Revolutionising Edtech With the R&D Tax Credit Incentive

There are currently over 1,600 edtech companies in the UK that propel the scholastic sector to new heights, but what role does the R&D tax credit incentive play? We explored the vast expanse of edtech including the technical innovations, how AI is personalising education, future trends in educational technology and how R&D tax credits play a pivotal role in funding edtech research and development.

There was once a time when children would gasp at the sight of a projector being rolled into the classroom, knowing that today’s lesson would be different from the norm. But with the power of research and development and HMRC’s R&D tax credits initiative, educational technology has revolutionised learning for millions of children.

Not only have these developments helped to bridge the gap between socioeconomic groups, but they’ve helped people all over the world to benefit from a more accessible approach to schooling. So today we want to explore the significance of edtech and how R&D tax credit relief helps to propel innovation in the educational sector.

Technological Innovation in Education

Believe it or not, educational technology (edtech) dates back to the early 20th century, where mechanical teaching aids such as radio broadcasts and film strips were integrated into the classroom. Since then, educational facilities have been quick to adapt to new technologies, for example:

- Computer assisted instruction (CAI) systems for interactive learning

- Programs such as LOGO to aid in coding and problem solving

- Online resources

- E-learning platforms such as Blackboard

- Multimedia technologies with educational interaction

- Massive open online courses (MOOC)

In the 21st century, classrooms have begun to adopt more advanced technology that present wholly immersive learning experiences with VR (virtual reality) and AR (augmented reality), and in the aftermath of a global pandemic, edtech is advancing quicker than ever – especially as businesses invest in innovative research and development methods.

Book a quick call back

How Does AI Personalise Education?

As pupils thrive with different teaching methods and at different paces, providing a unique experience that challenges students throughout their education has always seemed an impossibility. With the advancement of AI (artificial intelligence) in educational technology however, providing personalised education has become a reality.

Additionally in neurodiverse classrooms, AI can be used as a tool that helps educators to identify specific learning needs by analysing patterns in student behaviour and performance. This helps to make the learning experience more inclusive, ensuring that each student has access to the same standard of education.

The Impact of Edtech on Learning Outcomes

Providing students with remote learning capabilities, personalised education and expansive resources, edtech has a profound impact on learning outcomes.

These new approaches may also be challenging for traditional teaching methods however, as teachers take more of a guiding approach as they help students to navigate digital resources.

To offset this disconnect, there is a growing need for the research and development in educational technologies to combine traditional methods with digital age methods, in order to provide a well rounded learning experience.

The Importance of Research and Development in Educational Technology

When it comes to driving innovation in education, research and development in edtech is a priority. Not only does this help to advance the technology, but it also provides solutions to problems such as educational inequity, and diverse learning needs.

Businesses investing in edtech research and development play a pivotal role in advancing the future of education by developing cutting edge technologies that aid students and teachers alike. Some of the key reasons for businesses investing in edtech are:

- Market growth

- Competitive edge

- Social impact and equity

- Collaboration opportunities with educational institutions

Emerging Trends in Edtech

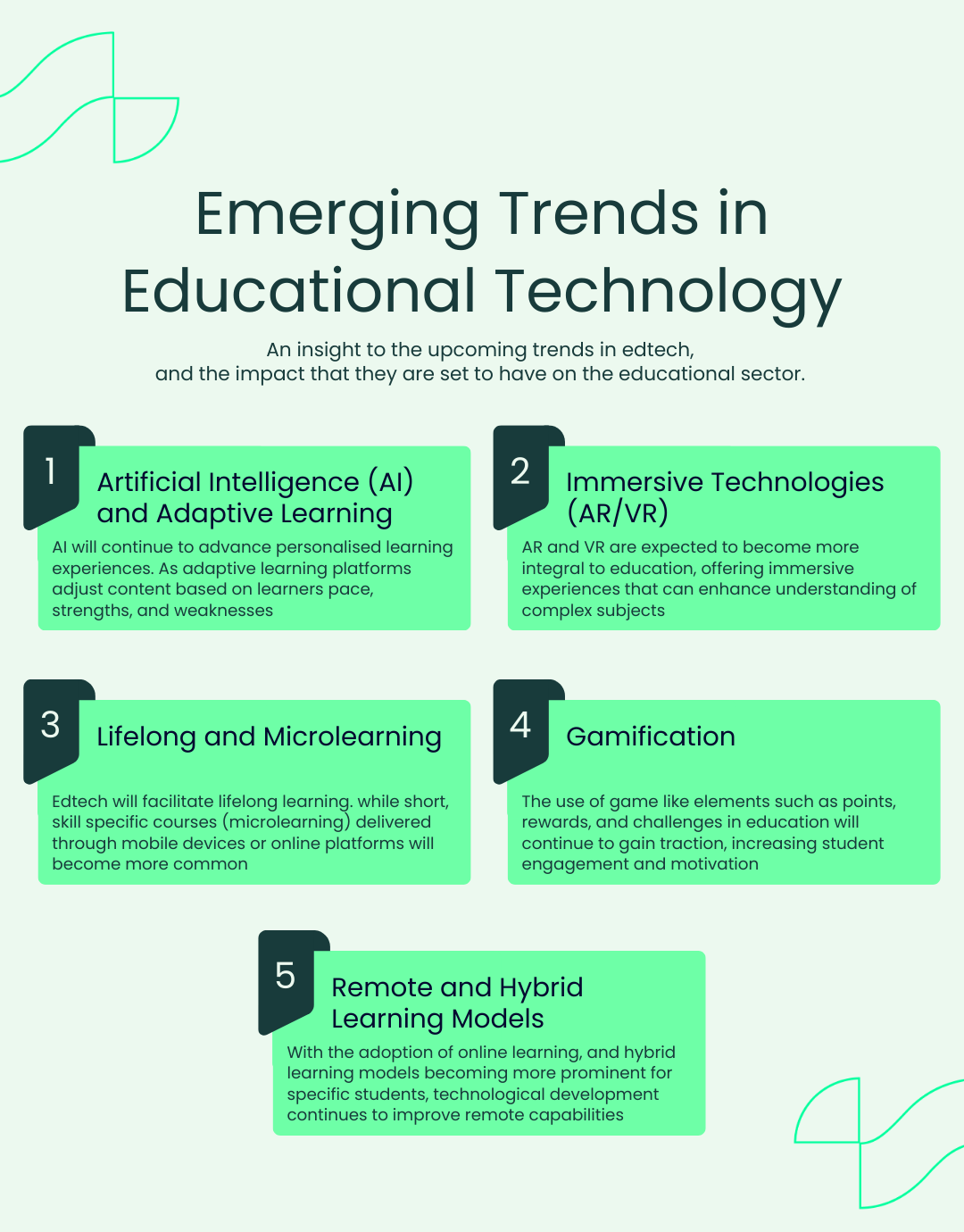

With research and development fuelling innovative advancement, and more businesses directing their focus towards educational technologies, the future of edtech is vast. Considering how rapidly this sector is set to expand, there are a range of emerging edtech trends that you can see in this infographic:

Funding Edtech Research and Development

One of the biggest things that prevent businesses from investing in research and development is the financial risk that they may face. Fortunately in the UK, there are a range of financial opportunities available to those choosing to invest in edtech innovation, such as:

- Crowdfunding

- Accelerators and incubators (such as Google for startups)

- Venture capital and private investment

- Government grants and initiatives

- Tax reliefs and R&D tax credits

How R&D Tax Credits are Impacting Edtech

R&D tax credits work by reimbursing a significant portion of investment in qualifying research and development. This is often done through providing the equivalent cost in tax relief, allowing businesses to offset the cost of their innovative projects.

Considering the purpose of R&D tax relief is to incentivise businesses in the UK to invest in scientific or technological research and development, projects that seek advancement in educational technology often qualify for the relief, as long as:

- The claiming business is liable to corporation tax in the UK

- The project aims to overcome an uncertainty that cannot be otherwise solved by an individual

As many edtech research and development projects aim to solve problems and advance the field, R&D tax credits are a popular option for British based educational innovations.

Qualifying for R&D Tax Credit Relief

R&D tax credit relief is overseen by HMRC, who have set a range of criteria that determine eligibility for the incentive. We covered the eligibility criteria for qualifying R&D projects in the previous section, but what makes a qualifying R&D activity?

A qualifying activity is a task within the research and development project, and to qualify for R&D tax credits, must meet these criteria:

- Activity should aim to advance knowledge or capability

- Activity must seek to resolve industry uncertainties

- Activity should be conducted using a systematic approach

- Activity should not be easily replicated

Essentially a qualifying activity is an active part of the research and development process that drives the project forward. From these qualifying activities, businesses are able to determine their qualifying costs.

Eligible expenditure for R&D tax credits are specific costs involved in qualifying activities, and may include the following:

- Direct research and development staff costs

- Subcontracted research and development costs

- Consumable item costs

- Software used directly in research and development

For a complete guide on eligible R&D expenditures, click here.

The Benefits of R&D Tax Credits

Many people believe that the only benefit to making an R&D claim is a financial reprieve, but there’s a lot more to it than that. In fact, some of the benefits include:

FAQ’s

While your biggest aim may be to revolutionise the world of edtech, our mission is to simplify the R&D claims process. With this in mind, we wanted to address some of your most pressing questions.

What are Common Mistakes Made During an R&D Tax Credit Claim?

Some of the biggest mistakes that we come across in R&D tax credit claims are as follows:

- Misunderstanding of the qualifying criteria

- Inaccurate cost allocation

- Inadequate documentation

- Overlooking qualifying costs

- Failure to account for grant funding

Mistakes such as this can be pretty costly, as it raises cause for concern with HMRC. This could lead to an enquiry that – if handled incorrectly – may result in having to repay the tax relief.

In order to avoid making these common errors, HMRC recommends that businesses work with an R&D tax credit specialist when compiling a claim.

Can Startups in Edtech Claim R&D Tax Credits?

Startups are eligible for R&D tax credit relief, so long as their research and development projects meet the qualifying criteria. Benefits for startups that claim the tax relief can include:

- Ability to make new ideas and products a reality

- Ability to further protect intellectual property

- Provides advancement for testing market assumptions

How Do You Calculate R&D Tax Credits?

Once you’ve established your eligible expenditure, you can determine the total worth of your claim by referencing the latest rates from the R&D scheme that your business qualifies for.

We understand that this process can be complicated, so we developed an R&D tax credit calculator to help.

Final Thoughts

In conclusion, research and development in educational technology is one of the most rewarding prospects for many businesses. Not only does it allow them to focus on bettering the scholarly prospects of the next generation, but it also provides them the perfect opportunity to advance their reputation.

What’s more, with R&D tax credits, businesses are able to transform the future of education without the financial burden.

How Alexander Clifford Supports Edtech Innovation With R&D Tax Credits

As leading R&D tax credit specialists, our team has a broad knowledge that extends beyond the tax relief system. With deep interest in the technology sector, our specialist consultants combine their work with their passion to compile in depth R&D claims.

This has allowed our team to develop a 5-star service that has compiled over 2,400 successful claims. And that’s what makes Alexander Clifford your trusted choice for R&D tax credits.

Get a head start on your claim by entering your details in the form below, or book your appointment with one of our specialists.

Get a decision on your R&D eligibility from a qualified specialist in 15 minutes.