs (including PAYE, pension and NIC contributions)

- Consumables and utilities

- Software purchases (including data storage and operating systems)

- Clinical trial volunteer costs

- Travel costs

Calculating Your Total Expenditure

After identifying each of your qualifying costs, combining these costs will give you your total expenditure.

In order to calculate the overall worth of your claim however, you must apply the rate of the scheme under which you’re claiming, to the total expenditure. While this can be done manually, it’s easier to calculate your total expenditure by using an R&D tax credit calculator.

What Documentation Do I Need for an RDEC Claim?

To prepare a strong RDEC claim, gathering the right documentation is essential. HMRC requires accurate and detailed records to verify your eligibility and qualifying expenditure.

Here’s what you’ll need:

- A technical narrative explaining the R&D work

- Detailed project breakdowns showing objectives, challenges, and outcomes

- Time tracking records for staff involved in R&D

- Financial records showing qualifying expenditure (e.g. payroll, software, consumables)

- Contracts for subcontracted R&D or grant funding (if applicable)

- Any correspondence with HMRC or related documentation from past claims

FAQ’s

There’s a lot to remember when it comes to the RDEC scheme, so to ensure that you know everything about your upcoming R&D tax credit claim, we wanted to answer some of your most frequently asked questions.

When Does My R&D Claim Move to the Merged Scheme?

The merged scheme went into effect on April 1st 2024.

This means that if your accounting year begins on or after April 1st 2024, your R&D tax credit claim will fall under the merged scheme instead of RDEC or the SME scheme.

Can I Make a Claim Under RDEC if My Business is Loss-Making?

Under the RDEC scheme – regardless of your company’s profitability – all applicants are treated equally, meaning that even if your large business is operating at a loss, you’re able to make a claim.

When operating at a loss, businesses can receive their tax credits in a variety of ways. For example:

- Immediate cash refund

- Offset the cost against previous profits

- Offset the cost against taxable profits in the same tax group

When Can I Expect My R&D Tax Credits?

After compiling and submitting an R&D tax credit claim, it usually takes between 4-6 weeks for HMRC to process the claim.

Prior to your claim being processed, you can typically expect to see payment within 14 days.

What is the difference between the R&D Large Scheme and the new RDEC?

The old R&D large company scheme provided a deduction against profits. The RDEC scheme replaced it, offering a visible taxable credit, which is often more beneficial for businesses, even those not making profits.

When does my claim move to the merged scheme?

If your accounting year starts on or after 1 April 2024, you’ll fall under the new merged scheme, replacing both SME and RDEC schemes.

Common Mistakes in RDEC Claims (and How to Avoid Them)

Even experienced companies can fall into common traps that delay or reduce the value of their RDEC claim. Avoid these pitfalls to maximise your benefit:

- Overlooking qualifying indirect activities

- Incorrectly classifying software or subcontractor costs

- Failing to apply the correct RDEC rate

- Omitting supporting documentation or technical justification

- Claiming for ineligible projects that don’t meet the criteria

Tip: Working with a specialist like Alexander Clifford can help you avoid these issues and streamline your claim process.

How Alexander Clifford Can Help With Your Claim

With expert knowledge of the R&D schemes and HMRC legislation, our specialist consultants have helped compile and submit over 2,400 successful claims. Their attention to detail ensures that no stone is left unturned, allowing clients to maximise the benefits of R&D tax credits.

This is what makes Alexander Clifford your trusted choice for R&D tax credits.

Begin your RDEC claim with a 5-star specialist team. Fill in the contact form below, and get a call back from one of our experts within 15 minutes.

Book a quick call