What is the R&D Additional Information Form (AIF)? | Tax Claim Guide

The Additional Information Form (AIF), introduced by HMRC on 8th August 2023, is a mandatory electronic submission required for all (R&D)Research & Development tax relief claims. This form is essential in ensuring that HMRC has all the necessary details to process claims accurately, helping to prevent fraudulent or incomplete submissions.

Failing to submit the form could lead to the rejection of your R&D claim, which is why completing it correctly is crucial for businesses seeking tax relief.

What Is the Additional Information Form for R&D Claims?

The additional information form is an important electronic document that must be submitted to HMRC as part of the Research & Development (R&D) tax relief claim process. This form captures essential company details, project descriptions, and qualifying R&D expenditures, helping HMRC to accurately assess your eligibility for tax relief.

What is the purpose of the R&D additional information form?

The purpose of this form is to ensure HMRC has all the information they need to understand your claim, it helps them analyse your eligibility smoothly. It is mandatory to complete this, failure to do so will result in HMRC removing your R&D claim from your company tax return. This form helps HMRC to effectively administer the scheme, analyse authentic eligibility by improving the quality of claims, and prevent abuse of R&D.

Essentially if they have all the key information in front of them, they’ll be less likely to send out enquiries about the gaps in information.

When was the R&D additional information form implemented?

The additional information form was made compulsory on August 8th 2023 and was one of the changes announced in April 2023, the others included:

- Increase in the RDEC tax relief rate.

- Decrease in the SME tax relief rate.

- Extension of new qualifying expenditures such as data licenses, mathematics, and cloud computing costs.

- A new notification process starting April 1, 2023: If you are new to claiming R&D tax credits or haven’t claimed them in the past three accounting periods, you must inform HMRC of your intention to submit an R&D tax credit claim. This notification is mandatory for both the SME and RDEC schemes.

- Ineligibility of overseas R&D activity delayed until 2024: The government had planned to introduce a new rule that limits R&D tax credit eligibility to activities conducted within the UK. However, this change has been postponed and will now be enforced from April 1, 2024. This geographical requirement also extends to externally provided workers (EPWs), who must perform their work within the UK to qualify for the tax credit.

From the 8th of August 2023, you must complete and submit an R&D additional information form to HMRC to support all your claims for Research and Development (R&D) tax relief or expenditure credit. This includes claims for the end of the 2022 tax year.

Find out more about R&D tax credit.

Why was the Additional Information Form (AIF) Introduced?

The primary reason for introducing the AIF was to combat the rising levels of non compliance and fraud associated with R&D tax relief claims in the UK. By requiring businesses to submit comprehensive details about their R&D projects, HMRC can better assess the validity of each claim. This move protects the integrity of the R&D tax relief scheme and ensures that taxpayer money supports genuine innovation rather than fraudulent claims.

The AIF represents a significant shift in how UK businesses document and submit their R&D activities, providing HMRC with detailed insights into the nature and scope of projects being claimed.

Which businesses are affected by the AIF?

The AIF affects all UK businesses seeking to claim R&D tax relief, regardless of their size or industry. Both small and medium sized enterprises (SMEs) and larger companies must now provide detailed project descriptions, cost breakdowns, and evidence of R&D activities undertaken.

Three specific categories must submit the AIF:

- First Time Claimants: Businesses claiming R&D tax relief for the first time.

- Returning Claimants: Businesses that have not made an R&D claim within the last three years.

- All Other Claimants: Any business, regardless of size or industry, making an R&D tax relief claim for accounting periods beginning on or after April 1, 2023

What details are needed for the R&D additional information form?

Instead of sending a PDF attachment with your CT600, the additional form is an electronic version of the claim report that is directly submitted to HMRC’s systems. This needs to be completed before the company tax return. In order to complete this electronic form, you need the following information to hand:

Company details

This includes your VAT registration number, Unique Taxpayer Reference (UTR), employer PAYE reference number, and Standard Industrial Classification (SIC) code.

Contact details

The details of the most senior person in your team who is responsible for the R&D claim such as a director. Or any agent involved in the claim who can claim on behalf of the company.

The details of your project | How were you involved in R&D?

HMRC want to know the number of R&D projects you’re claiming for and their details around the topics of:

- What is the main field of science or technology that resonates most with the nature of your project?

- Prior to your project, what was the baseline understanding or state of science or technology that your project intended to progress from?

- Using the answer to the previous question, state the aim of your project; quantify or explain how you wanted to progress from what was already known.

- Throughout the project, what scientific or technological uncertainties arose?

- How did you attempt to overcome these uncertainties?

Select the scheme you’re claiming for: SME or RDEC

The R&D tax credits you’ll receive, if your claim is successful, depend on what scheme you’re applying for because they have different relief rates. Therefore, in the information form, you’ll need to select which scheme you’re applying for and provide the amount you’re eligible for. For larger companies, it will be RDEC and for small and medium-sized enterprises, it will be the SME incentive, although there are some exceptions so it’s worthwhile to double-check with an R&D specialist.

Our free R&D tax credit calculator can help you calculate which you can submit as an estimate in your form, ready for HMRC to check.

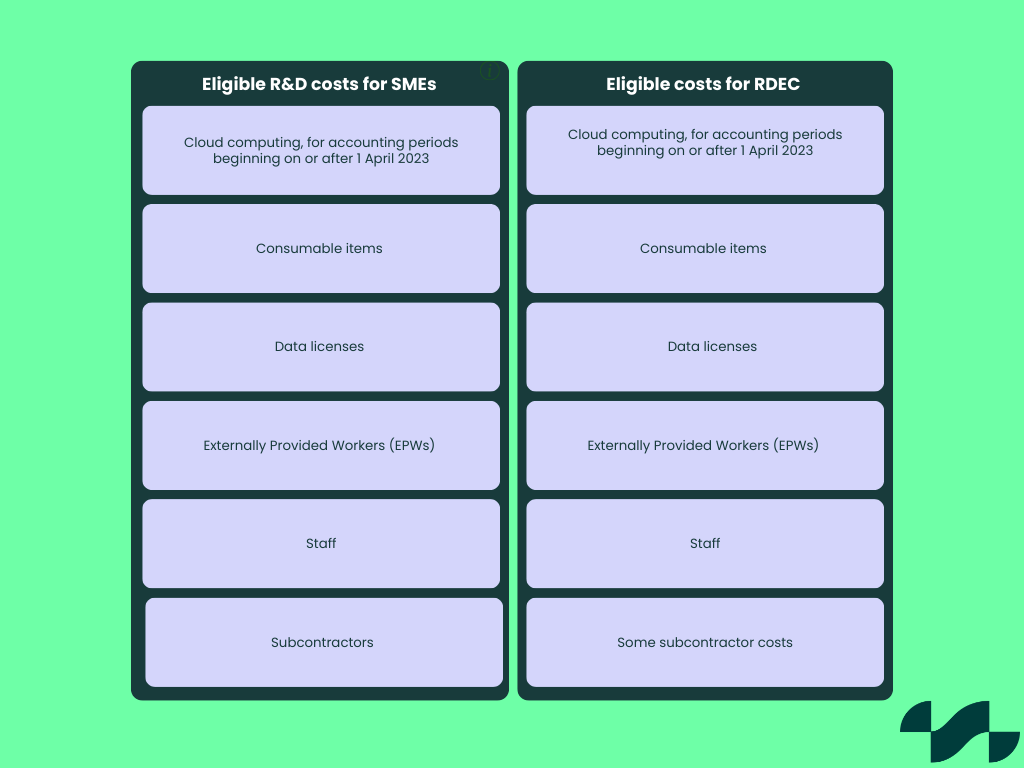

The details of your R&D qualifying costs

Inform HMRC of your qualifying R&D expenditure:

The details of qualifying direct and indirect activities

Indirect activities are the tasks that are part of a project but don’t directly contribute to solving the scientific or technological uncertainty. Essentially, they are the activities that helped facilitate and support the direct R&D work. Examples include:

- Scientific and technical information services, specifically when they are carried out to support R&D, such as creating the initial report on R&D findings.

- Indirect support activities like maintenance, security, administrative and clerical tasks, financial, and personnel activities such as paying R&D staff, but only when they are conducted for R&D purposes.

- Supplementary activities necessary for conducting R&D, for instance, hiring and compensating staff, renting laboratories, and maintaining R&D equipment, including computers used for R&D.

- Training that is needed to complete the R&D project.

- Research conducted by students and researchers at universities.

- Research activities (including related data collection) aimed at developing new scientific or technological testing, survey, or sampling methods, provided this research isn’t considered R&D on its own.

- Feasibility studies that inform the strategic direction of a specific R&D activity.

Details of each project

In cases where you have more than one R&D project you’d like to claim for, you’ll need to provide:

- A full description of qualifying expenditure if your claim includes 1-3 projects.

- A description that provides 50% coverage of the qualifying expenditure if you’re claiming for 4-10 projects, with a minimum of 3 full descriptions.

- A description that provides 50% coverage for qualifying expenditure if you’re claiming for 11-100 but you need to provide 10 complete explanations for the projects with the highest qualifying expenditure.

The start and end date of the accounting period you’re claiming in

The accounting period’s beginning and ending dates for which you are seeking tax relief must align with those specified in your Company Tax Return.

Describing Each R&D Project for the Additional Information Form

When completing the AIF for R&D tax relief, it’s essential to provide detailed descriptions of each project. Here’s a comprehensive guide on how to describe your R&D projects effectively:

Main Field of Science or Technology

Provide a clear description of the field of science or technology related to your project. Use this terminology:

- Science: The systematic study of the nature and behaviour of the physical and material universe.

- Technology: The practical application of scientific principles or knowledge.

- Mathematical Advances: From April 1, 2023, mathematical advances are treated as science, whether or not they represent the physical and material universe.

Baseline Level of Science or Technology

Describe the existing level of knowledge or capability at your project’s start:

- If improving existing materials or devices: Detail their features and capabilities before your project began.

- If developing new knowledge: Explain what was already known in the field before your project commenced.

Advance in Scientific or Technological Knowledge

Clearly describe your intended advance using the baseline level as a comparison. This could include:

- Creating new processes, materials, devices, products, or services.

- Significantly improving existing ones to enhance functionality, save costs, or reduce waste.

- Using science or technology to replicate the effects of current processes in new or improved ways.

Scientific or Technological Uncertainties

- Detail the specific uncertainties faced during your project, such as:

- Uncertainty about the feasibility of creating or improving a product or process.

- Challenges in determining how to achieve the desired advancements. Technical problems that couldn’t be readily resolved using available knowledge.

Importantly, explain:

- What prevented the achievement of the advance.

- Why it was a technological or scientific uncertainty for the industry, not just your company.

- If a competent professional in the field would be uncertain about how to achieve the advance.

Overcoming Uncertainties

Describe the direct R&D activities and qualifying indirect activities you used to resolve uncertainties:

- Direct Activities: Creating or adapting software, materials, or equipment; planning; designing, testing, and analysis.

- Indirect Activities: Include qualifying costs incurred on supporting activities.

Who can submit the R&D additional information form?

Either a representative of the company or an agent acting on behalf of the company can submit the additional information form. You’ll need to provide this person’s contact details in the form.

When to submit the additional information form for R&D tax credit claims?

Submit the AIF before or on the same day as your CT600. Claims submitted without the AIF will be automatically rejected by HMRC.

The additional information form should be sent to HMRC prior to submitting the company’s Corporation Tax Return. Failure to do so will prompt HMRC to contact the company to verify the removal of the R&D tax relief claim from the Company Tax Return.

In case you’ve already submitted your tax return and subsequently submitted the R&D additional information form, you will need to file an updated tax return. The initial tax return will be replaced by the amended version.

Common errors when completing the AIF

Here are some common mistakes to avoid:

- Incomplete project descriptions

- Incorrect cost categorisation

- Late submissions

- Missing support documents

- Claiming under the wrong scheme

- Company detail errors

Common Pitfalls in Filling Out the AIF

Completing the Additional Information Form (AIF) for R&D claims can be challenging. Here are some common pitfalls to avoid:

- Incomplete Information: Ensure all fields are filled out completely and accurately.

- Lack of Supporting Documentation: Attach all necessary documents to support your claim.

- Incorrect Calculations: Double-check all financial figures to avoid errors.

Step by Step Guide to Completing the AIF

A thorough guide can help streamline the process. Follow these steps to complete the AIF:

- Gather Required Documents: Before you start, ensure you have all necessary documents, such as financial records and project reports.

- Fill Out Personal and Company Information: Enter accurate details about your company and the individuals involved in the R&D project.

- Describe the R&D Activities: Provide a detailed description of the R&D activities, including objectives, methodology, and outcomes.

- Financial Information: Accurately report all financial information related to the R&D activities.

Detailed Examples of Successful AIF Submissions

Learning from successful submissions can be highly beneficial. Here are detailed examples of well completed AIFs:

Example 1:

A software development company successfully claimed R&D tax credits by thoroughly detailing their innovative algorithm development process.

They clearly outlined:

- The baseline technology (existing algorithms in the field)

- The scientific advancement sought (50% improvement in processing speed)

- The technological uncertainties (memory optimization challenges)

- The systematic approach to overcome these uncertainties (iterative testing protocols)

Example 2:

Manufacturing Firm A UK manufacturing firm created a compelling AIF by providing:

- Detailed descriptions of material science advancements

- Clear explanations of how their project extended beyond standard industry practices

- Specific technical challenges faced and systematic approaches to solve them

- Well documented expenditure with clear links to R&D activities

How to submit this form?

The form needs to be submitted electronically.

What happens after finalising the additional information for R&D?

HMRC will notify you that they’ve received your form and they will provide a reference number. The next step is to start your R&D claim!

How has the R&D additional information form changed Alexander Clifford’s processes?

At Alexander Clifford, we always collect the information required for the additional information form during our technical call with every client. This means we collect the essential information for both the form and your claim at the same time and take leadership over the full R&D claiming process, guiding you through your role in it. We’re well prepared for all the changes that have been rolled out to the R&D incentive and these haven’t impacted our success level due to our detailed compliance processes.

Do you need support for your R&D claim?

Completing the AIF can be complex – our R&D tax experts are here to ensure your claim is accurate and fully compliant with HMRC’s 2025 expectations.

The R&D Additional Information Form (AIF) is now a critical requirement for all UK businesses seeking R&D tax relief. Understanding the proper completion process, from detailed project descriptions to accurate expenditure reporting and timely submission before your CT600 is essential for securing your rightful tax benefits and avoiding claim rejection.

At Alexander Clifford, we’ve seamlessly integrated AIF requirements into our proven R&D claim methodology, collecting all necessary information during our initial technical consultation. Don’t let the complexity of this form prevent you from accessing valuable tax incentives contact our expert team today for a free consultation and discover how our industry leading compliance processes can help secure the financial boost your innovation deserves.

Book a quick call